Let's be honest, few things get our hearts racing quite like thinking about...accounting! Okay, maybe that's a slight exaggeration. But understanding basic accounting principles, like the interplay between assets and liabilities, is surprisingly useful in navigating our financial lives. It's the bedrock of understanding how businesses operate, and even helps us make smarter decisions about our own money. Think of it as the secret sauce behind wealth building – once you understand the recipe, you can start cooking!

Why bother learning about assets and liabilities? Well, it's all about understanding your financial position. Knowing what you own (your assets) and what you owe (your liabilities) gives you a clear picture of your net worth. This, in turn, empowers you to make informed decisions about spending, saving, and investing. It also helps you understand financial news, company reports, and even real estate deals with a more critical and insightful eye. Imagine being able to decipher a company's balance sheet and immediately spot potential red flags or hidden opportunities – that's the power of understanding assets and liabilities!

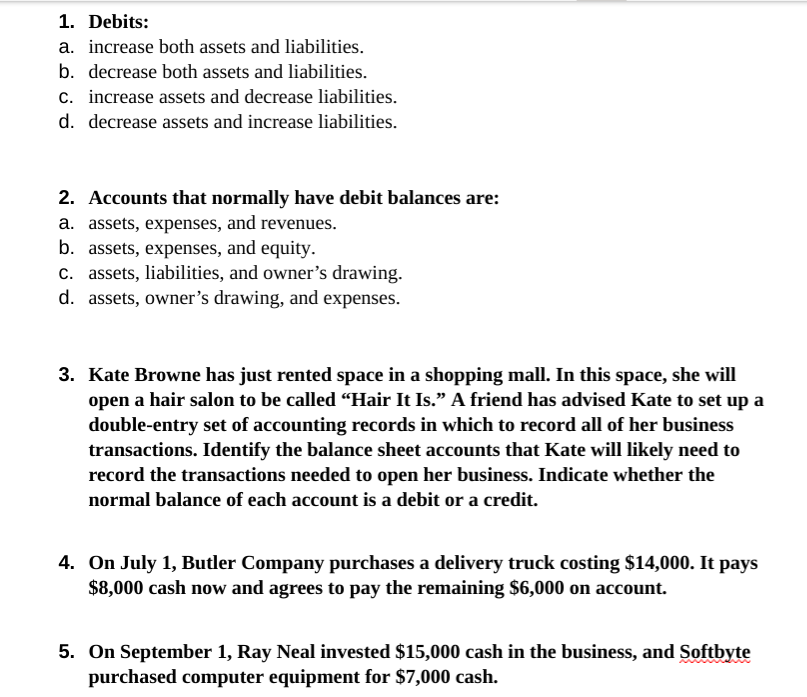

We encounter examples of this concept daily. Consider a home purchase. The house itself is an asset – something you own that has value. But if you take out a mortgage to buy that house, the mortgage becomes a liability – something you owe to the bank. Similarly, a car is an asset, but the car loan is a liability. Businesses use this framework constantly. They might buy equipment (an asset) using a loan (a liability), hoping the equipment will generate more revenue than the loan costs. Even something as simple as buying groceries on a credit card creates an asset (the groceries) and a liability (the credit card bill).

So, let's get to the question at hand: Which of the following would increase both assets and liabilities? The answer is typically something that involves acquiring an asset through debt. Think about this: Taking out a loan to purchase equipment. The equipment is an asset, and the loan is a liability. Taking out a loan to buy inventory. The inventory is an asset, and the loan is a liability. Issuing bonds to fund the construction of a new factory. The factory is an asset, and the bonds are a liability.

Now, how can you enjoy learning about this stuff more effectively? First, don't be intimidated! Start with the basics and build from there. Many free online resources and introductory courses can demystify accounting principles. Second, relate it to your own life. Track your own assets and liabilities to see how they change over time. Use budgeting apps or spreadsheets to gain a better understanding of your personal finances. Finally, don't be afraid to ask questions! Talk to financial advisors, friends who understand accounting, or even post questions in online forums. The more you engage with the material, the easier it will become to grasp. Remember, understanding assets and liabilities isn't just about numbers; it's about empowering yourself to make smarter financial decisions and achieve your goals. So, embrace the accounting adventure – your wallet will thank you for it!