Let's talk about something that might sound a bit dry at first, but is actually super important for understanding how businesses work: company obligations. Think of it like this – a company isn't just a faceless entity; it's a player in a much bigger game, and like any player, it has responsibilities. Understanding these obligations can be surprisingly interesting, whether you're thinking about investing, starting your own business, or just want to be a more informed consumer.

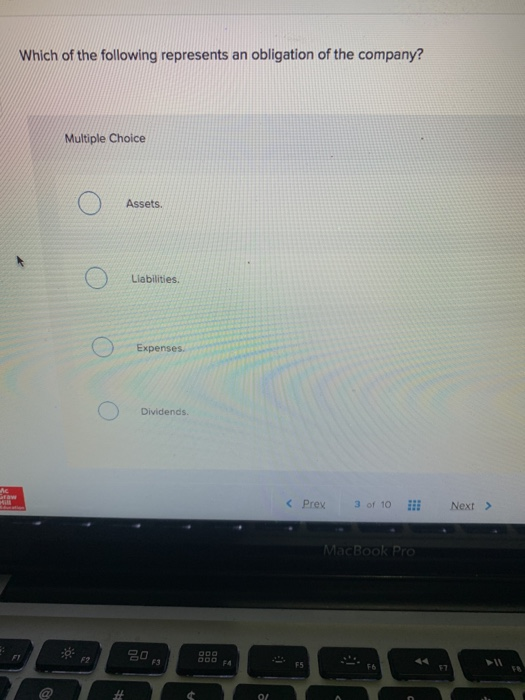

So, what exactly represents an obligation of the company? It boils down to anything the company is legally or contractually required to do. These obligations can be financial, like paying back a loan or providing employee benefits, or they can be operational, like fulfilling a contract with a supplier. Recognizing these obligations is crucial for different groups of people for different reasons:

- For beginners: Understanding obligations is like learning the rules of a game. It helps you see how a company functions and what it's accountable for. This is especially important if you're considering working for a company.

- For families: Thinking about long-term security? Knowing if a company is financially healthy and meeting its obligations (like pension payments) is crucial for your family's future.

- For hobbyists (like investors): If you're into stocks or bonds, understanding a company's debt and liabilities is key to assessing its risk and potential for growth. You want to know if they can actually pay you back!

Let's look at some examples. Imagine a company takes out a loan to expand its operations. That loan is a definite obligation – they're legally bound to repay it, usually with interest. Another example is employee salaries. A company has a contractual obligation to pay its employees for their work. Failing to do so can lead to serious legal trouble. Even something like a warranty on a product represents an obligation. If the product breaks within the warranty period, the company is obligated to repair or replace it.

Variations on obligations exist too. Some obligations are short-term, like paying suppliers for goods received. Others are long-term, like paying off bonds over several years. Some are fixed, like a mortgage payment, while others are variable, like commissions based on sales. The key takeaway is that these obligations represent a legal or contractual duty the company has to fulfill.

Getting started with understanding company obligations is easier than you might think. Here are a few simple tips:

- Read the news: Pay attention to articles about company earnings and financial reports. They often mention key obligations.

- Look at company websites: Many companies publish annual reports that detail their financial performance and obligations.

- Take an online course: There are many free or low-cost courses that cover basic accounting and finance, which will help you understand company obligations.

Ultimately, understanding company obligations isn't just about memorizing definitions; it's about gaining a deeper understanding of the business world and making more informed decisions. It empowers you to be a smarter consumer, a more informed investor, and a more engaged citizen. So, dive in, explore, and discover the fascinating world of company responsibilities!