Ah, the grand adventure of living! We all embark on it, day in and day out, whether we're chasing career dreams, raising a family, or simply enjoying a good cup of coffee. And at the heart of making that adventure truly enjoyable lies a concept often deemed dry, but is, in fact, incredibly liberating: understanding the cost of living. It’s not just about numbers; it’s about unlocking the secrets to a comfortable, joyful existence in a place you love. For many, that place is the vibrant, diverse city of Irving, Texas.

Why do we talk about it? Because knowing the cost of living in Irving isn't just about budgeting; it's about empowerment. It’s the compass that guides your financial decisions, ensuring you can thrive rather than just survive. The benefit is profound: peace of mind. When you understand what your daily life costs, you can plan, save, and splurge intelligently. It serves the crucial purpose of helping you align your income with your desired lifestyle, preventing those unwelcome financial surprises that can turn a sunny day in Las Colinas into a stormy one.

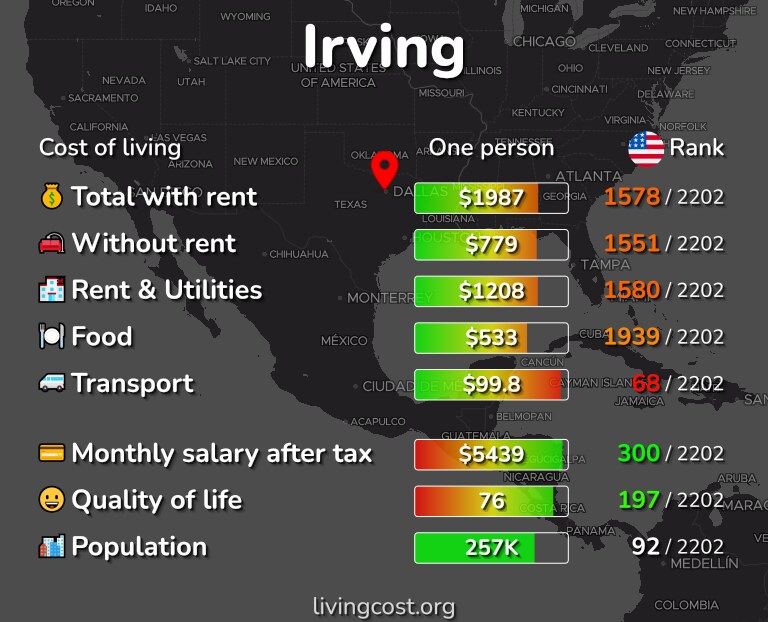

So, what does this "cost of living" actually cover in our beloved Irving? Think of it as the price tag on your daily reality. It starts, most significantly, with housing. Are you looking at a sleek apartment in the bustling business district, a cozy family home near a great school, or something in between? Rent or mortgage payments are often the biggest piece of the pie. Then there's the fuel for life itself: groceries. Your weekly trips to the supermarket, whether for gourmet ingredients or everyday essentials, add up. Don't forget transportation – commuting on the DART, filling up your tank, or navigating toll roads in the sprawling DFW metroplex. Utilities (electricity, water, internet) are non-negotiable, keeping your home comfortable and connected. And finally, there's discretionary spending: dining out at Irving's fantastic eateries, catching a show, or enjoying a round of golf. All these common examples paint the picture of your financial landscape.

Now, how can you "enjoy" this sometimes daunting topic more effectively? By becoming a savvy financial detective! Here are some practical tips: First, create a budget. Seriously, it's not restrictive; it's freeing. Apps and spreadsheets can make this surprisingly fun. Second, become a master of meal planning. Cooking at home more often can significantly cut down on your grocery and dining-out expenses, leaving more for experiences. Third, explore Irving's incredible free and low-cost entertainment options – from strolling through the Mandalay Canal to enjoying local parks and community events. Fourth, leverage public transportation when possible, or consider carpooling to reduce fuel and parking costs. Finally, always be on the lookout for deals and discounts, from utility providers to your favorite local shops. Knowing the cost of living in Irving isn't about pinching pennies; it’s about making informed choices that allow you to fully embrace all the wonderful opportunities this city has to offer, without a shred of financial worry.