Hey there, friend! Ever stared at a hospital bill and thought, "Did I accidentally buy the hospital?" You're not alone. It's one of those grown-up mysteries, right up there with how socks disappear in the laundry. But fear not, we're going to demystify this beast a little, with a few laughs along the way. Think of me as your friendly, non-medical tour guide through the thrilling (and occasionally terrifying) world of healthcare costs.

Why Does It Cost So Much?!

So, why does a quick bandage change sometimes feel like you’ve financed a small rocket launch? Well, hospitals are kinda like miniature cities. They’ve got top-notch tech, highly specialized human brains (doctors, nurses, therapists – basically superheroes in scrubs), fancy operating rooms that probably cost more than my house, and they’re open 24/7.

That's a lot of moving parts, and unfortunately, none of them run on good vibes alone. They don't just charge for the medicine; they charge for the entire ecosystem that provides it. It's like paying for your coffee, but also contributing to the espresso machine's retirement fund. (Don't worry, the barista won't ask for a retirement contribution from you. Usually.)

The Great Bill Influencers

The real secret sauce (or secret scary monster, depending on your perspective) behind your bill often boils down to a few key players.

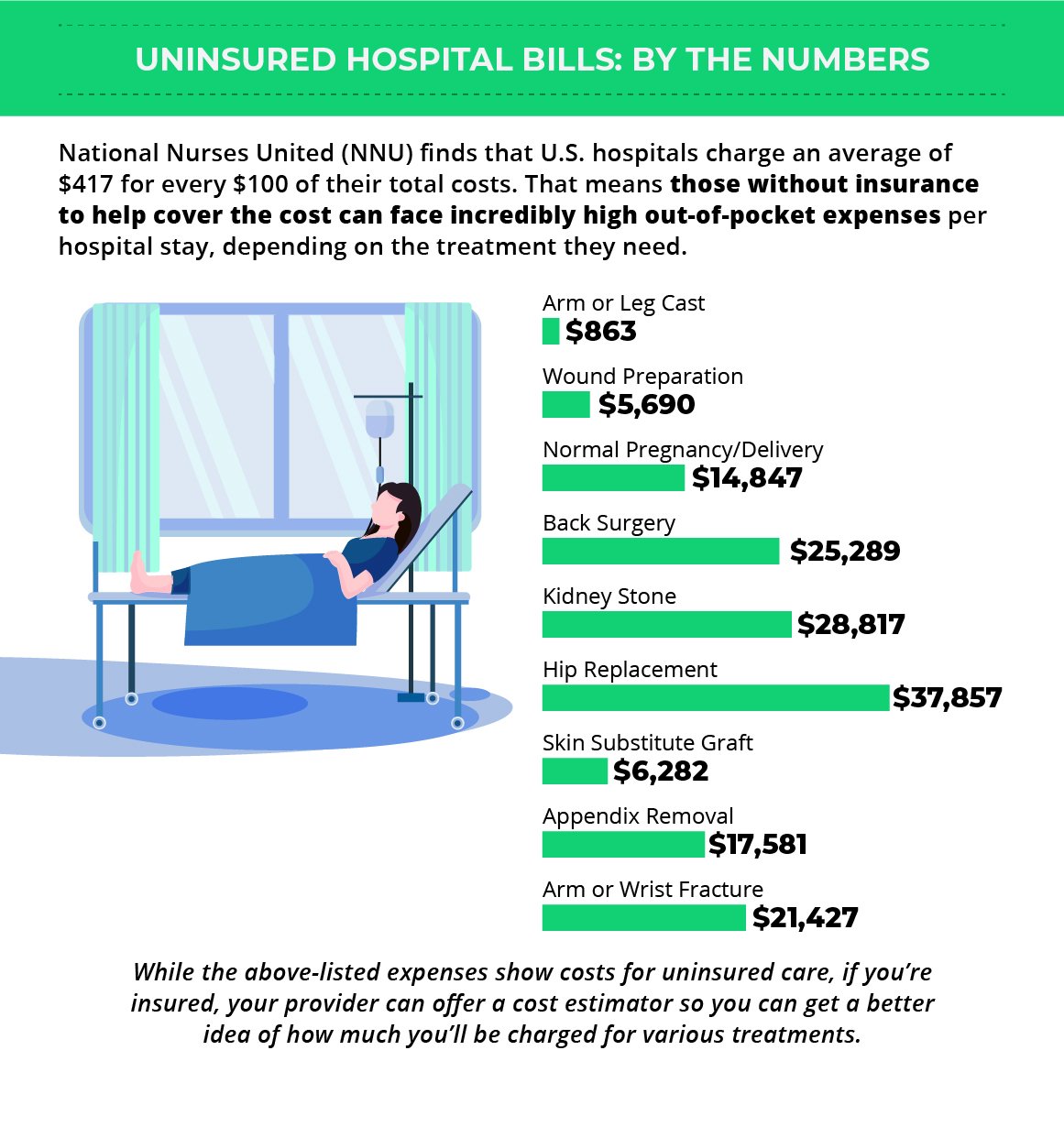

First up: insurance. Ah, insurance! The knight in shining armor that sometimes forgets its sword. Whether you’re "in-network" or "out-of-network" can turn a bill from 'ouch!' to 'OH MY GOODNESS!' Always, always check if your providers are in-network. Seriously, it's worth a phone call. It's like checking if your flight has an actual pilot before boarding.

Then there's the service itself. A broken pinky toe? Probably less than a spontaneous open-heart opera. Makes sense, right? Though, I once had a band-aid applied that felt like it cost as much as a small car. Go figure.

Location, location, location! Just like real estate, healthcare costs can vary wildly depending on where you are. A procedure in a big city hospital might cost more than in a quaint rural clinic. It’s the healthcare equivalent of a designer handbag versus a really chic thrift store find.

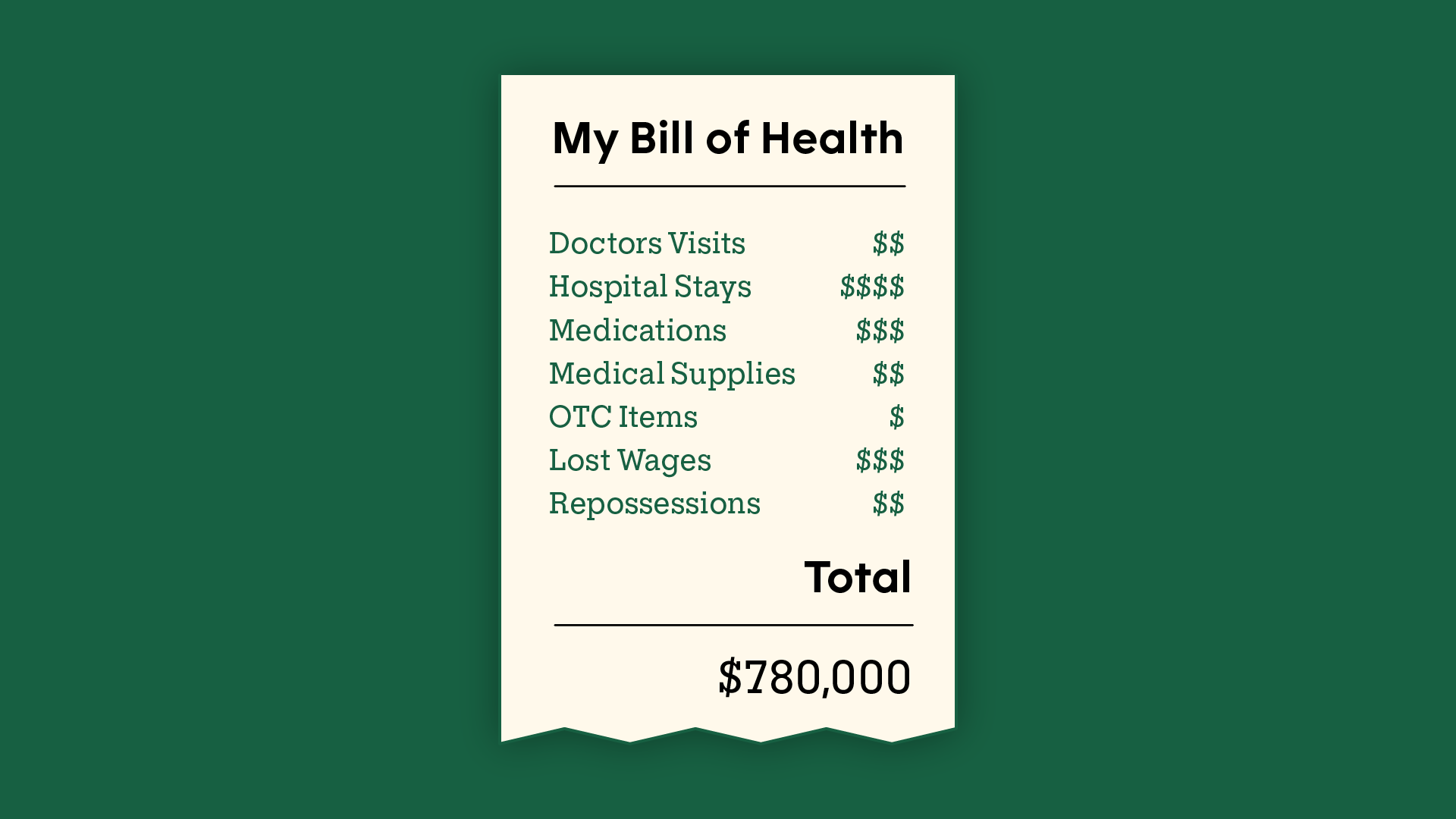

And finally, time. The longer you're serenaded by the beeping machines, the more those lovely charges stack up. Each day is like a new episode of 'Hospital Stay: The Saga Continues,' and each episode has a price tag.

Decoding the Enigma (aka Your Bill)

When that bill finally lands in your mailbox, it often looks less like an itemized list and more like a secret code from a spy movie. You’ll see things like "CPT codes" and "DRG codes" – don't worry, you don't need a degree in medical billing to understand that they're just fancy ways of categorizing services.

But here’s the kicker: sometimes those codes, or the descriptions, can be super confusing. Don't be shy about asking for a detailed, line-item bill. It's your right! Sometimes, you might even spot an error. Like, "Did I really get charged for two tonsillectomies when I only have two tonsils and they're both still there?"

Your Superpower: Actionable Tips!

Okay, enough with the scary stuff. Let's talk about how to tackle this monster. You've got more power than you think!

1. Before You Go (If You Can)

If it's a planned procedure, call your insurance company and the hospital's billing department. Ask about estimated costs, what’s covered, and what your "out-of-pocket maximum" is. Knowledge is power, my friend! And peace of mind. Seriously, put on your detective hat and make those calls.

2. During Your Stay

Don't be afraid to ask questions. "Is this test really necessary?" "Can we use a generic version of that medication?" Doctors are busy, but they also want to help. You're a patient, not a silent passenger on a very expensive ride.

3. After the Bill Arrives

- Review it with a fine-tooth comb. Look for anything that seems off. Trust your gut.

- Call the billing department. Seriously, this is your secret weapon. Hospitals often have financial assistance programs or can negotiate prices, especially if you're uninsured or underinsured. They’d rather get some money than none. You can often get a discount for paying cash or setting up a payment plan. Don’t be afraid to say, "This is a lot for me, what can we do?" The worst they can say is no, but often, they say yes!

- Compare to your "Explanation of Benefits" (EOB) from your insurance. Make sure they match up. It's like checking your restaurant bill against your order – nobody wants extra appetizers they didn't eat.

- Ask for an advocate. Some hospitals even have patient advocates who can help you navigate the labyrinth. They're like your personal guide through the billing maze.

The Happy Ending

So, while hospital bills can feel like a pop quiz you never studied for, remember you’re not alone and you’re not powerless. A little bit of proactive questioning and a dash of confident negotiation can go a long way. It's not about being a Scrooge McDuck, it's about being an informed patient and a savvy consumer of healthcare.

And hey, even if the bill is bigger than you hoped, remember the real value: your health, your well-being, and the incredible people who patched you up. That's truly priceless. Now go forth, be well, and may your next bill be a pleasant surprise (or at least, less of a shock!). Keep smiling, you got this!