Okay, let me set the scene. It was the absolute peak of summer, the kind where the asphalt shimmers and even the birds look sweaty. My old AC unit, bless its ancient heart, decided that was the perfect moment to stage its dramatic exit from active service. Picture this: me, fanning myself with a pizza box, Googling "how to survive a heatwave indoors" while a tiny trickle of sweat made its way down my spine. The thought of shelling out thousands for a new one made me want to just move into the fridge. Seriously, who enjoys sweating through July?

That's when I started digging into what felt like a secret cheat code for homeowners: the tax credit for AC units in 2024. And let me tell you, it's a game-changer. It’s not just about getting a shiny new unit; it’s about making your wallet breathe a little easier too. Imagine that, saving money while staying cool. It's like finding a twenty in an old coat pocket, but better, because it helps you avoid melting into a puddle.

So, What's the Deal with This AC Tax Credit for 2024?

Alright, let’s get into the nitty-gritty without making your eyes glaze over. We're talking about the Energy Efficient Home Improvement Credit, which got a serious glow-up thanks to the Inflation Reduction Act (IRA). This isn't just some dusty old tax deduction; it's a credit. And what’s the difference, you ask? A deduction lowers your taxable income, but a credit directly reduces the amount of tax you owe, dollar for dollar. So, if you owe $3,000 in taxes and you get a $2,000 credit, suddenly you only owe $1,000. Pretty sweet, right?

For 2024, this credit can snag you up to 30% of the cost of certain qualified energy-efficient home improvements, with a juicy annual limit of $1,200 for most general upgrades. But wait, there's more! (Queue infomercial music in your head, you know the one). For *specific* high-efficiency property, like certain heat pumps and, yes, some super-efficient AC units, that limit jumps to a whopping $2,000 per year. Now we're talking!

Which AC Units Are We Talking About?

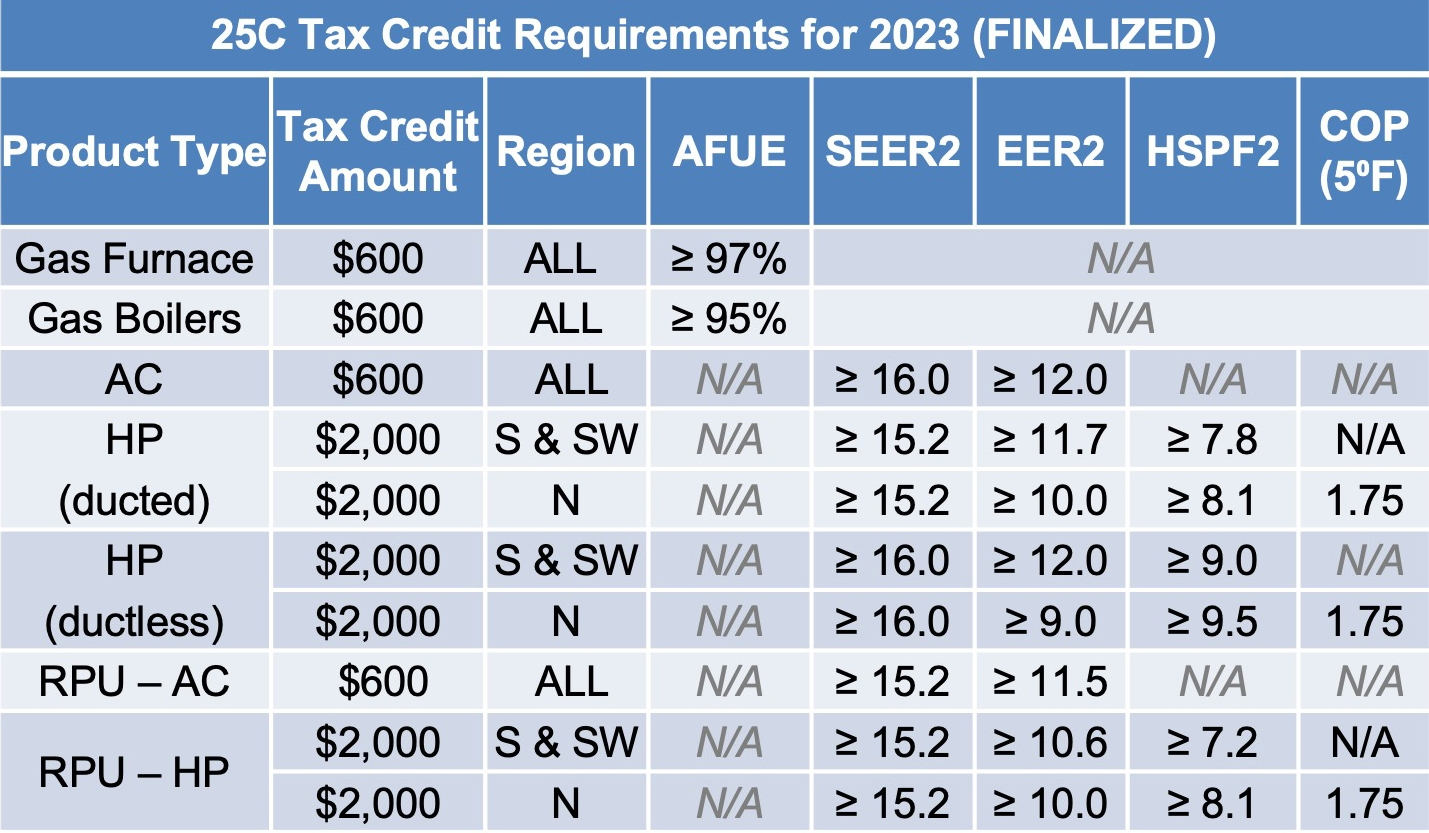

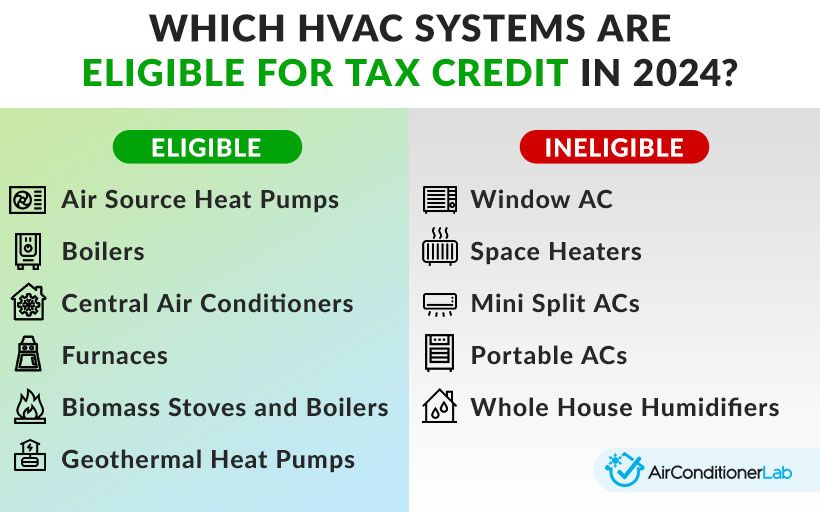

This isn't just for any old AC unit you pick up from a big box store, my friend. The IRS and the Department of Energy are looking for units that are truly going to make a difference in your energy consumption. We're talking about those high-efficiency models. Typically, this means units that meet or exceed specific ENERGY STAR requirements, often measured by SEER2 (Seasonal Energy Efficiency Ratio 2) ratings. The higher the SEER2, the more efficient the unit, and the more likely it is to qualify.

So, when you're chatting with your HVAC professional – and please, please chat with them – make sure you specifically ask about units that qualify for the 2024 Energy Efficient Home Improvement Credit. They’ll know the exact specifications needed. Don’t be shy; it’s literally their job to help you find the best options that save you money, both upfront and long-term.

The Nitty-Gritty Details You Need to Know:

- It's for your

primary residence : Sorry, rental properties or vacation homes usually don't qualify for this specific credit. - Installation matters: The unit needs to be installed in 2024.

- Keep those receipts! You'll need proof of purchase and installation for tax time. The IRS is all about documentation, so don't toss anything.

- Annual limits reset: This is a cool part – the $1,200/$2,000 limit resets each year. So, if you spread out your energy efficiency upgrades over a few years, you could potentially claim more credits.

Think about it: replacing an old, struggling AC unit with a brand-spanking-new, energy-efficient one isn't just about escaping the summer sweat. It's about seeing a noticeable drop in your monthly energy bills, feeling more comfortable in your own home (no more hot spots!), and yes, getting a sweet chunk of change back come tax season. It’s like a triple win!

Ready to Ditch the Sweat and Embrace the Savings?

This isn't just some fleeting offer; it's a multi-year program designed to make our homes more efficient and our lives more comfortable. So, if you've been eyeing that ancient, rattling AC unit of yours with a mix of dread and resignation, 2024 might just be your year to make the upgrade. Seriously, future you (the one enjoying perfectly cool air and a fatter bank account) will thank current you for looking into this.

Don't let the thought of taxes scare you off. A quick chat with a trusted HVAC company and a tax professional (they’re the real heroes here) can clarify all the specifics for your situation. It's easier than you think to navigate, and the payoff in comfort and cash is absolutely worth it. So go on, get cool, save some green, and enjoy not fanning yourself with a pizza box this summer!