Okay, so you're itching to jump into the world of stocks with Robinhood? Awesome! It's like deciding you're finally going to try that amazing-looking pizza place everyone's been raving about. But just like you can't order pizza at 3 AM (usually!), there are specific times you can buy and sell stocks.

Let's break down when you can actually buy on Robinhood and why knowing this is super important. Think of it as knowing the restaurant's opening hours so you don't show up to a locked door and a rumbling tummy!

The Regular Trading Hours: Your Go-To Time

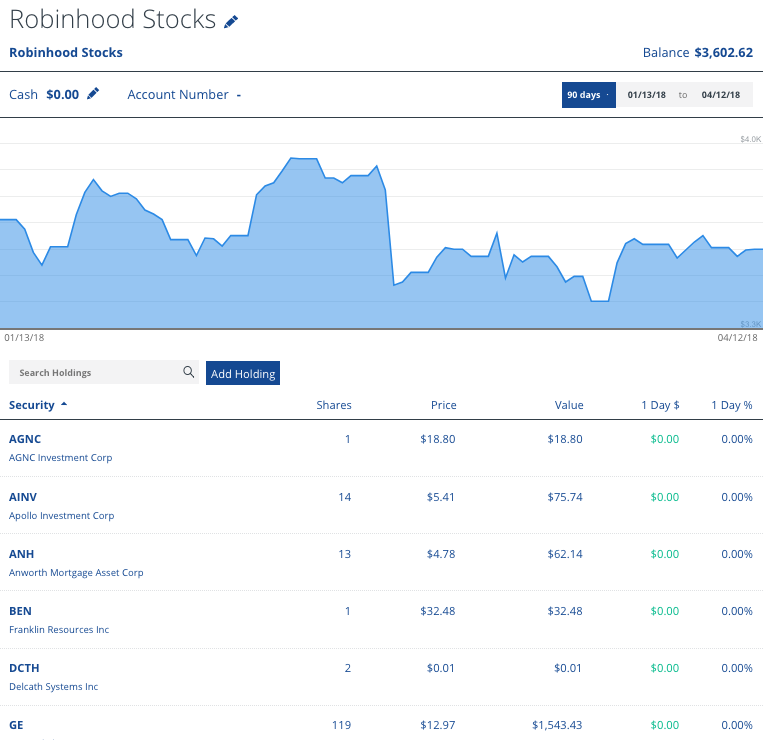

The bread and butter of stock trading happens during what's called "regular trading hours." This is when the major stock exchanges, like the New York Stock Exchange (NYSE) and NASDAQ, are buzzing with activity.

On Robinhood, regular trading hours are 9:30 AM to 4:00 PM Eastern Time (ET), Monday through Friday. That's your sweet spot. It's like knowing your favorite coffee shop opens at 7 AM - you can reliably get your caffeine fix during those hours.

Why is this important? Most trading activity, and therefore the most stable prices, happen during these hours. It's generally considered safer to trade then, because there are more buyers and sellers around.

Extended Hours Trading: Early Bird or Night Owl?

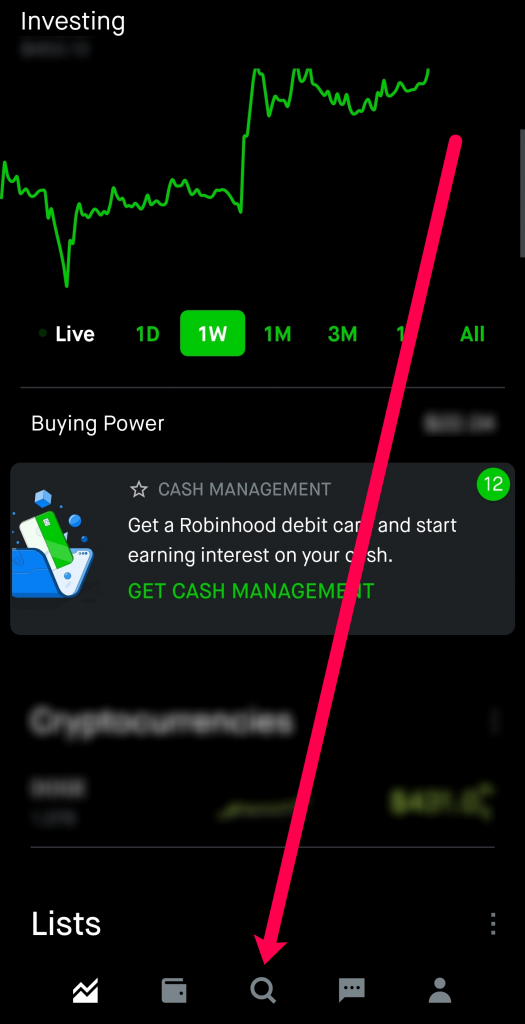

Robinhood also offers something called Extended Hours Trading. Think of it like the restaurant offering brunch before they officially open for lunch, or a late-night menu after dinner service ends. It gives you a little more flexibility.

Extended hours trading on Robinhood is split into two sessions:

- Pre-Market: 7:00 AM to 9:30 AM ET

- After-Hours: 4:00 PM to 8:00 PM ET

So, if you're an early bird who wants to react to news before the market opens, or a night owl catching up after work, extended hours can be appealing. Imagine waking up and seeing some breaking news about your favorite company – extended hours let you potentially act on that information faster.

But here's the catch: Extended hours trading can be a bit like venturing into a less crowded, somewhat unpredictable street. Fewer people are trading, meaning:

- Lower Liquidity: It might be harder to buy or sell your stock quickly at the price you want.

- Higher Volatility: Prices can jump around more dramatically, leading to unexpected gains or losses.

Think of it like buying a rare collectible at a small auction. There might be fewer bidders, which could mean you get a steal... or you might overpay because there's less competition to keep the price down.

Weekends and Holidays: The Market's Day Off

Just like most of us enjoy weekends and holidays, so does the stock market! Robinhood, along with other major exchanges, is closed on weekends (Saturdays and Sundays) and on certain holidays.

Think of it as the restaurant closing for Thanksgiving. You just can't get your order in that day!

Common holidays when the market is closed include:

- New Year's Day

- Martin Luther King Jr. Day

- Presidents' Day

- Good Friday

- Memorial Day

- Juneteenth National Independence Day

- Independence Day

- Labor Day

- Thanksgiving Day

- Christmas Day

Pro Tip: Robinhood usually announces these closures in advance, so keep an eye out for notifications.

Why Timing Matters: Beyond Just Placing Orders

Knowing when you can trade is more than just a logistical detail. It's crucial for:

- Managing Risk: Trading during regular hours generally provides a more stable environment.

- Reacting to News: Extended hours allow you to respond quickly to overnight or pre-market announcements, but with caution.

- Avoiding Frustration: Nothing's more annoying than planning to make a trade only to realize the market is closed!

Ultimately, understanding the trading hours on Robinhood is like knowing the rules of the game. It helps you make informed decisions, manage your risk, and navigate the world of investing with more confidence. So go out there, explore the market during open hours, and have fun growing your financial future!