Alright, grab your favorite mug, settle in, because we're about to demystify something that confuses a lot of folks: Texas state tax. And honestly, it’s not nearly as scary as you might think. In fact, for some, it’s downright delightful!

So, you’re wondering, “How much is Texas state tax?” Well, let me hit you with the headline right off the bat, loud and clear, because it’s the best part:

No State Income Tax!

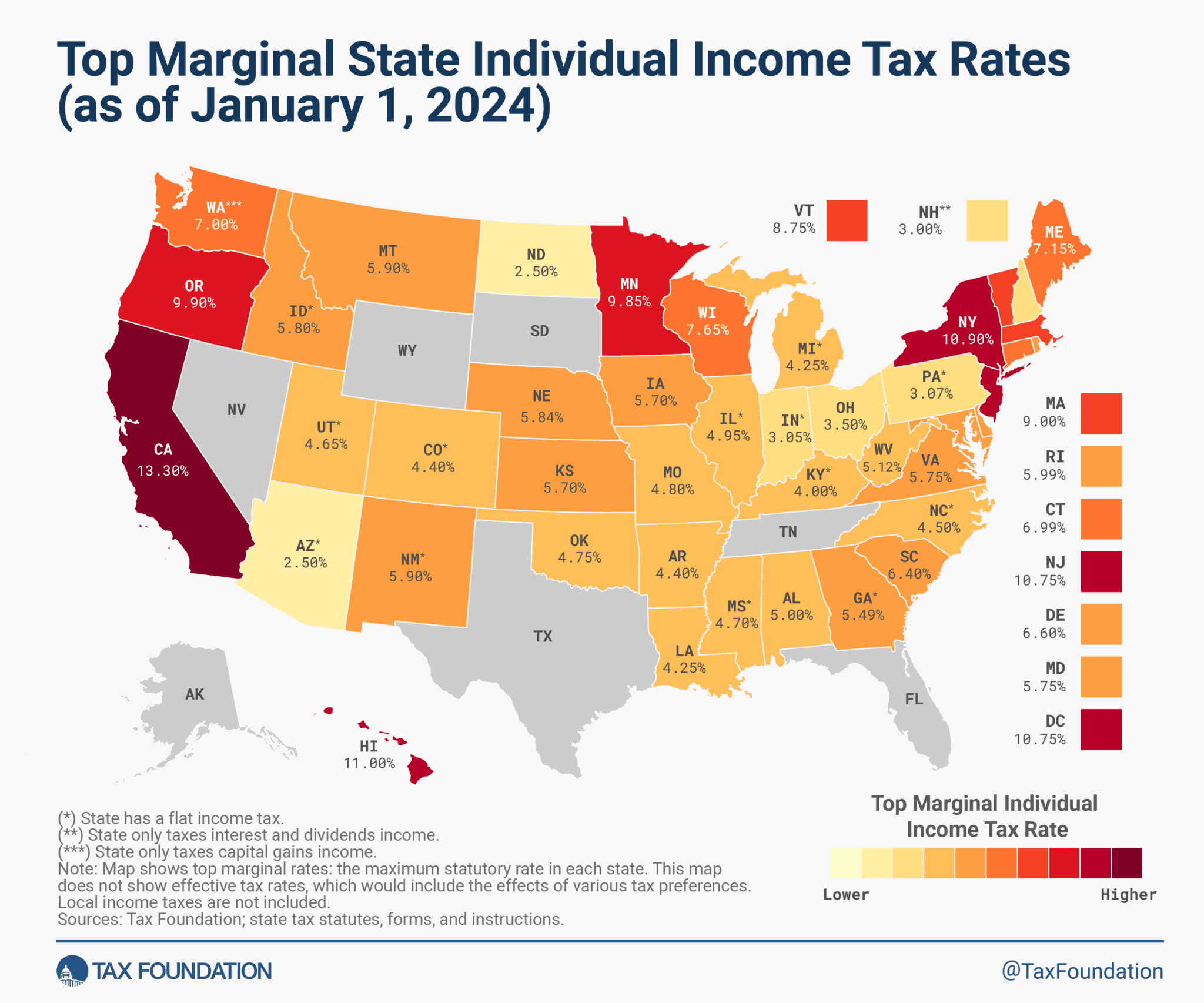

Yep, you read that right. Let that sink in. Texas is one of those magical states that says, “Nah, we’re good,” when it comes to taking a chunk out of your paycheck for state income tax. Isn't that wild? You work hard, you earn your money, and the state government isn't reaching into your pocket for a slice of that pie. *Imagine* what you could do with that extra cash! A few more lattes? A tiny vacation? A slightly fancier avocado toast?

This is probably the biggest reason folks from other high-tax states look at Texas with starry eyes. It’s a pretty sweet deal for your take-home pay. So, if your buddy from California is complaining about their state income tax, you can just gently remind them about the Texas way. 😉

Sounds too good to be true, right? Like, surely there’s a catch. And, my friend, you are perceptive. Because while Texas doesn't have an income tax, it's gotta fund its schools, roads, and all the other important stuff somehow. And that "somehow" comes primarily from a couple of other places.

Property Taxes: The Big One

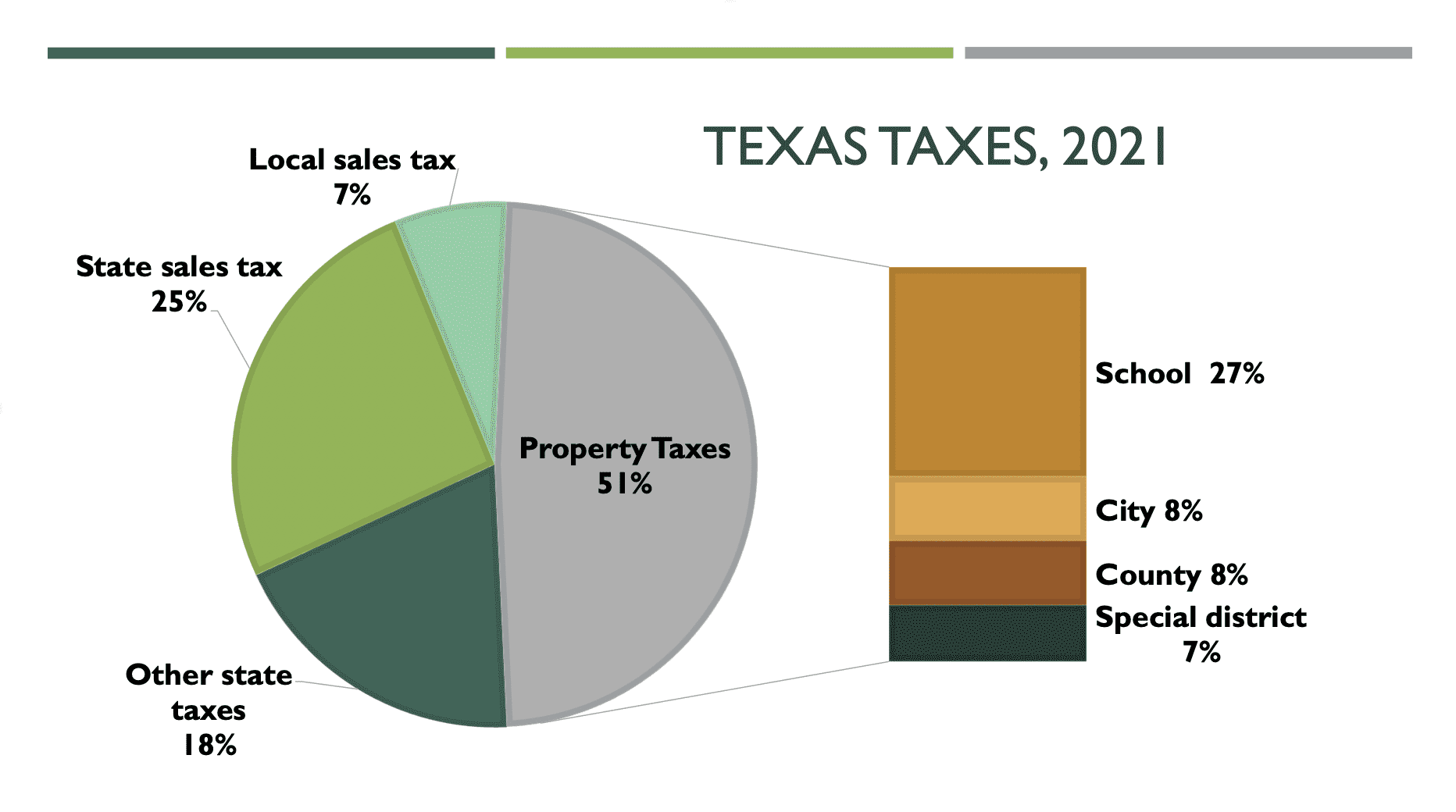

This is where Texas makes up for its no-income-tax generosity. If you own property in Texas, be prepared for some of the highest property taxes in the nation. I’m talking about some serious numbers. It's not uncommon for homeowners to pay thousands, even tens of thousands, annually in property taxes. Ouch, right?

These taxes are collected by local entities – your county, city, school districts, and other special districts. So, your property tax bill can vary wildly depending on exactly where your home is located. Moving just a few miles down the road can mean a big difference. It's truly a local affair.

So, while your paycheck might feel fatter, your mortgage payment (which often includes property taxes, FYI) might also be a bit chunkier. It’s a trade-off. No income tax, but your house might feel like it's sending a rather large monthly check to the taxman. Something to definitely consider if you're thinking of buying a home here!

Sales Tax: The Everyday Nibble

Okay, so no income tax, high property tax. What else? Well, Texas also has a sales tax, just like most states. It’s not exorbitant, but it’s there, chilling out, waiting for you to buy stuff.

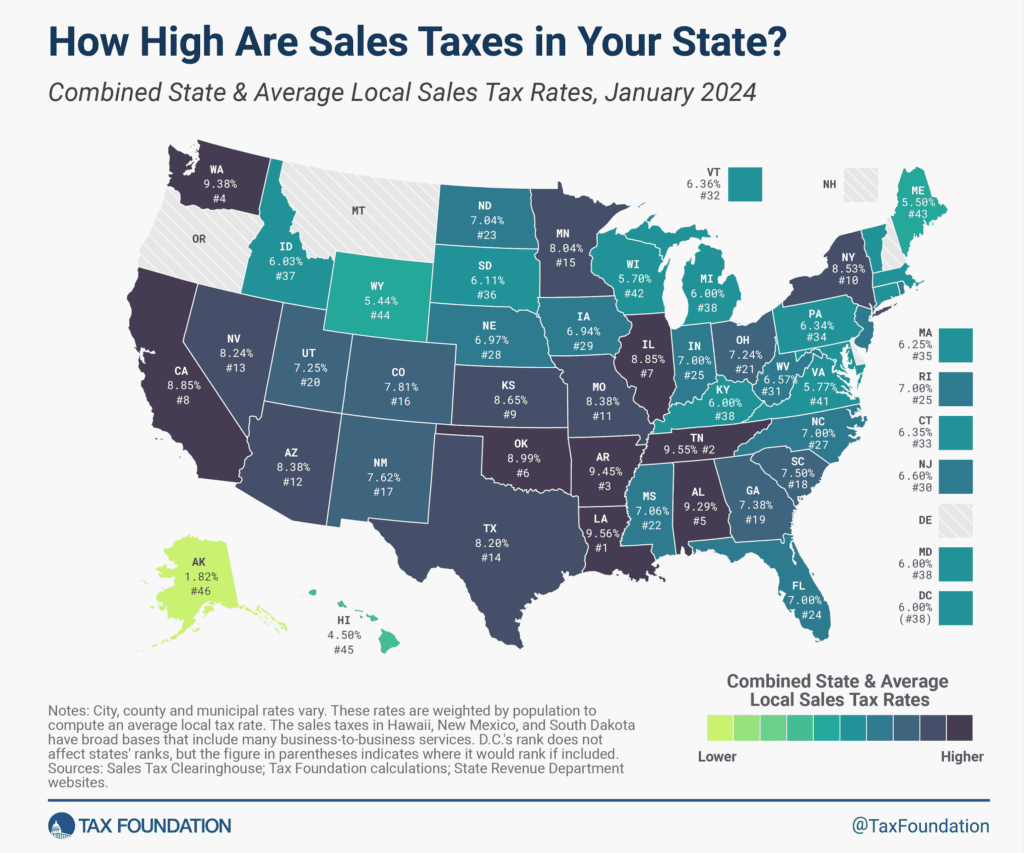

The statewide sales tax rate is currently 6.25%. But wait, there’s more! Local cities and counties can add up to an additional 2%. This means that in most places, you’ll be paying around 8.25% in sales tax on most of your purchases. So, that new gadget, those clothes, your furniture – expect that extra percentage to pop up on your receipt.

Groceries, by the way, are generally exempt from sales tax, which is a nice little break. Thank goodness for that, right? Can you imagine paying sales tax on every loaf of bread? Yikes!

Other Minor Taxes (The Usual Suspects)

Beyond the big two, Texas also has other taxes, but these are pretty standard and probably won't surprise you. We're talking about things like:

- Gasoline tax (gotta pay for those Texas-sized roads!)

- Alcohol and tobacco taxes (sin taxes, as they're often called)

- Vehicle registration fees

- Hotel occupancy taxes

These are pretty common across the board and don't usually cause too much financial angst for the average person. They're just part of the background hum of living in any modern state.

The Bottom Line: It's a Balance!

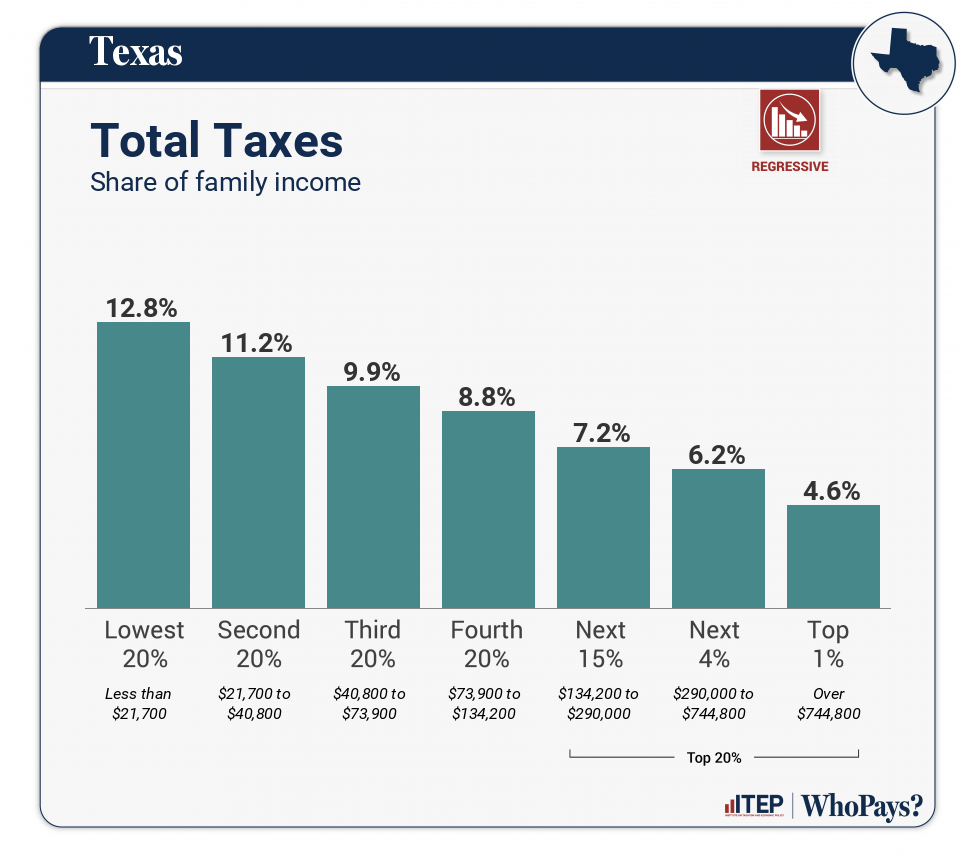

So, to bring it all back home: How much is Texas state tax? The answer is nuanced, but delightfully simple in one huge way: zero state income tax! But that freedom comes with the responsibility of higher property taxes for homeowners and a standard sales tax for everyone else.

For some people, especially those with high incomes but who rent or own lower-value property, this can be a fantastic deal. For others, particularly those with very valuable homes, the property taxes might make them wish for a different system. It really just depends on your personal financial situation and lifestyle.

It's not a free ride, but it's a *different* kind of ride. And for many, it’s a ride worth taking! Now, about that second coffee…?