Alright, y'all, let's talk about something that makes hearts sing a little tune and wallets feel a little heavier! Have you ever found yourself gazing at the endless, beautiful Texas horizon, maybe with a plate of brisket in one hand and a sweet tea in the other, and a little question pops into your head? Something like, "Does this glorious state, with all its friendly folks and wide-open spaces, also take a bite out of my paycheck before I even get to see it?"

The Big Reveal: A Texan's Financial High-Five!

Well, buckle up, buttercups, because I’m about to drop some seriously good news that’ll make you want to do a little happy jig! When it comes to a state income tax, the answer for Texas is a resounding, joyful, incredibly liberating… NO!

That's right! When you're earning your keep in the Lone Star State, you don't have to wave goodbye to a chunk of your hard-earned cash because of a state income tax. It's like finding an extra French fry at the bottom of the bag, but way, way better and on a much grander scale!

Imagine this: your paycheck lands, and while the federal government still gets its due (sorry, Uncle Sam is everywhere!), the state of Texas steps back and says, "Nope, not from us!" It's a genuine, honest-to-goodness financial sigh of relief. It means more of your salary stays right where it belongs: in your pocket. Think of it as a little extra cash to put towards that dream pair of cowboy boots, an epic road trip to Big Bend, or even just an extra scoop of your favorite Blue Bell ice cream!

So, How Does Texas Keep the Lights On?

Now, before you start picturing Texas as some kind of magical, tax-free wonderland where money literally grows on bluebonnets, let's keep it real. While we absolutely revel in the freedom from a state income tax, Texas isn't completely devoid of taxes. Like any other state, we have ways to fund our fantastic schools, build those impressive highways (gotta drive those big trucks somewhere!), and keep all our state services humming along.

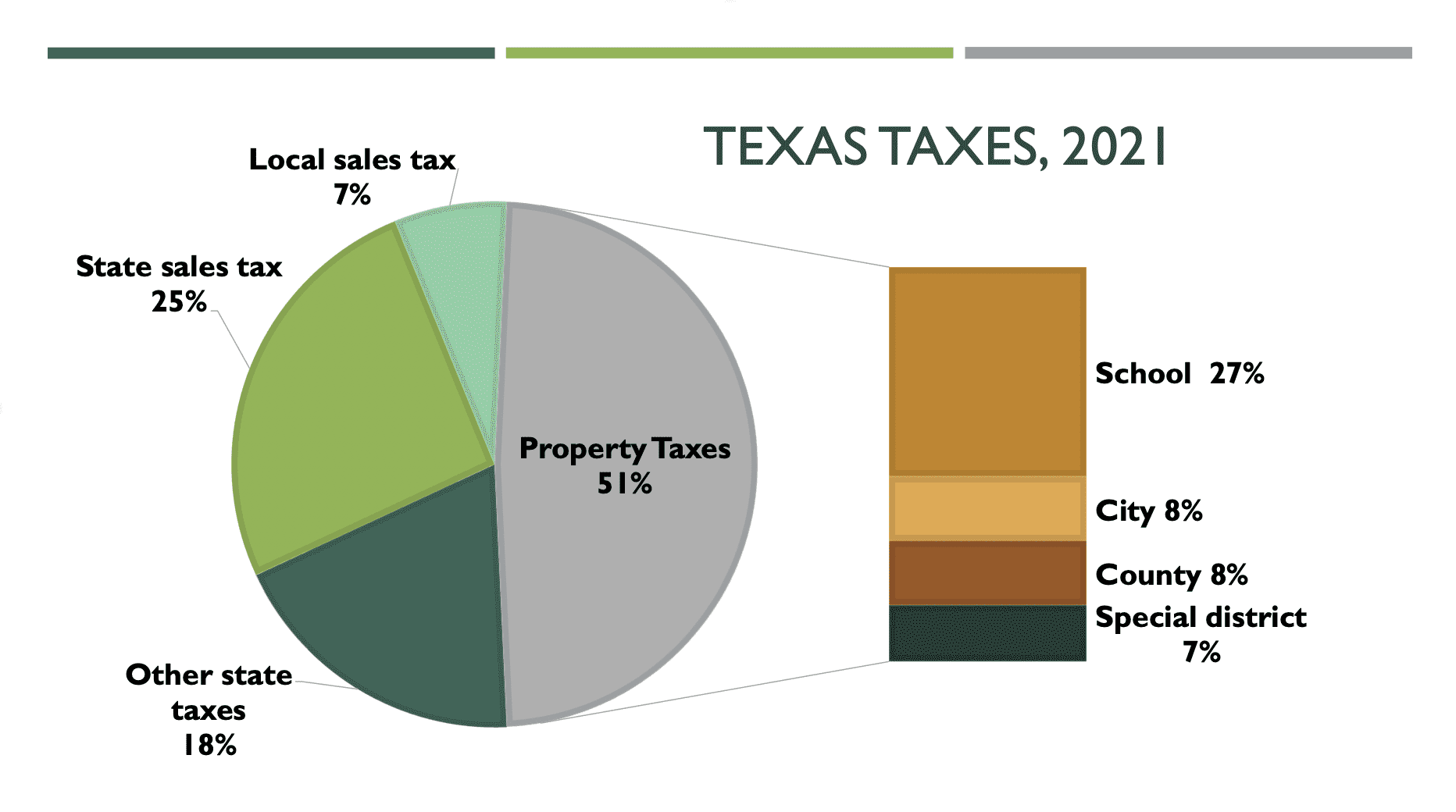

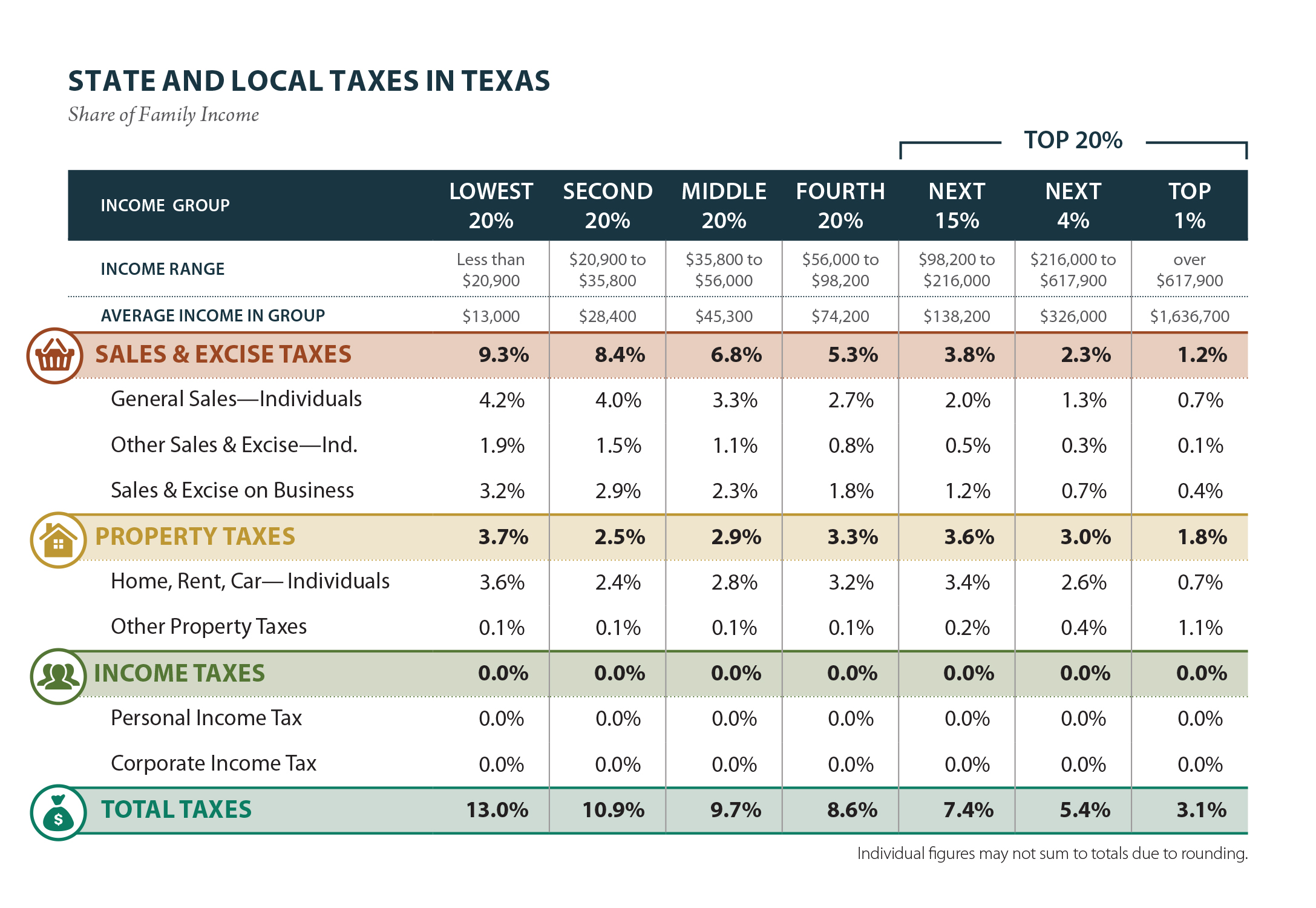

The main ways Texas brings in revenue are through a sales tax and property tax. So, when you're grabbing that new gadget or buying groceries (though some essentials are exempt!), you'll see a sales tax. And if you own a home or land, you'll be familiar with property taxes, which are usually handled at the local level. But here's the kicker: these are taxes you see and understand, rather than a hidden chunk disappearing from every single paycheck.

Your Wallet's Best Friend: The Power of No State Income Tax

Let's get back to the good stuff, because the absence of a state income tax is a seriously big deal. For many, it means a tangible difference in their monthly budget. It’s like getting a little raise every single time you get paid, without even asking for it! That money could go into savings, help pay down debt faster, or fuel a fantastic family vacation. It gives you more financial flexibility and, let's be honest, just feels really, really good.

Imagine the joy! You can put those dollars towards experiences: cheering on your favorite football team, exploring the historic missions, or simply enjoying another plate of world-famous Texas BBQ without that nagging feeling that the state just took a slice of your earnings. It’s about more personal freedom, more choices, and more opportunities to truly enjoy all that Texas has to offer.

So, the next time someone asks you about taxes in the great state of Texas, you can puff out your chest with a confident smile and declare, "We've got plenty of heart, plenty of hospitality, and absolutely no state income tax!" It's one of the many reasons why living in Texas feels like a little piece of financial paradise, giving you just a bit more jingle in your pocket to truly live large!