Alright, y'all! Pull up a virtual chair, maybe grab a sweet tea (or something stronger, no judgment here!), because we're about to chat about a topic that usually makes people's eyes glaze over: taxes. But don't you dare click away! We're talking about taxes in the great state of Texas, and trust me, it's not nearly as scary as it sounds. In fact, there's a pretty sweet deal waiting for you.

Think of this as a casual confab, no stuffy jargon, just the lowdown from one friend to another. We’ll navigate the Lone Star State's unique tax landscape with a smile, a few winks, and maybe a mental high-five or two.

The Star of the Show: No State Income Tax!

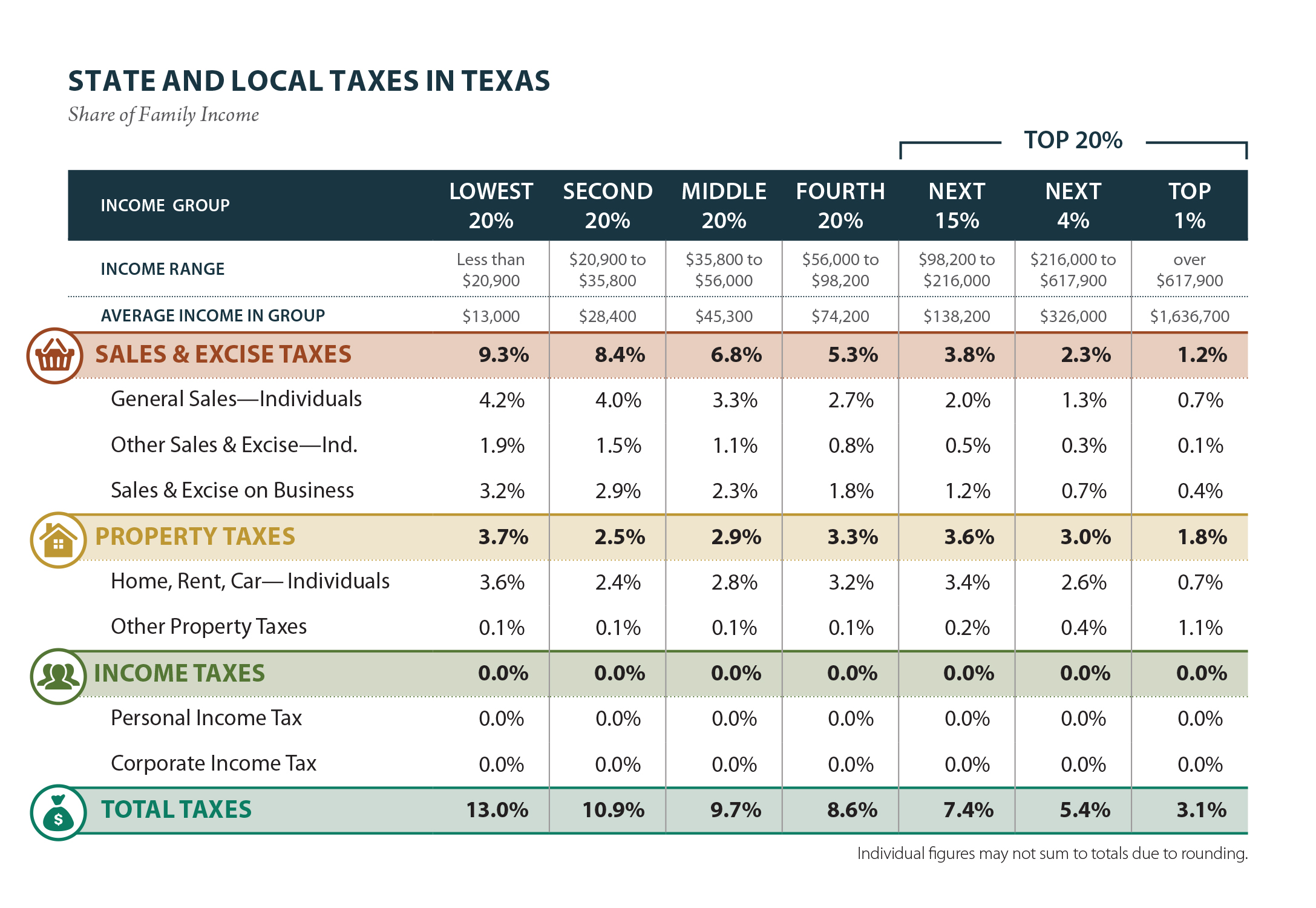

Let's kick things off with the absolute best news, the one that makes many Texans puff out their chests with pride: Texas has no state income tax! That's right, folks. When you get that paycheck, the state of Texas isn't reaching its sticky little fingers into your earnings before they even hit your bank account. Pretty fantastic, right?

This is a huge deal, especially if you've ever lived in a state where a chunk of your hard-earned money disappears before you even see it. Here in Texas, what you earn is largely yours to keep (after federal taxes, of course – Uncle Sam still wants his cut, bless his heart). It means more money in your pocket for whatever brings you joy, be it a new pair of boots, a weekend getaway, or just more avocado toast.

So, if Texas isn't taking a slice of your income pie, how does it keep the lights on? How do we fix those infamous potholes and fund our schools? Well, that's where the other major players come in.

Property Taxes: The Big Kahuna (Local Style)

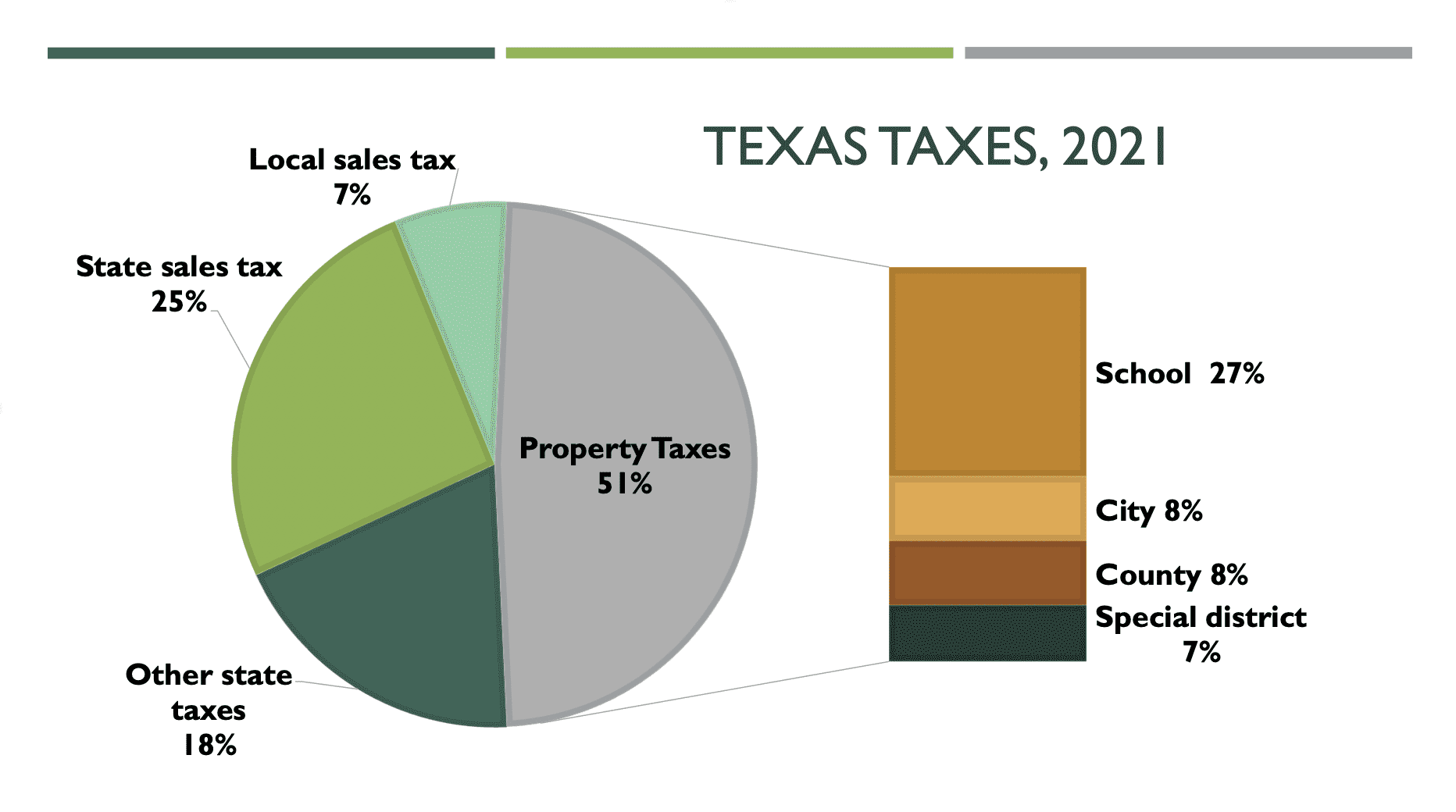

Okay, deep breath. Because while we cheer about no income tax, we do need to acknowledge Texas's other major revenue stream: property taxes. And yeah, they can be a bit hefty. But here's the crucial part: they're primarily collected at the local level, not by the state itself.

What does that mean? It means your property tax bill isn't just one big number from "the state." Instead, it's a collection of taxes from various local entities: your county, your city, emergency services districts, and most significantly, your school district. Those local schools, roads, and fire departments? They're mostly funded by what homeowners pay in property taxes.

Think of it as contributing directly to your community's well-being. And because there's no state income tax, these local property taxes tend to be higher than in some other states to make up the difference. So, when you're house hunting, remember to factor those property taxes into your budget. It's the trade-off for keeping more of your paycheck!

Your property's value is determined by local appraisal districts, and yes, sometimes those appraisals can make you raise an eyebrow. But hey, at least you know your property is considered valuable, right? Glass half full!

Sales Tax: The Little Nibbler

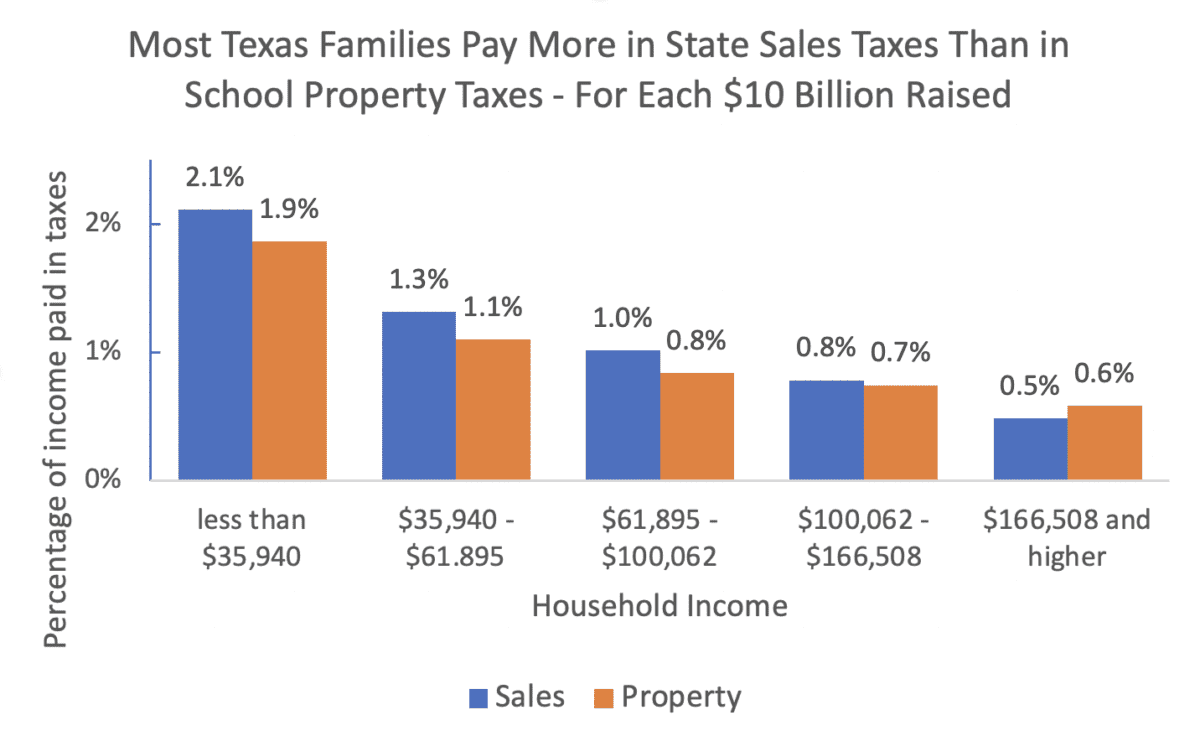

Next up, we have the ubiquitous sales tax. This one you're probably familiar with no matter where you're from. In Texas, the state sales tax rate is 6.25%, but most cities, counties, and special purpose districts can add their own local sales taxes on top of that. This usually brings the total combined sales tax rate to somewhere around 8.25% in many areas.

So, every time you buy something – that new outfit, a gadget, or even just a coffee – a little bit extra gets added to the total. It’s like a tiny, almost imperceptible handshake with the tax man. The good news? Most unprepared groceries are exempt from sales tax. So you can stock up on all your favorite snacks and ingredients without that extra ding. Feel free to splurge on that fancy cheese!

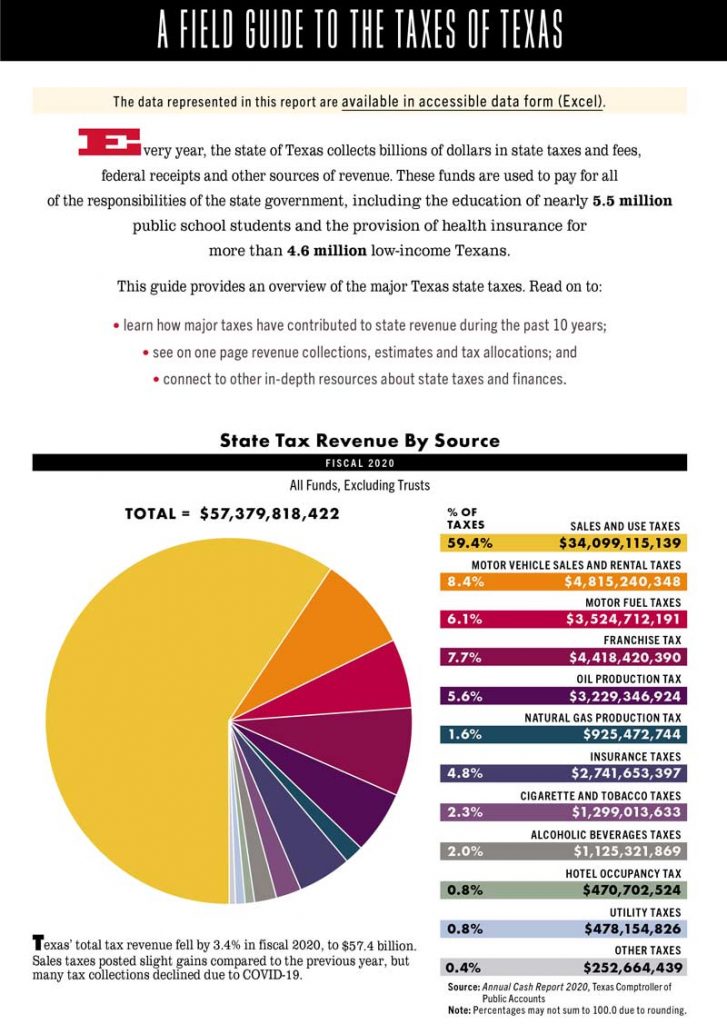

Sales tax is another big source of revenue for the state and local governments. It’s how visitors contribute to the state’s coffers too, even if they don't own property here. Clever, huh?

A Few Other Nitty-Gritty Bits

Texas also collects taxes on things like fuel (gotta keep those big trucks and SUVs moving!), alcohol, and tobacco (sometimes called "sin taxes" – cue dramatic music). If you own a business, you might encounter the Texas Franchise Tax, which is basically a business tax based on revenue or margin, but we won't dive too deep into those weeds right now. This is a chill chat, remember?

The Texas Tax Trade-off: Is It Worth It?

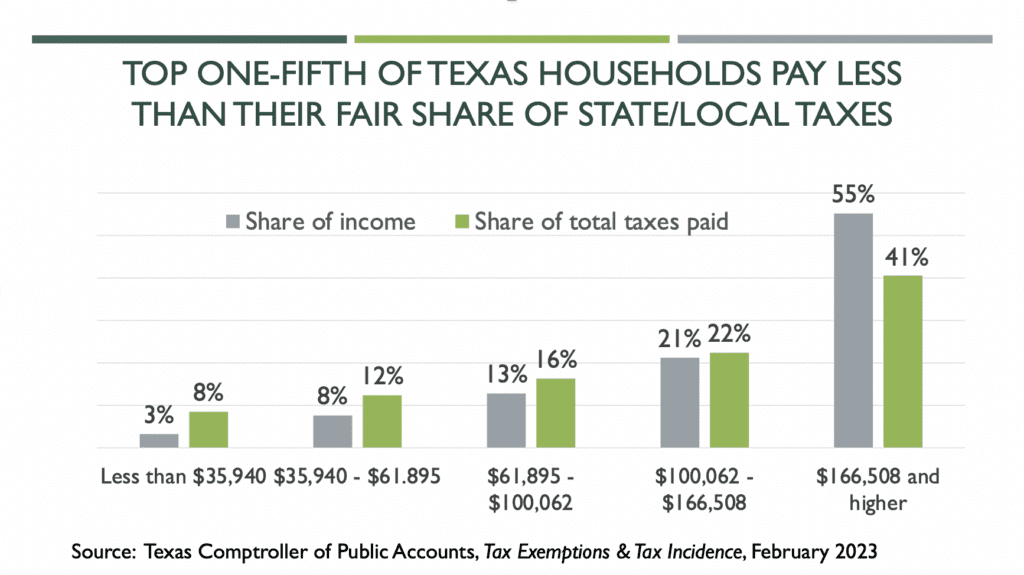

So, to recap: no state income tax (hooray!), but higher property taxes (mostly local) and a standard sales tax. It’s a different beast than many other states, but for a lot of people, the trade-off is absolutely worth it.

Keeping more of your gross income upfront can be a huge financial advantage, even with the other taxes. It offers more flexibility and freedom in your personal budgeting. Many find the Texas system simpler to understand than trying to calculate various income tax brackets and deductions.

A Smiling Conclusion

See? That wasn't so bad, was it? Texas taxes might be a little different, but they're straightforward once you get the hang of them. We pride ourselves on freedom here, and that extends to keeping more of your hard-earned cash in your pocket.

So next time someone brings up taxes, you can confidently explain the Texas way. And then, go enjoy that extra cash you saved from not paying state income tax. Maybe treat yourself to some delicious Texas BBQ, a concert, or just a relaxing evening under our big, beautiful sky. Because in Texas, we work hard, we play hard, and we keep more of what's ours. Now go forth and enjoy the financial freedom, friend!