Ever feel like your finances are a mysterious black box? Don't worry, you're not alone! Accounting terms can seem daunting, but understanding even one key concept can unlock a whole new level of financial confidence. Today, let's demystify something called the "Accumulated Depreciation Account" – and trust me, it’s far more interesting than it sounds!

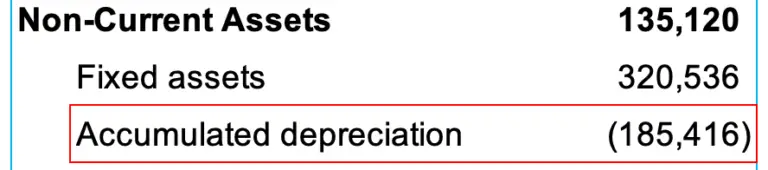

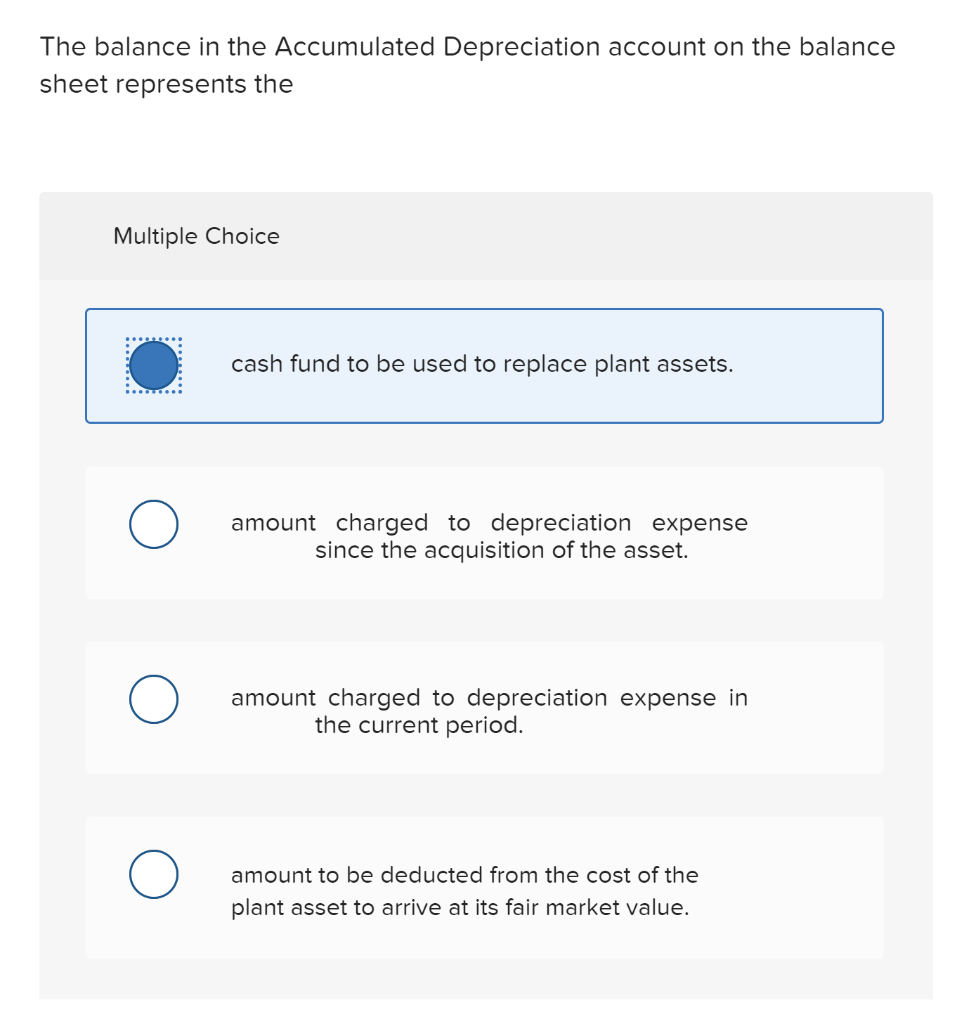

The balance in the Accumulated Depreciation Account represents the total amount of depreciation that has been recognized on an asset since it was put into use. Think of it as a running tally of how much "wear and tear" an asset has experienced over its lifetime. So why should you care? Well, understanding this helps paint a more accurate picture of a company's financial health.

Even if you're not a financial whiz, understanding depreciation has practical applications. Imagine you're an artist who invests in expensive equipment like a pottery wheel, a high-end camera, or specialized software. These are assets! Knowing about depreciation helps you understand how their value decreases over time, influencing your business decisions.

Benefits for Artists, Hobbyists, and Casual Learners:

- Financial Planning: Understanding depreciation helps you plan for replacing equipment as it ages. A photographer, for instance, knows their camera body needs replacing every few years and can budget accordingly.

- Tax Implications: In many places, you can deduct depreciation from your taxes, reducing your tax burden. This is a crucial aspect of running any small business.

- Resale Value: Knowing the concept of depreciation also provides insights into setting fair prices when reselling used equipment.

- Investment Decisions: Understanding how different equipment depreciates affects future purchase decisions, as it helps in evaluating true cost of ownership.

Examples in Action:

- Software: A graphic designer using Adobe Creative Suite understands that even with regular updates, the older versions become obsolete. The cost may remain the same, but the value depreciates.

- Tools: A woodworker's table saw or lathe will lose its precision over years of use, decreasing its utility, a clear case of depreciation.

- Musical Instruments: A musician's prized guitar may be timeless and durable, but even instruments lose value with wear and tear.

Trying it at Home (Simplified):

- Choose an Asset: Pick something tangible you own, like a computer or a car.

- Estimate its Lifespan: How many years will you use it before replacing it?

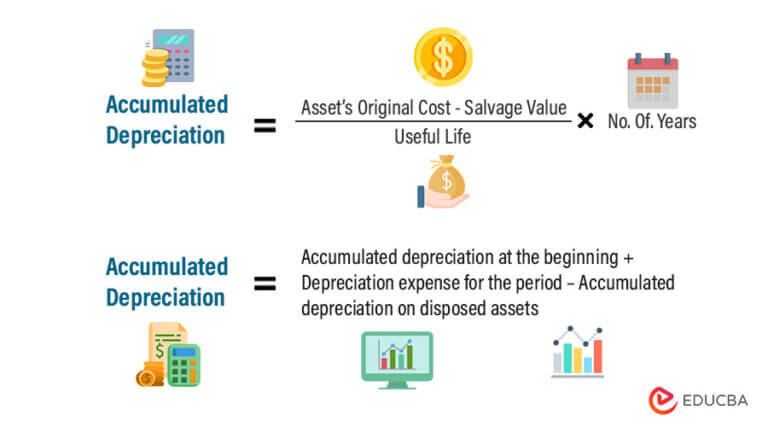

- Calculate Annual Depreciation: Divide the original cost by its estimated lifespan. (This is a simplified method called "straight-line depreciation.")

- Track Accumulated Depreciation: Each year, add the annual depreciation amount. The total is your accumulated depreciation.

For example, say you purchased a camera for $2000 and expect it to last 5 years, then you divide $2000/5 = $400, that is the depreciation expense per year. After three years, the accumulated depreciation is $400 * 3 = $1200.

Understanding the Accumulated Depreciation Account might not seem like a thrill ride, but it's a powerful tool to empower your financial decisions. It offers insights into the real value of the things you own, and it can make your budget and financial planning a whole lot clearer. And honestly, who doesn't love the feeling of being more financially savvy?