So, picture this: I was chatting with a friend the other day, someone who’s dreaming of making the big move to Texas. They had that starry-eyed look, you know? And the first thing they said was, "Oh, I can't wait to escape those state income taxes!" And I just smiled. A knowing, slightly ironic smile, if I'm honest.

Because while they're absolutely right about that particular tax, it's a bit like saying you're thrilled to avoid rain, only to find yourself in a delightful (or not-so-delightful, depending on your perspective) sandstorm. Texas definitely has its perks, don't get me wrong! But when it comes to taxes, it’s less about avoiding them entirely and more about a strategic re-shuffling of where your money goes. It’s a different game, my friend.

And if you’re thinking of calling the Lone Star State home, or just curious about how we keep the lights on down here, then buckle up. Let's talk about what really pays for everything in Texas. Spoiler alert: it’s not free barbecue.

The Big Kahuna: No State Income Tax! (Yes, Really!)

Alright, let’s get the good news out of the way first, because it’s a genuinely attractive feature for many. Texas is one of a handful of states that boasts no individual state income tax. Zip. Nada. You won't see a line item on your paycheck deduction for state income tax here, and you won't be filling out a separate state income tax return come April.

Pretty sweet, right? This is often the headline, the shiny lure that draws people in. And it’s true! But hold on to your hats, because states need money to run schools, fix roads, and, you know, exist. So, if they’re not getting it from your income, where are they getting it from? *That* is the million-dollar question.

Prepare for Sticker Shock: Property Taxes

Welcome to the other side of the coin, folks! If you live in Texas and own a home, you’re likely familiar with the concept of property taxes. If you’re considering moving here, prepare yourself: Texas property taxes are notoriously high. And I mean, *really* high, often among the highest in the nation.

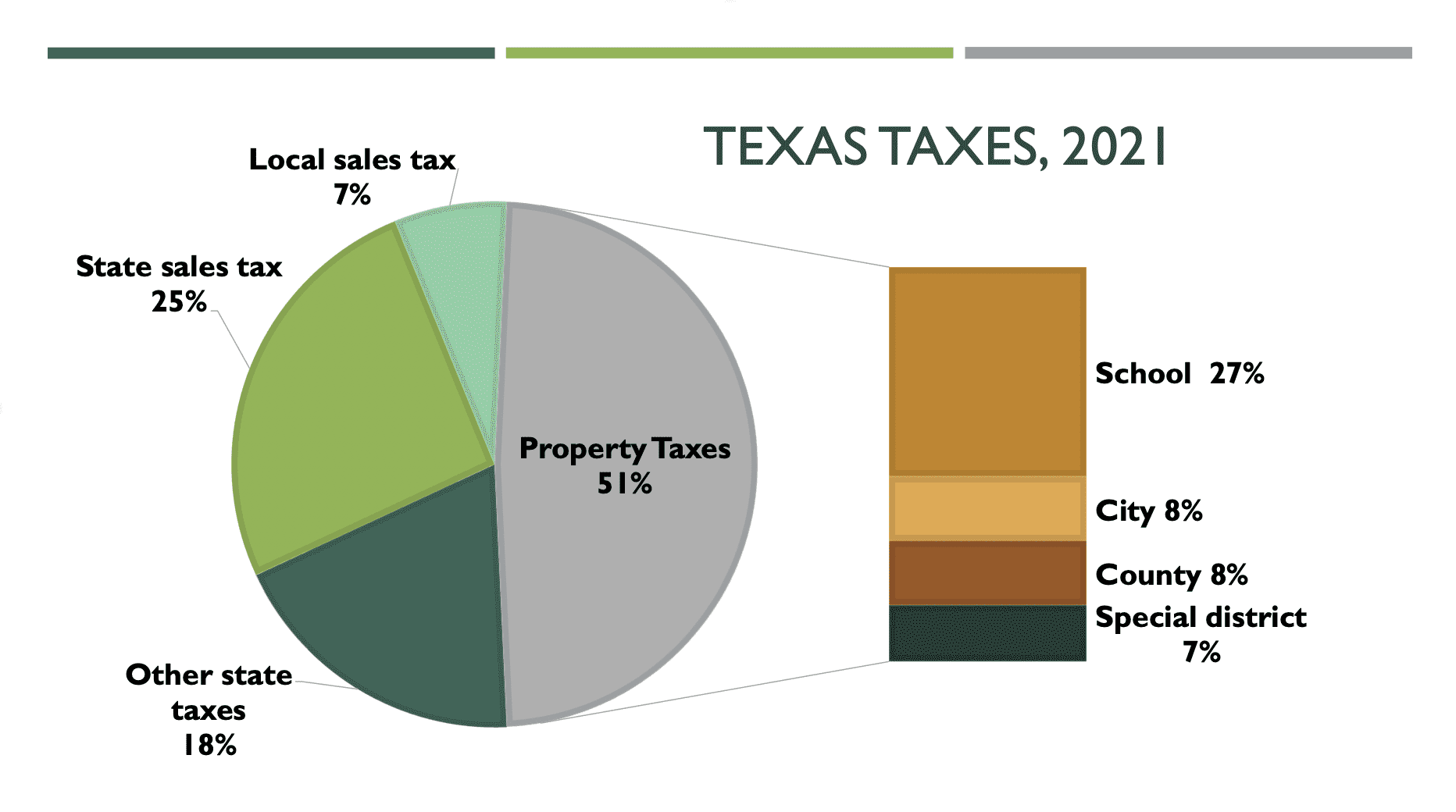

Unlike state income tax, property taxes are assessed at the local level. We're talking cities, counties, school districts, and special districts (like community colleges or hospital districts). Each of these entities sets its own tax rate, and they all add up. The bulk of your property tax bill usually goes to fund local public schools, which is a big reason why those rates can climb so high.

So, while you might celebrate not paying income tax, don't fall off your chair when you see your annual property tax bill. It can be a significant chunk of change, and it’s a crucial factor to consider when buying a home here. Do your homework on specific addresses, because rates can vary widely even within the same county!

Everyday Spending: Sales Tax

Okay, this one is pretty standard fare, but still a significant source of revenue. Texas has a state sales tax rate of 6.25%. On top of that, local governments (cities, counties, transit authorities) can add their own sales taxes, typically up to 2%.

This means that depending on where you are, you could be paying up to 8.25% in sales tax on most goods and some services. Buying a new TV? That extra percentage adds up. Grabbing groceries? Good news! Most unprepared food (like your weekly supermarket run) is exempt from sales tax, as are prescription medications. But if you're eating out, that sales tax is definitely coming along for the ride.

It's one of those "death by a thousand cuts" situations, you know? You don't always feel it directly, but it's constantly skimming a little off the top of almost everything you buy.

Other Ways Texas Gets Its Green

Beyond the big three, there are a few other ways the state collects revenue, proving that no matter how you slice it, the government always finds a way to fund public services. Think of these as the supporting cast members in the grand tax play:

- Fuel Taxes: You pay state and federal taxes on gasoline and diesel, which primarily go towards maintaining our roads and infrastructure. Vroom vroom!

- Alcohol and Tobacco Taxes: Often called "sin taxes," these are levied on, you guessed it, alcoholic beverages and tobacco products.

- Franchise Tax: This is a tax on businesses operating in Texas, not individuals. So, if you're thinking of starting a company, that's another thing to keep in mind, but it won't hit your personal wallet directly.

- Hotel Occupancy Tax: If you're staying in a hotel, you'll pay this. Great for funding local tourism and convention centers.

The Texas Tax Takeaway

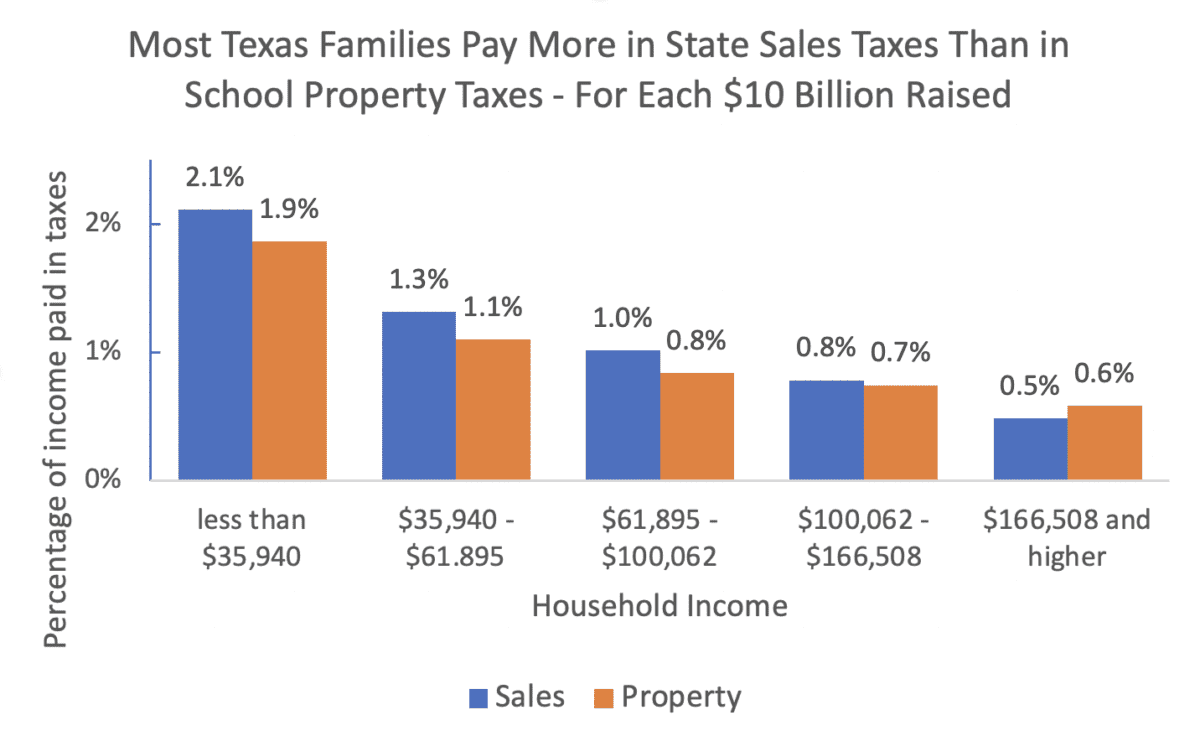

So, what’s the big picture here? Texas might not have a state income tax, which is a huge plus for many. But the state still needs to pay its bills, and it does so by leaning heavily on property taxes and sales taxes.

It’s a different balance, a different financial ecosystem. For some, the trade-off is absolutely worth it, especially if they have a lower-valued home or don't spend a lot. For others, particularly those with expensive homes, the property tax bite can be more significant than the income tax savings they’d gain elsewhere.

The lesson? Don't just hear "no income tax" and assume it's a financial paradise. Do your homework, crunch the numbers specific to your situation, and understand where your money will actually be going. Because while we love our Lone Star State, those public services aren’t powered by optimism alone!