Ah, Texas! The land of wide-open spaces, legendary BBQ, and a certain swagger that’s as big as the state itself. When folks think about moving to the Lone Star State, one of the first things that often sparks interest (and sometimes a little confusion) is its unique tax situation. You've heard whispers, perhaps, about how things are "different" here. Well, pull up a chair, grab a sweet tea, and let's unravel the mystery of what exactly the Texas state tax looks like, in an easy-going, no-fuss kind of way.

The Big Myth vs. The Lone Star Truth: No State Income Tax!

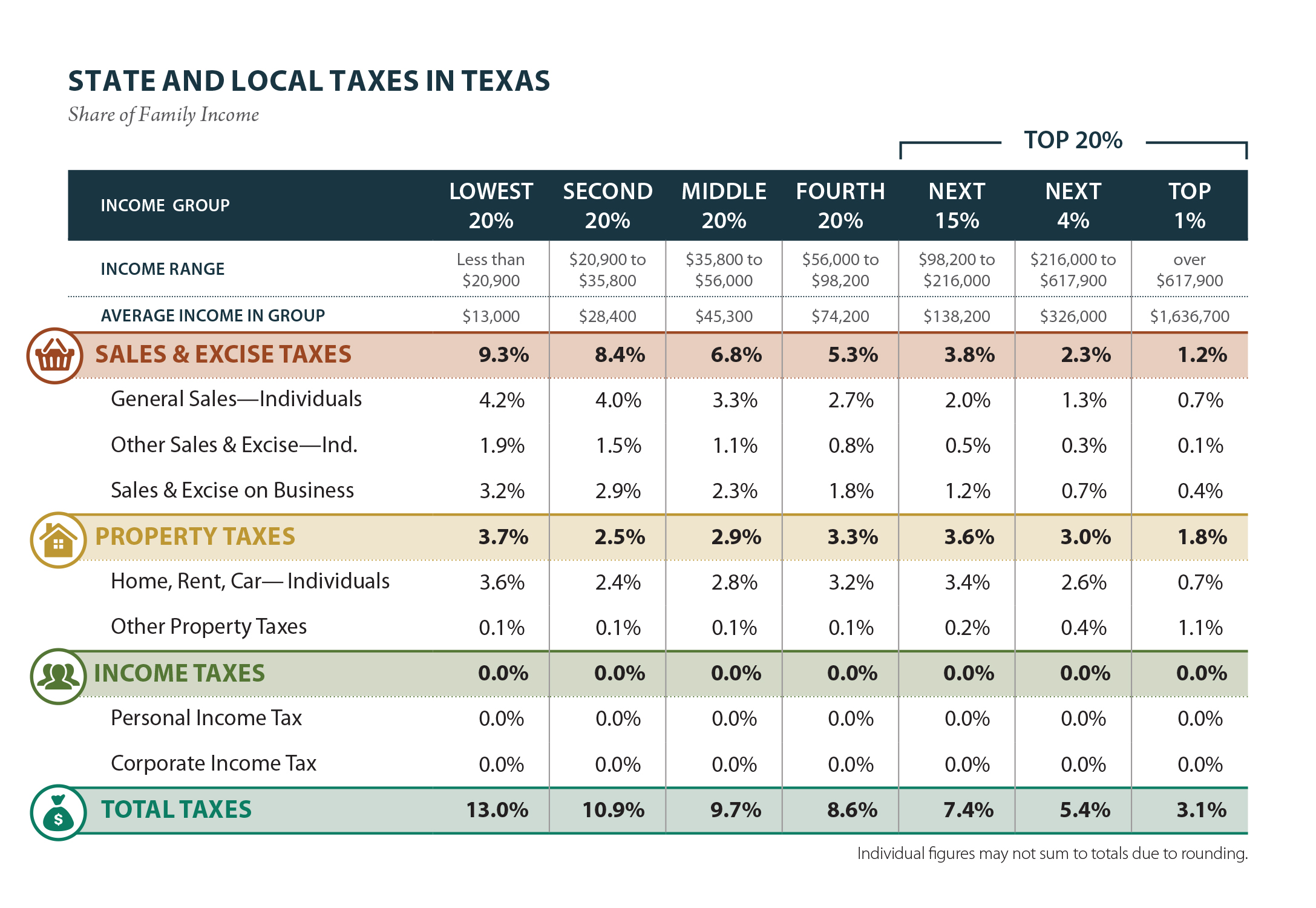

Let's kick things off with the headline act, because it’s a big one: Texas is one of a handful of states that does not levy a state income tax. Yes, you read that right! When you get your paycheck, what you see is generally what you get, minus federal taxes, of course. For many, this is a huge draw, allowing residents to keep more of their hard-earned cash in their own pockets. It's a cornerstone of the "Texas advantage" and a big reason why so many people and businesses are flocking here.

So, How Does Texas Keep the Lights On? Meet Property Tax.

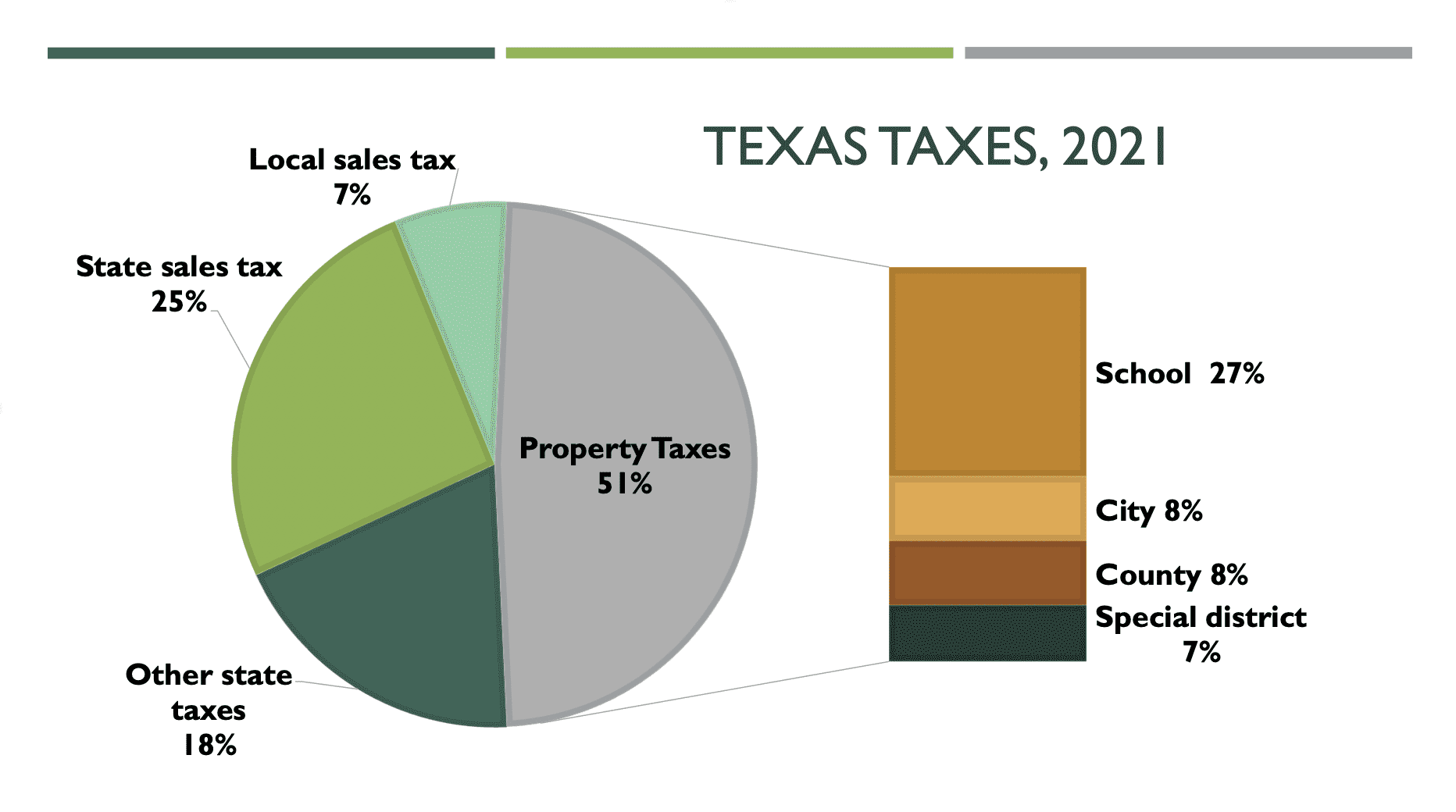

Now, before you start picturing a tax-free paradise, let’s talk about how Texas funds its infrastructure, schools, and local services. Because when one tax is absent, others usually step up to the plate. In Texas, the heavy hitter is the property tax. These taxes are levied by local entities like counties, cities, school districts, and special districts. This means your property tax rate can vary significantly depending on exactly where you live – sometimes even street by street within the same city!

It's vital to remember that Texas property taxes are generally higher than the national average, often compensating for the lack of state income tax. Practical tip: if you’re house-hunting, make sure to factor these local property taxes into your budget. Look up the specific appraisal district for the area you're interested in; it’s a quick search and can save you from sticker shock later on.

The Other Heavy Hitter: Sales Tax

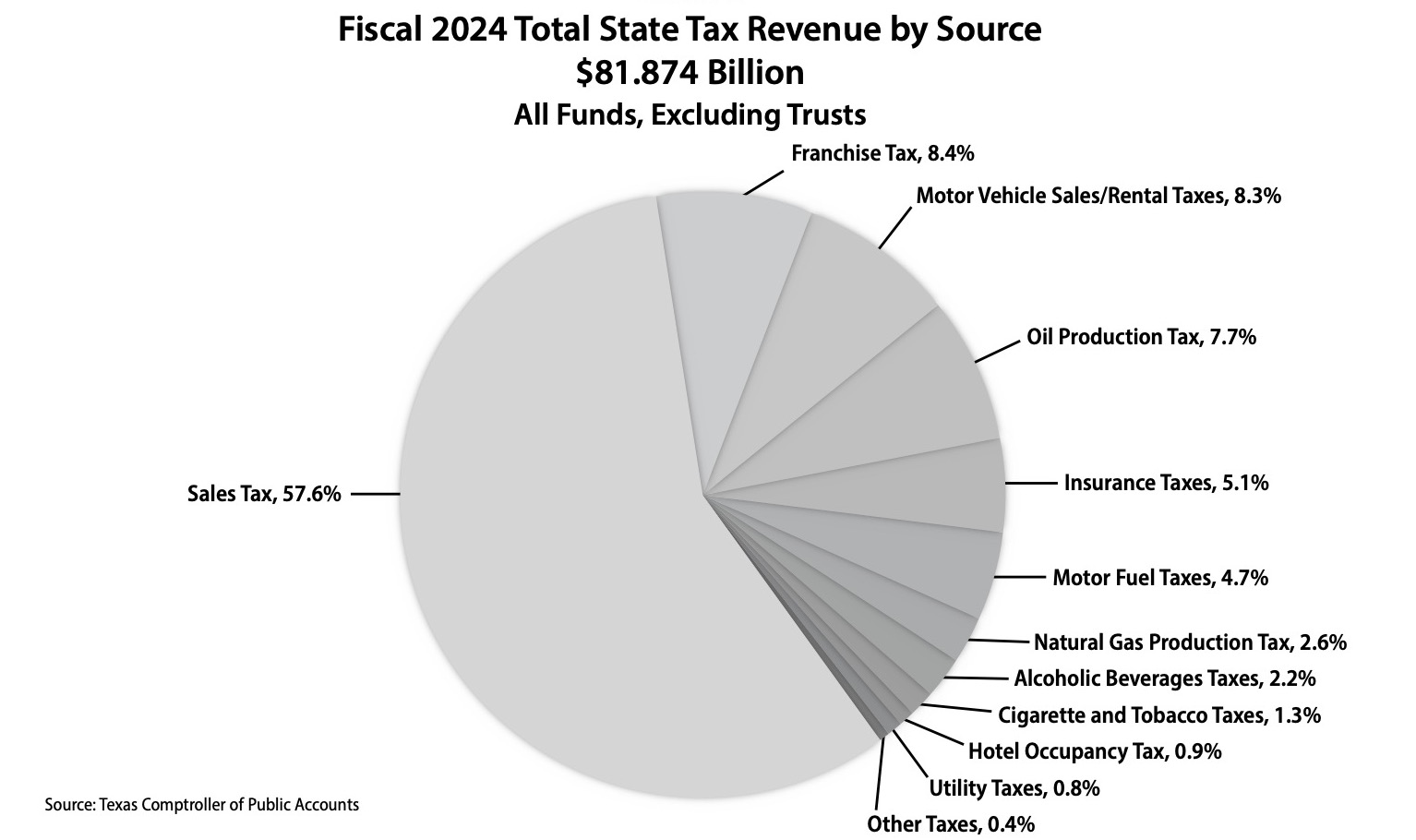

Next up in the Texas tax lineup is the sales tax. The statewide sales tax rate is 6.25%, but local jurisdictions (cities, counties, and special purpose districts) can add up to another 2% on top of that. This brings the maximum combined sales tax rate to 8.25% in many areas. So, when you're grabbing a new pair of boots, that famous Texas BBQ, or almost any tangible item, expect to see sales tax added to your bill.

However, there are some important exceptions! Essentials like most groceries, over-the-counter medicines, and prescription drugs are generally exempt from sales tax. So, while your new patio furniture will be taxed, your weekly run to H-E-B for groceries likely won't be. It’s a pretty standard approach, but good to keep in mind when you’re budgeting for daily expenses.

Beyond the Big Two: Other Ways Texas Taxes

While property and sales taxes are the main events for individual Texans, there are a few other taxes that play their part in the state's coffers. Businesses, for instance, might be subject to the Texas Franchise Tax. Then there are specific excise taxes on things like motor fuel, tobacco products, and alcoholic beverages. If you're staying in a hotel, you'll also encounter a hotel occupancy tax. These are usually less noticeable for the average person but contribute to the overall economic landscape.

What This Means For Your Wallet (and Your Lifestyle)

So, what’s the takeaway here? Living in Texas means you keep more of your gross income, which can feel like a significant financial freedom. However, that freedom comes with the responsibility of understanding and budgeting for potentially higher property taxes. It's a trade-off: instead of a percentage taken from every paycheck, you're looking at a larger, less frequent (but still substantial) bill for your homeownership, and a consistent, smaller percentage added to your everyday purchases.

This structure often appeals to entrepreneurs and those with higher incomes, as they can maximize their take-home pay. It also contributes to Texas's reputation as a business-friendly state, drawing investment and job growth. It's all part of the unique financial rhythm of the state.

At the end of the day, understanding the Texas tax landscape isn’t about finding a "tax-free" haven, but rather recognizing its unique structure. It’s about being an informed Texan (or future Texan!) and making smart financial choices. It connects directly to your daily life, from how much you save, to where you choose to live, and even how you budget for your weekend BBQ and rodeo tickets. So, plan wisely, budget carefully, and enjoy all the vibrant culture and opportunity the great state of Texas has to offer!