Ever dreamt of a place where your paycheck feels a little… heftier? Where the state doesn't take a slice right off the top of your hard-earned income? Well, saddle up, buttercup, because we're talking about Texas, and its delightful approach to income tax. If you're new to the Lone Star State, or just curious about its financial quirks, get ready for some good news!

The Lone Star Secret: No State Income Tax!

Let's get straight to the juiciest bit: Texas does not have a state income tax. Read that again. It’s not a typo. It’s a beautiful, wonderful fact that makes many Texans do a happy little jig. This means that when you earn money from your job, your investments, or your side hustle, the State of Texas won't be asking for a percentage of it. Your federal taxes? Absolutely, Uncle Sam still wants his share. But that state-level bite? Gone with the wind!

This is a major reason why Texas has become such a magnet for businesses and individuals alike. Imagine what you could do with that extra cash! More BBQ, more rodeo tickets, maybe even saving up for that dream pair of cowboy boots. It’s a pretty sweet deal, and it’s one of the state's biggest draws.

So, How Does Texas Keep the Lights On?

Now, before you pack your bags and move here thinking it’s a tax-free paradise (bless your heart!), let’s be real. Texas is a huge state with big needs – schools, roads, public services, you name it. So, if they aren’t collecting income tax, how do they fund everything?

The answer lies in other forms of taxation, primarily:

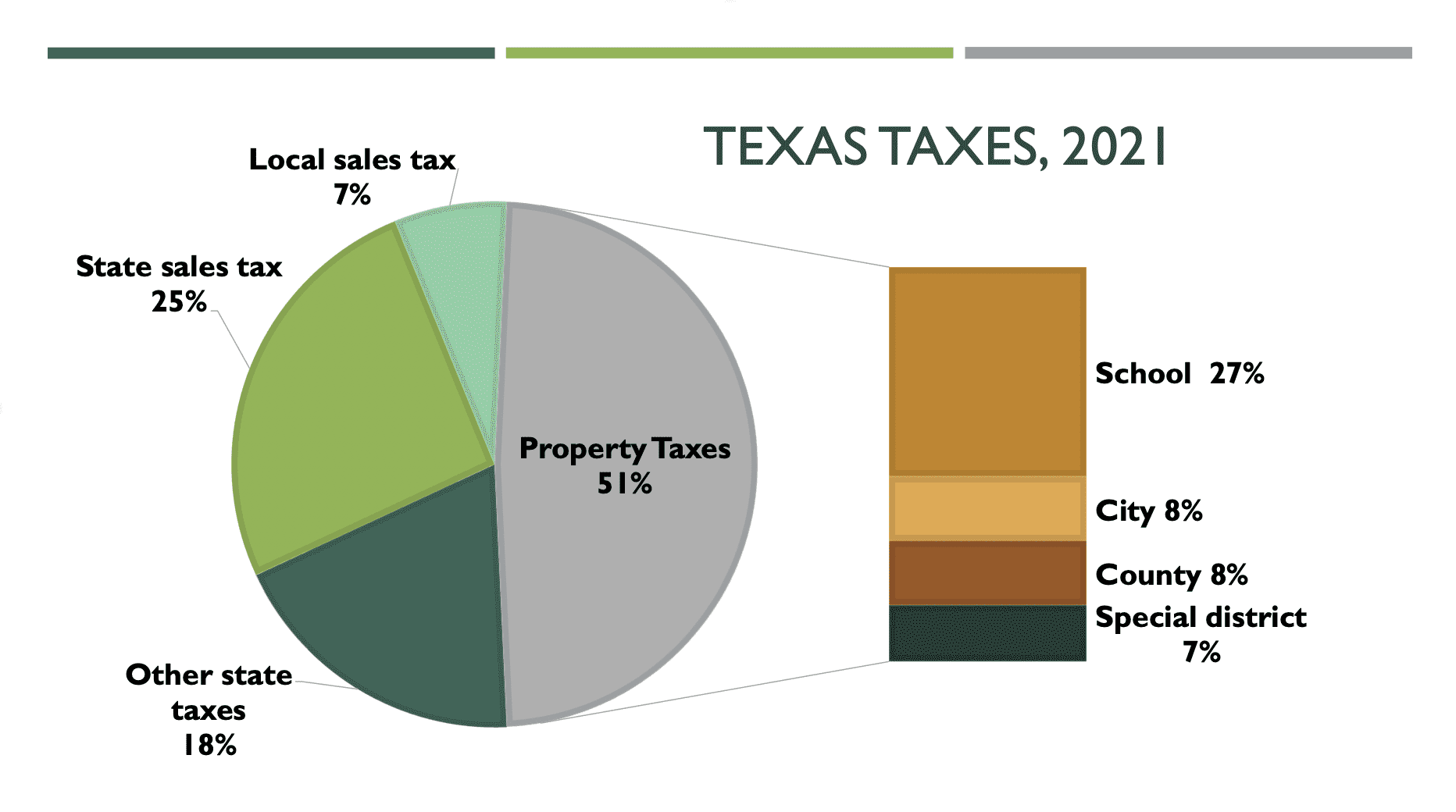

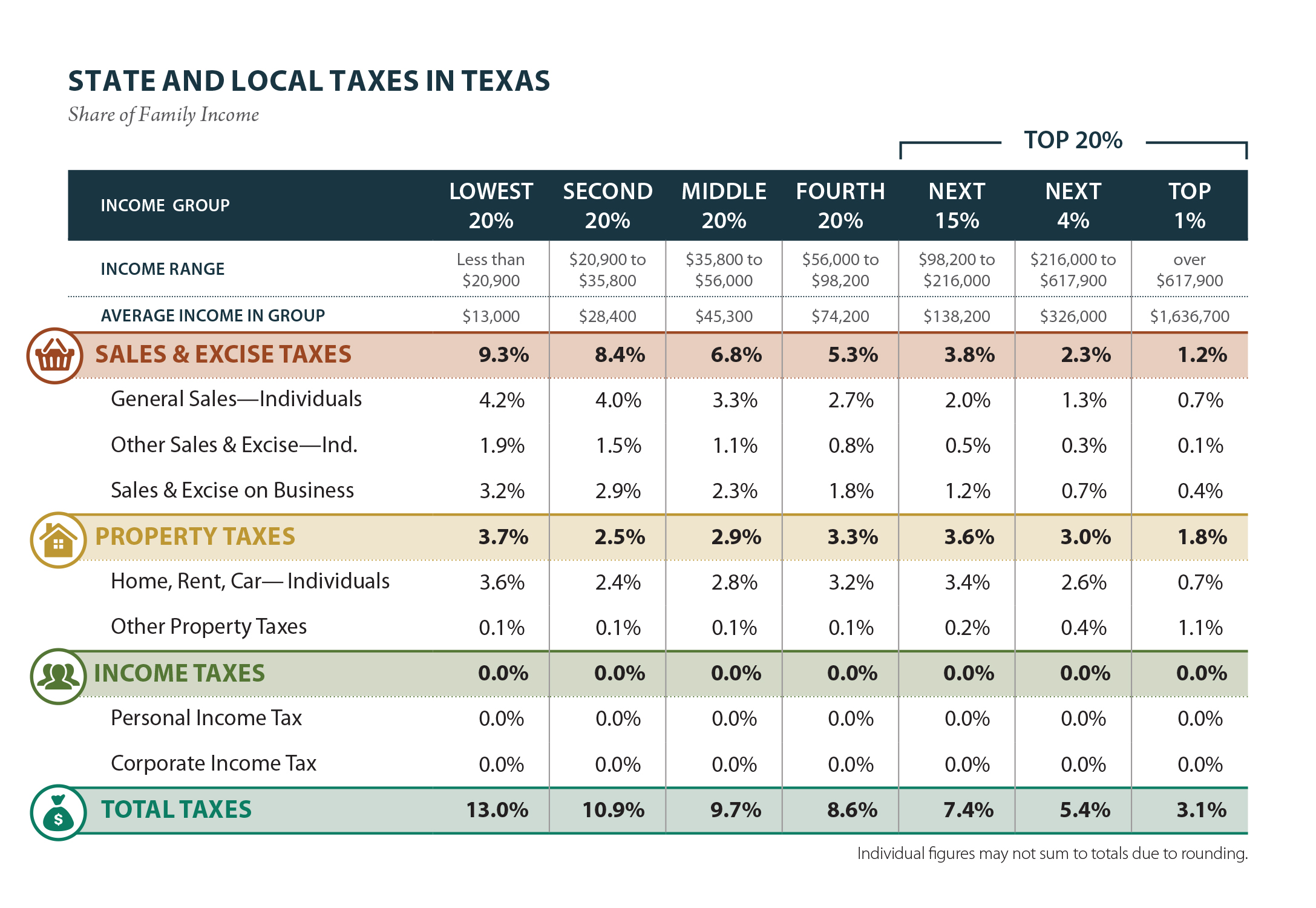

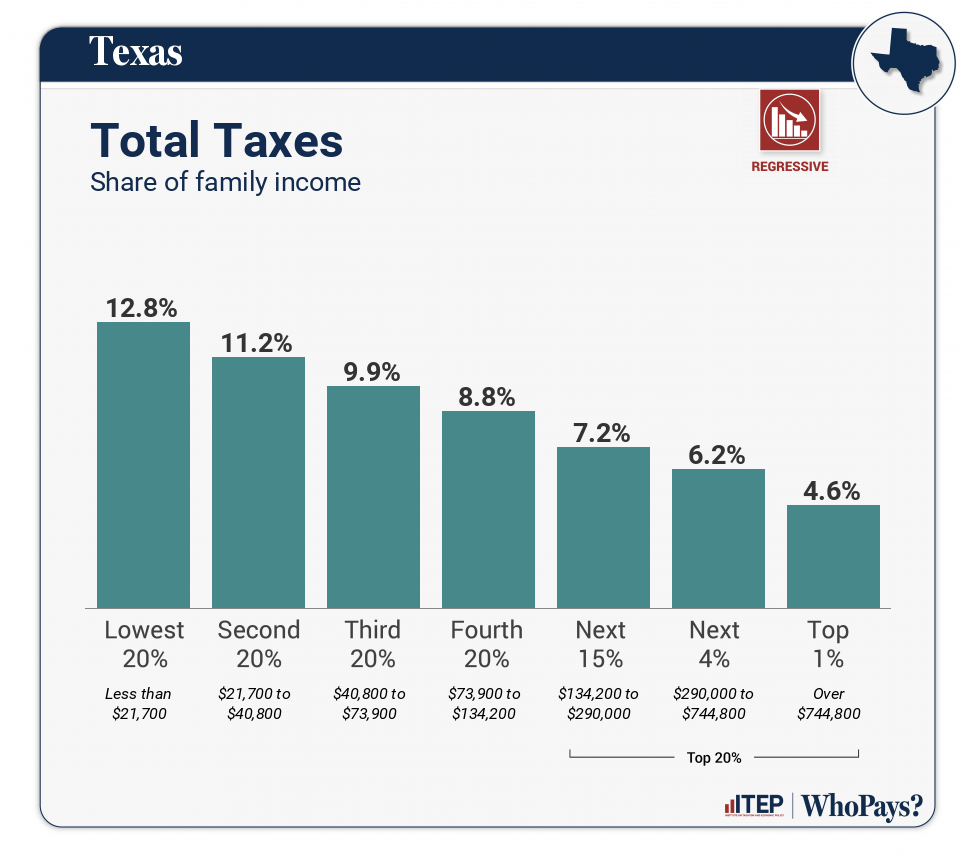

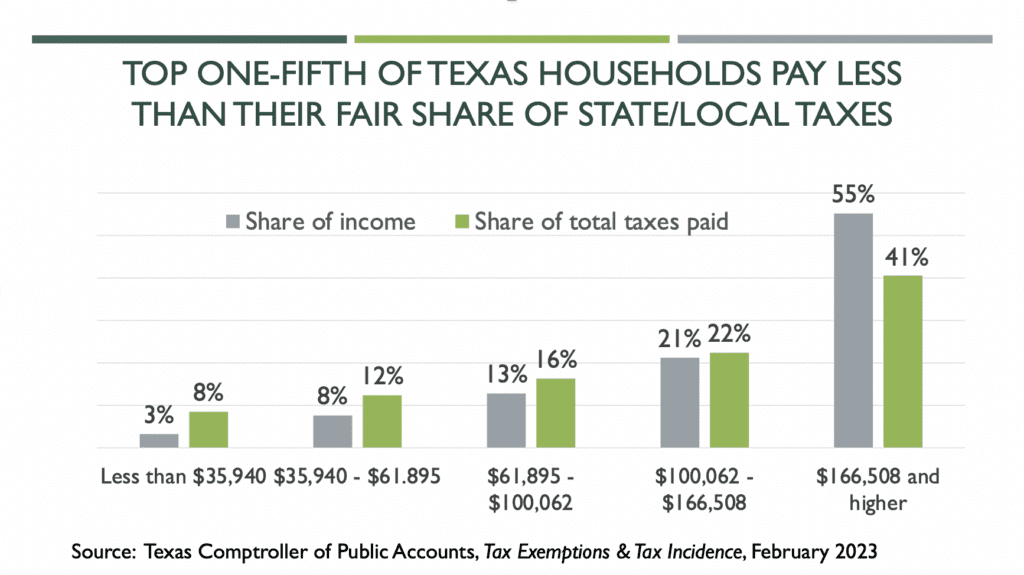

- Property Taxes: This is the big one, folks. Texas relies heavily on property taxes levied at the local level by counties, cities, and school districts. These can vary significantly depending on where you live. Owning a home in Texas means understanding your local appraisal values and tax rates.

- Sales Tax: When you buy goods and services in Texas, you’ll pay a sales tax. The statewide rate is 6.25%, but local jurisdictions can add up to 2%, bringing the combined rate to a maximum of 8.25%. So, that new pair of jeans or that delicious taco plate will come with a small extra charge.

- Business Franchise Tax: For many businesses operating in Texas, there's a franchise tax. This is a tax on a business's privilege of doing business in Texas, rather than on its income.

Think of it as a different kind of financial balancing act. Instead of a direct cut from your earnings, Texas leans on your spending and your property ownership to fund its operations.

Navigating the Texas Tax Landscape: Tips & Tricks

Living in a state without income tax can feel liberating, but it’s still smart to be financially savvy. Here are a few practical tips:

- Understand Your Property Taxes: If you're a homeowner, this is crucial. Research the tax rates in your desired area before you buy. Many Texans take advantage of the homestead exemption, which reduces the taxable value of your primary residence, saving you a chunk of change. Make sure you apply for it!

- Budget for Sales Tax: It might seem small on individual purchases, but 8.25% adds up. Factor it into your monthly spending, especially for bigger buys.

- Know Your Localities: Tax rates can differ from one county or city to another. A quick drive down the road could mean a different property tax burden. Do your homework!

- Businesses, Beware the Franchise Tax: If you're an entrepreneur, get familiar with the Texas franchise tax. It’s not income tax, but it’s still a significant obligation for many companies.

By being aware of these other taxes, you can truly appreciate the benefits of not having a state income tax.

The Texas Vibe: More Than Just Taxes

Beyond the financial perks, Texas offers a unique lifestyle. There's a certain freedom that comes with knowing more of your hard-earned money stays in your pocket. This often translates to a vibrant local economy, with people investing in their communities, enjoying the vast array of cultural offerings, and generally having a bit more wiggle room in their budgets.

Whether you're exploring the live music scene in Austin, enjoying some authentic BBQ in Lockhart, or hitting the beach in Galveston, that extra financial breathing room means you can embrace the Texas spirit a little more fully. It’s a state proud of its independence, and its tax structure definitely reflects that ethos. "Don't Mess With Texas" isn't just a slogan; it's a way of life, even when it comes to your paycheck!

So, there you have it. Texas keeps it simple on the income tax front. While it's not a complete tax haven (no place truly is!), the absence of a state income tax is a pretty sweet deal for residents. It means more financial flexibility, more opportunities to save, invest, or simply enjoy all the incredible things the Lone Star State has to offer. Understanding how Texas funds itself empowers you to make smarter financial choices and truly savor that extra bit of freedom in your daily life. Go forth and enjoy, y'all!