Hey there, fellow curious minds! Ever found yourself daydreaming about wide-open spaces, delicious BBQ, and perhaps, the mysteries of state taxes? If Texas has ever popped onto your radar, you might have pondered one of its most talked-about quirks: Is there state tax in Texas?

It's a question that often sparks a little lightbulb moment for folks contemplating a move or just trying to understand how different states tick. And trust me, Texas definitely has its own way of ticking!

The Big Reveal: No State Income Tax!

Let's cut to the chase, shall we? When people ask about "state tax" they're usually wondering about state income tax. And on that front, the answer for Texas is a resounding and pretty exciting: nope! That's right, folks. Texas is one of a handful of states that chooses not to levy a state income tax on its residents.

Pretty cool, right? Imagine your paycheck coming in without that extra chunk taken out by the state. For many, this is a huge draw, like finding an extra twenty in your old jeans. It means more of your hard-earned money stays right there in your pocket, ready for that next rodeo, delicious taco truck visit, or maybe just, you know, bills.

This isn't just a win for individuals; it's often seen as a big magnet for businesses too. Companies looking to set up shop might eye Texas precisely because their employees get to keep more of their earnings, making the state an attractive place to live and work. It's like Texas offers a slightly sweeter deal on the personal finance front.

So, How Does Texas Pay for... Everything?

Now, before you pack your bags and move sight unseen, a little reality check. Texas isn't a magical land where services appear out of thin air. Roads, schools, public safety, state parks – they all cost money. So, if there's no state income tax, how does the Lone Star State keep the lights on?

This is where it gets interesting, like a puzzle with different pieces. Texas largely relies on a different mix of taxes to fund its government. Think of it like a restaurant that doesn't charge a cover fee but makes its money on all the delicious dishes you order. Let's peek at the menu:

Property Taxes: The Heavy Hitter

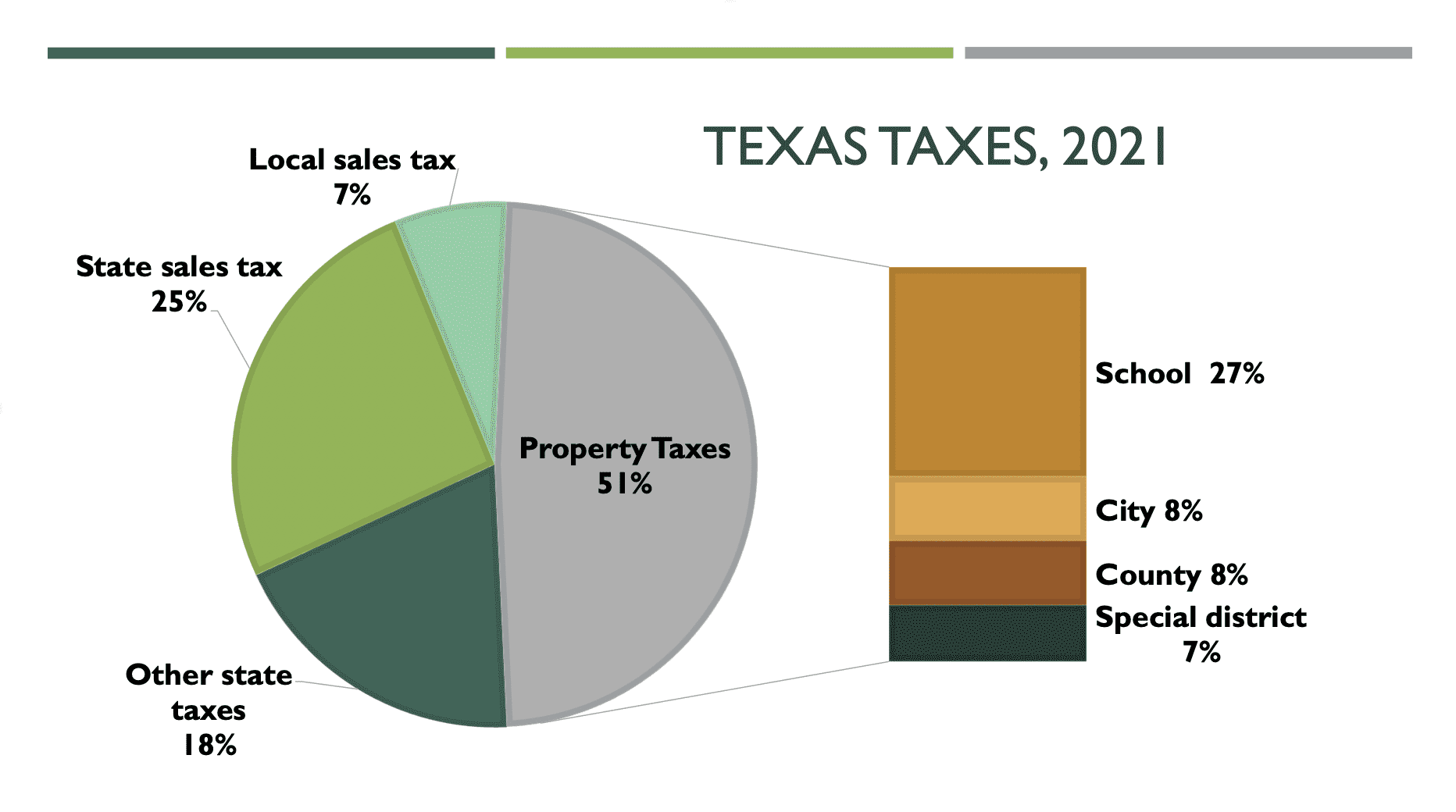

If you own property in Texas, you'll definitely get acquainted with property taxes. These are arguably the most significant tax for many Texans. While levied at the local level (by counties, cities, school districts, etc.), they make up a massive chunk of how local services, especially schools, are funded. So, instead of a state income tax, Texas leans heavily on what you own. It's a different way of balancing the books, and for some, it can feel like a pretty hefty annual bill.

This is why you'll often hear people say that while Texas has no income tax, its property taxes can be quite high compared to other states. It's a trade-off, like choosing between paying more for your car's fuel efficiency or paying more for its purchase price. Different strokes for different folks!

Sales Tax: Almost Everywhere Else

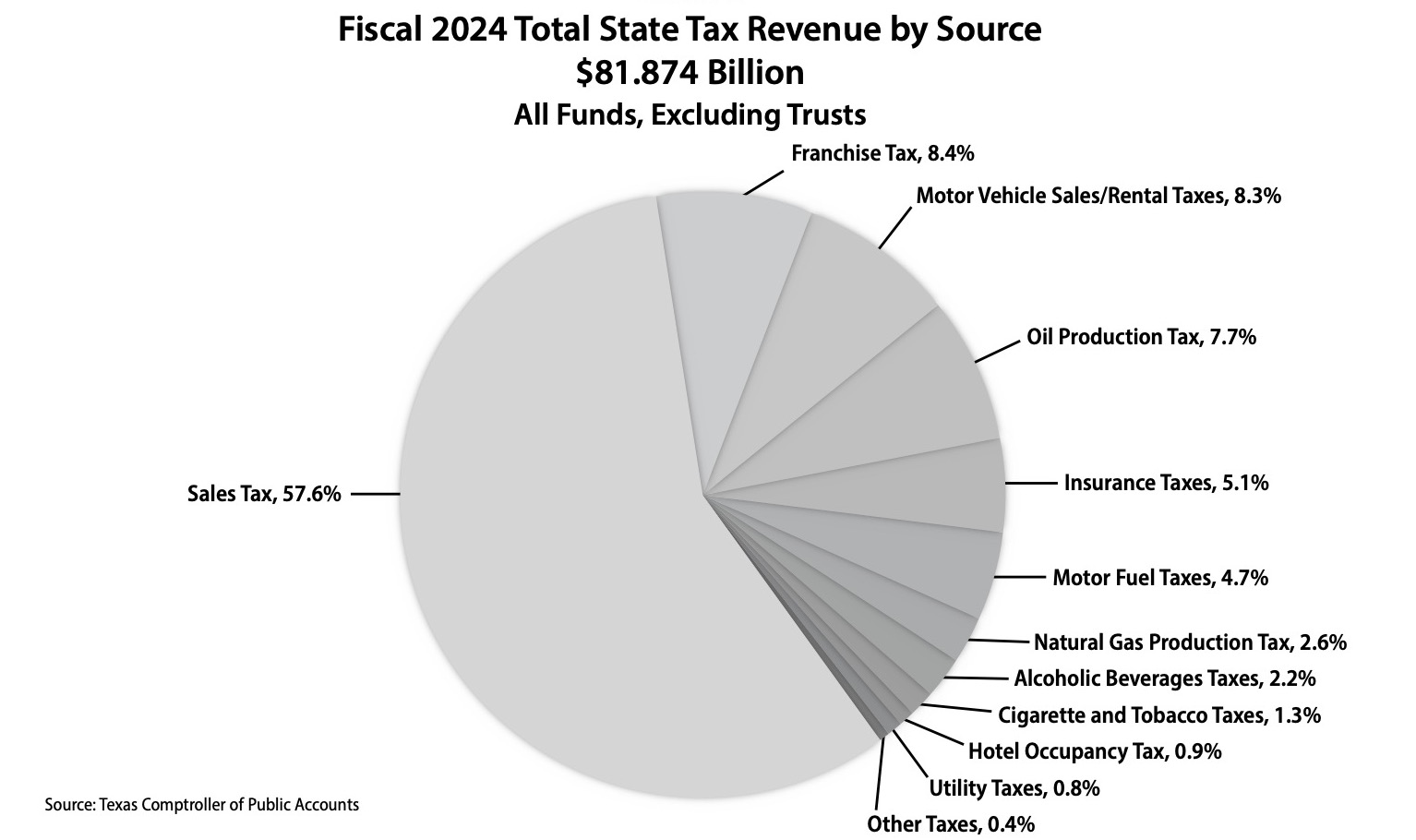

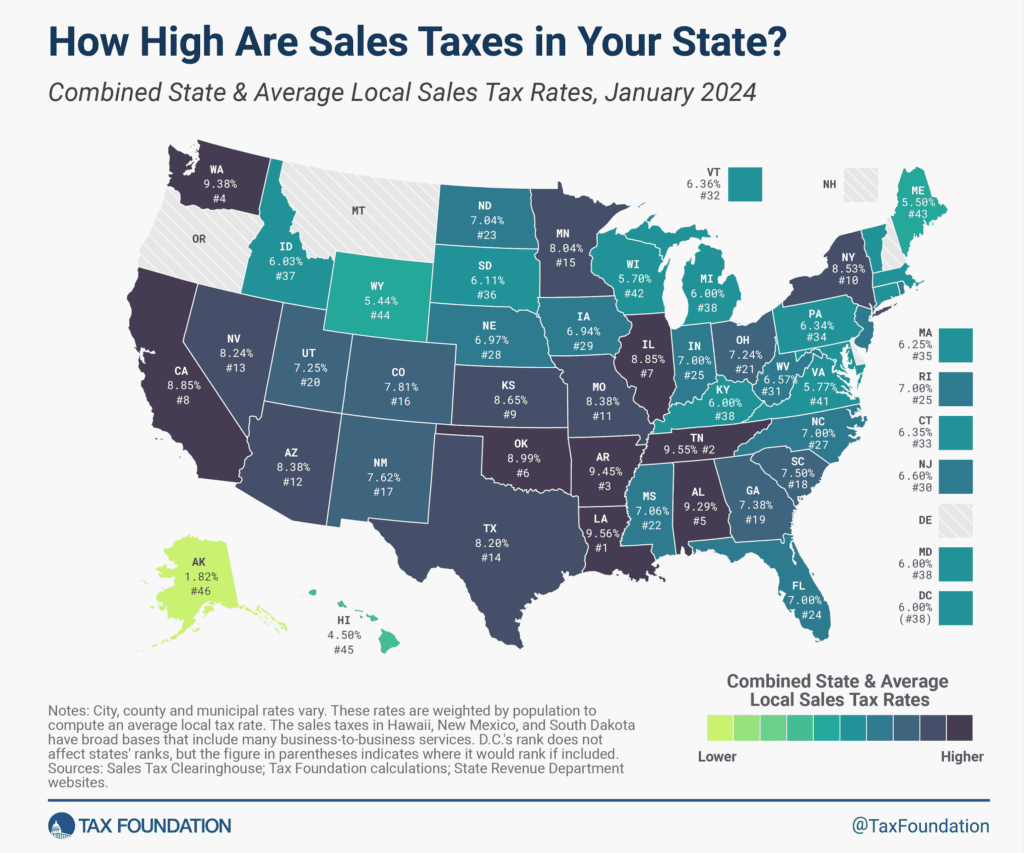

Another major player in Texas's revenue game is sales tax. When you buy most goods and services in Texas, you'll pay a state sales tax, plus any local sales tax that might be added on. The state portion is 6.25%, and local jurisdictions can add up to 2% more, making the total sales tax up to 8.25% in most places. It's right up there with many other states, so you're certainly not escaping sales tax by moving to Texas!

Think of it as paying a little bit extra on almost everything you purchase – from groceries (though many food items are exempt!) to a new pair of boots. This broad-based tax ensures that even visitors contribute to the state's coffers, which is pretty clever, right?

Other Taxes: The Supporting Cast

Beyond property and sales taxes, Texas also collects revenue through other means, though they might not directly impact every resident as much. We're talking about things like:

- A business franchise tax (which is essentially a state tax on businesses).

- Fuel taxes at the pump.

- Various fees and licenses (for everything from driving to hunting).

- Taxes on specific industries like oil and gas production.

A Different Flavor of the Tax Pie

So, to circle back to our original question: Is there state tax in Texas? When it comes to income tax, no! But does Texas collect taxes from its residents? Absolutely! It just does so through a different recipe. Instead of taking a slice directly from your paycheck, it gets its share through property ownership and consumer spending.

Is this system better or worse than one with state income tax? Well, that's a whole other conversation, and honestly, it depends on your individual situation and priorities! For some, the idea of keeping more of their earned income is incredibly appealing, even if it means higher property taxes. For others, a more balanced approach might be preferred.

Texas's approach to taxation is a fascinating example of how states can choose very different paths to fund their public services. It's a reminder that every state has its own unique economic personality, and understanding it is part of the fun of exploring our diverse country. So, next time you're enjoying some Texas BBQ, you can chew on that thought too!