Okay, so we're talking credit cards, right? Specifically, that scary number lurking in the fine print: APR. Annual Percentage Rate. It sounds so...official. But what APR is too high? Like, run-for-the-hills-before-your-wallet-explodes high?

Well, there's no single, magic number. It's more like a "depends" situation. Annoying, I know! But hear me out. Grab your coffee (or tea, or whatever floats your boat), and let's break it down.

The "It Depends" Dance

First things first, what are you using the card for? Are you a responsible spender who pays off their balance every single month? If so, congrats! You're basically playing the credit card game on easy mode. The APR almost doesn't matter to you! (Okay, maybe *almost*.) Why? Because you're not accruing interest!

But if you tend to carry a balance – and let's be honest, who hasn't at some point? – then APR becomes your new best (or worst) friend. It's the price you pay for borrowing money. And like any price, you want it to be as low as possible. Think of it as rent for borrowing cash. Rent you don't want sky-high, am I right?

So, what’s high? Well, anything above the average credit card APR is generally considered… not great. You can find the average easily enough with a quick Google search. But even the average might be too much, depending on your situation.

The Credit Score Connection

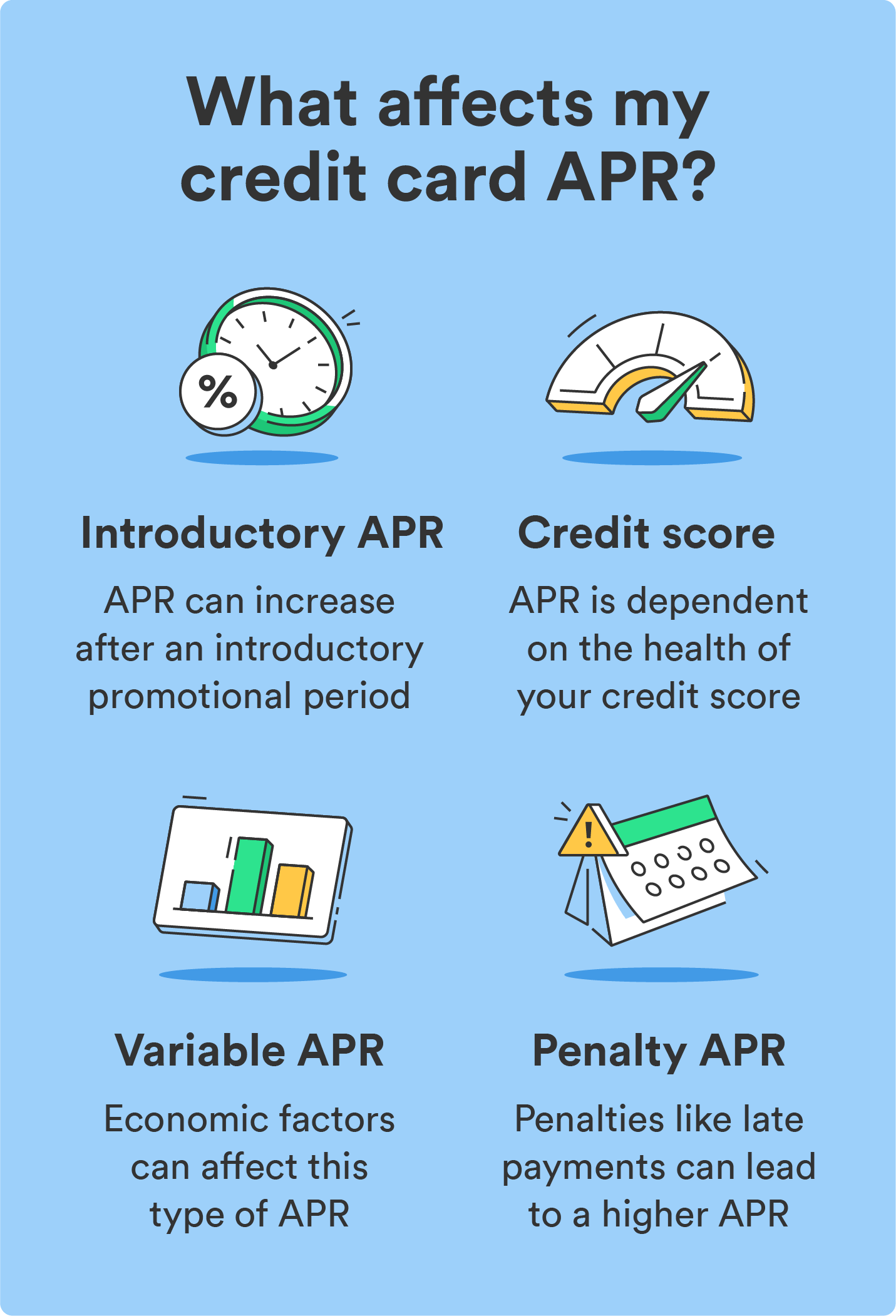

Your credit score plays a huge role here. A stellar credit score? You're more likely to qualify for cards with lower APRs. A not-so-stellar score? Prepare for those numbers to creep upwards. Lenders see you as a riskier borrower, and they compensate by charging more interest. Fair? Maybe not. But it's the game we're playing.

Think of it like car insurance. A clean driving record gets you lower rates. A history of fender-benders? Buckle up for higher premiums. Credit cards work the same way. So, keep that credit score healthy!

Comparing Apples and Oranges (and Credit Cards)

Don't just look at the APR! Check out the fees. Some cards have annual fees, late payment fees, over-the-limit fees… the list goes on. A card with a slightly lower APR but tons of fees might actually cost you more in the long run. It's sneaky like that.

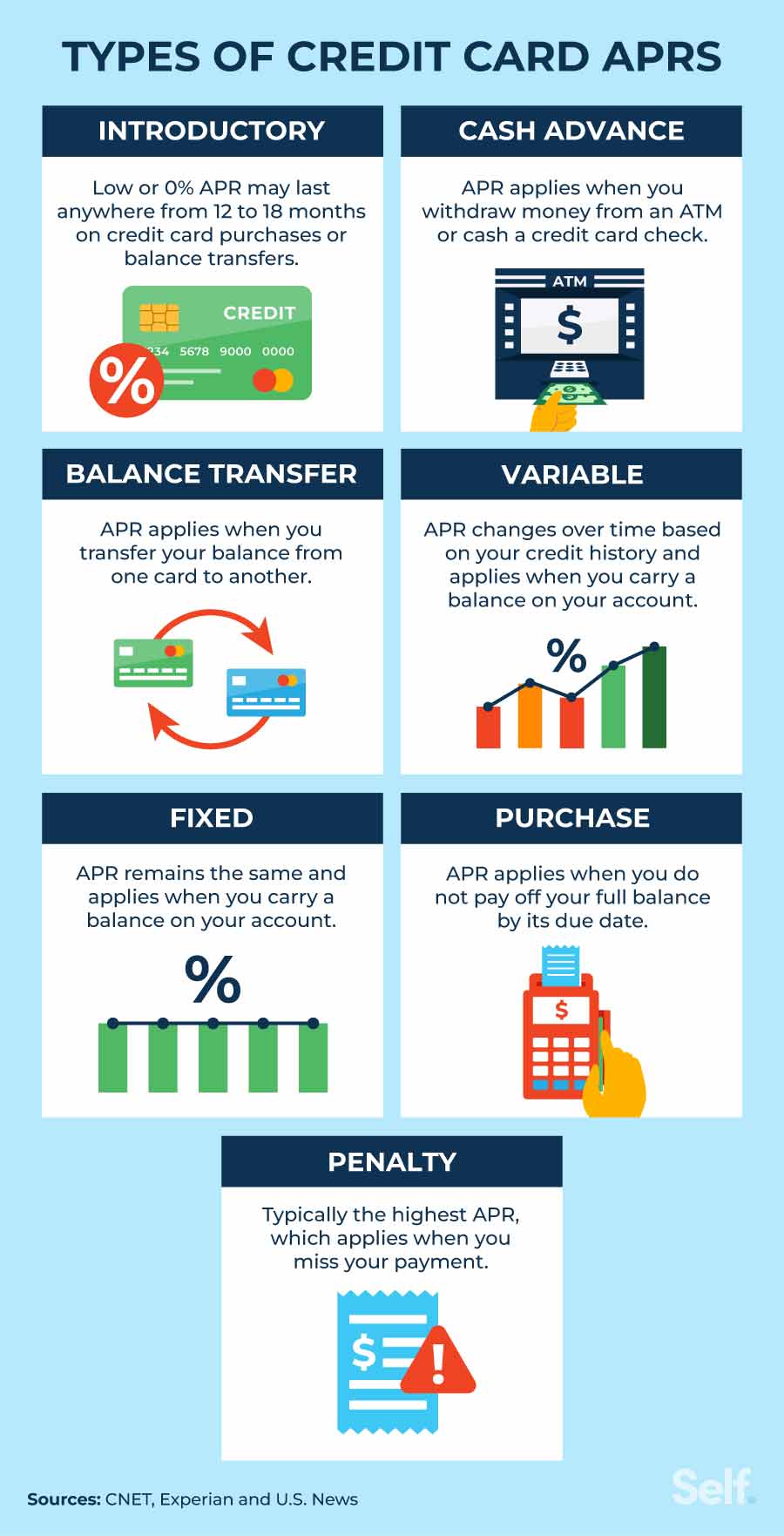

And then there are those tempting 0% introductory APR offers. They sound amazing, right? And they can be! But read the fine print! What happens after the intro period ends? The APR could skyrocket! Make sure you have a plan to pay off the balance before that happens, or you'll be singing the blues (and paying a lot of interest).

Another thing, consider the type of card. Rewards cards often have higher APRs than, say, a basic, no-frills card. You're paying for those points, miles, or cashback! Are the rewards worth the higher interest rate? That's a question only you can answer.

When to Say "No Way, Jose!"

Okay, so let's get down to specifics. When should you absolutely, positively walk away from a credit card due to a high APR?

- If the APR is pushing 30% or higher, that's generally a red flag. Unless you have absolutely no other options (and even then, explore other options!), that's going to eat you alive.

- If the APR is significantly higher than the average and you know you'll be carrying a balance, that's a no-go. Find a card with a lower rate, even if it means sacrificing some perks.

- If the APR is variable, meaning it can change with the market, be prepared for it to potentially increase. Consider a fixed-rate card if you prefer predictability.

Bottom line? Do your research! Compare cards! Don't just grab the first offer that comes your way. Your wallet (and your sanity) will thank you for it. And remember, paying off your balance in full each month is the ultimate cheat code to winning the credit card game. Happy spending (wisely!).