Ah, the sound of rain on the roof. For many of us, it’s a cozy lullaby, a gentle reminder of home. But then, one day, that gentle pitter-patter turns into a frantic drip-drip-drip… inside your living room! Suddenly, the cozy lullaby becomes a full-blown stress symphony.

That’s right, we’re talking about the dreaded *new roof*. It’s a major home improvement, a hefty expense, and often, an unexpected one. As soon as the estimate comes in, a little voice in your head, perhaps an optimistic whisper, begins to ask: "Is this a tax deduction?"

The Great Tax Deduction Mystery

Let's be honest, wouldn't it be wonderful? Imagine paying for a brand-new roof and then getting a big chunk of that money back from Uncle Sam. It feels like it *should* be deductible, right?

It’s like when you buy a new car and think about all the places you'll go. A new roof ensures your home *stays* where it is! So, does this essential home protector fall into the magical world of tax write-offs?

Hold onto your shingles, because the answer might be a little less straightforward, and perhaps even a touch surprising, than you'd hoped. But don't despair! There's a silver lining, a hidden gem, and even a few heartwarming tales in this roofing saga.

For most homeowners, when it comes to your primary residence, a new roof isn't typically a direct, dollar-for-dollar tax *deduction* in the year you install it. We know, we know. Cue the sad trombone sound effect.

Our friend, Uncle Bob, a meticulous record-keeper with a knack for spotting a bargain, often sighs dramatically when discussing home improvements. He'll say, "It's not a deduction, but it's an investment, darling, a real investment!"

It's Not a Deduction, It's an… Improvement!

So, if it’s not a deduction, what *is* it? Think of your home as a giant piggy bank. Every major improvement you make, like a new roof, adds to the *value* of that piggy bank. Tax folks call this increasing your home's "basis."

Imagine your home's original purchase price as the starting line. When you put on a new roof, you're not just fixing a leak; you're adding to that initial cost. This might sound like a bunch of tax jargon, but it's actually pretty simple when you think about it.

It's like when little Timmy got his first piggy bank. He started with $5. Then he earned $2 for chores and added it. His "basis" grew to $7. A new roof works similarly, but for your home's financial story.

This "basis" becomes incredibly important down the road. Why? Because when you eventually sell your home, that increased basis helps reduce any *capital gains* tax you might owe. It's a long-game strategy, a slow-burn win, but a win nonetheless!

Aunt Mildred, always one for immediate gratification, once tried to deduct her new roof herself, only to be gently corrected by her accountant. "But it cost so much!" she wailed. Her accountant, a kind soul named Mr. Henderson, explained the basis concept with a simple drawing of a house getting taller with each improvement.

It’s like planting a tree. You don't get immediate fruit, but years later, you'll enjoy the shade and the harvest. A new roof is very much like that, a long-term investment in your future comfort and financial well-being.

When a Roof *Might* Get a Tax Nod

Now, while your personal home's roof generally isn't a direct deduction, there are a few surprising twists to this tale. Not all roofs are created equal in the eyes of the IRS!

The Rental Property Revelation

If you're a landlord, owning a rental property, things change significantly. For a rental property, a new roof is often considered a depreciable asset. This means you can write off a portion of its cost each year over a set period.

This is a big win for landlords! It acknowledges that a rental property is a business, and maintaining it is a business expense. So, if you're the proud owner of an investment property, that leaky roof repair just got a little less painful.

"For landlords, a new roof isn't just a repair; it's a strategic move on the tax chessboard." – Mr. Henderson, Accountant Extraordinaire

Imagine Mrs. Gable, a sweet old lady who rents out a small cottage. She beams when discussing her new roof, not just because it's beautiful, but because she knows she can spread out that cost over several years on her taxes. It’s a quiet victory!

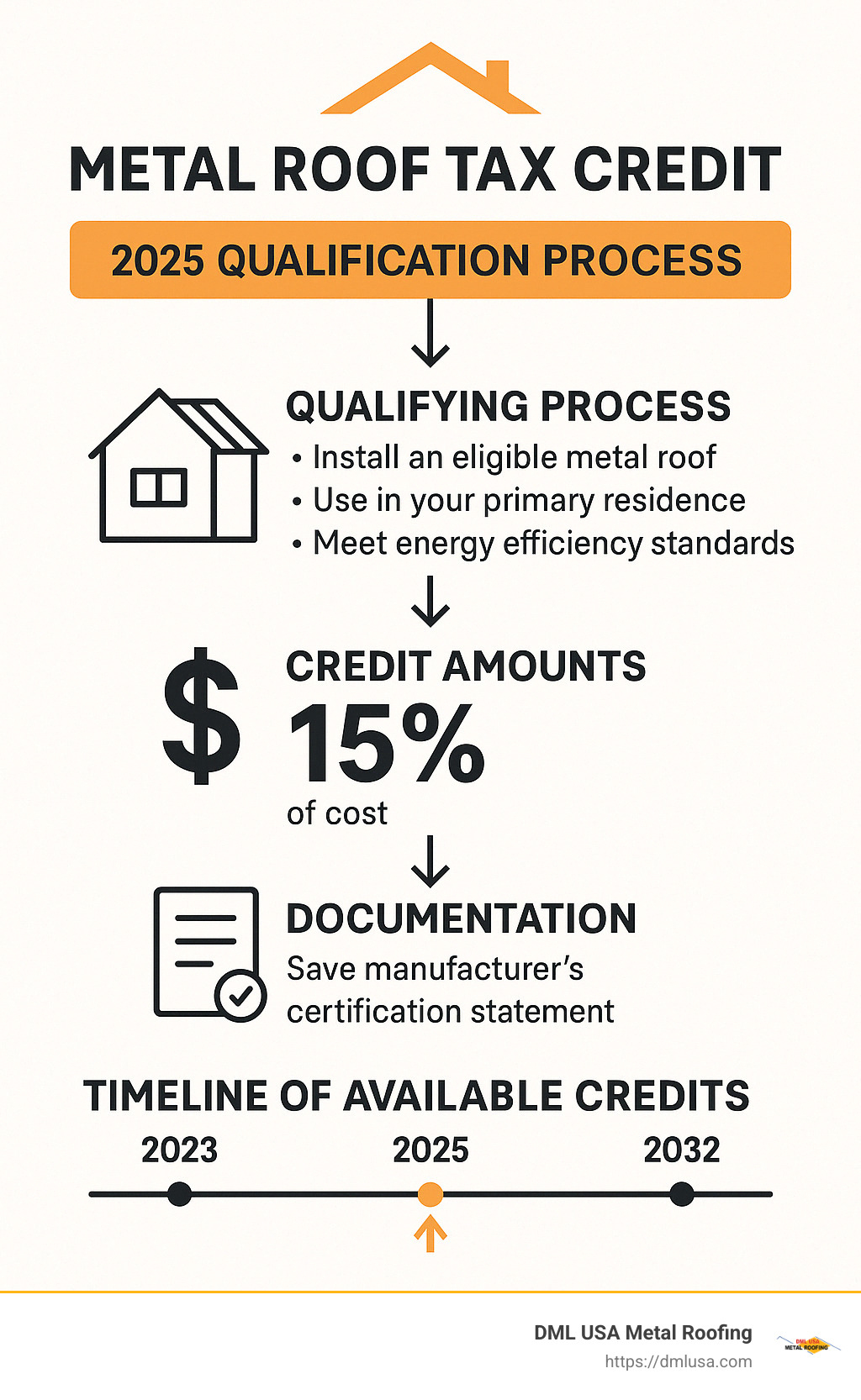

Energy Efficiency to the Rescue!

Another glimmer of hope comes from the world of energy efficiency. If your new roof includes certain *energy-efficient materials*, you might qualify for specific tax credits. These aren't deductions, but *credits* directly reduce your tax bill, dollar for dollar.

Think of things like reflective coatings or specialized insulation built right into the shingles. These features aren't just good for the planet; they can be good for your wallet too. Always check the latest guidelines for federal and local energy tax credits, as they can change.

Our friend Sarah, an avid environmentalist, meticulously researched every shingle for her new roof. She chose a reflective, cool-roof material and happily claimed a credit that year. "It's a win-win!" she exclaimed, "My house is cooler, and so is my tax bill!"

The Heartwarming Side of Roofing

Beyond the spreadsheets and tax forms, there’s a truly heartwarming side to getting a new roof. It’s about protection, security, and creating a safe haven for your loved ones. No amount of tax deduction can truly capture that feeling.

Remember that frantic drip-drip-drip? A new roof means those days are behind you. It means peace of mind during a torrential downpour, knowing your family and your belongings are safe and dry underneath a sturdy shield.

The decision to replace a roof often involves family discussions, saving pennies, and sometimes, even a community effort. We've heard stories of neighbors helping neighbors, bringing over snacks and moral support while the roofers work their magic.

The Millers, a family of five, saved for years for their new roof. Each child even contributed a little from their allowance. When the final shingle was laid, they celebrated with a picnic in their backyard, gazing up at their beautiful, protective new covering. It was more than just a roof; it was a symbol of their collective effort and security.

A new roof is an investment in your home's longevity and your family's comfort. It keeps the warmth in during winter and the cool in during summer, making your home a more enjoyable and efficient place to live.

"A roof isn't just wood and shingles; it's the guardian of your memories and dreams." – A wise old roofer, Mr. Santiago

Wrapping It Up: An Investment in Happiness

So, is a new roof a tax deduction? Generally, no, not directly for your primary home. But it *is* a significant capital improvement that adds to your home's basis, potentially saving you money on future capital gains. And for rental properties, it’s often a depreciable asset.

More importantly, it’s an investment in your family's safety, comfort, and peace of mind. It boosts your home's value, protects your most valuable asset, and ensures that the sound of rain remains a cozy lullaby, not a frantic stress symphony.

Before making any big decisions or assuming tax benefits, always chat with a qualified tax professional. They can offer personalized advice and ensure you’re taking advantage of every possible financial silver lining.

But beyond the numbers, remember the true value. A new roof is a promise kept to your home, a secure blanket against the elements, and a solid foundation for countless happy memories to come. And that, dear reader, is truly priceless.