Oh, glorious day! You've got a check. Not just *any* check, but a check burning a hole in your pocket (or, more likely, lost somewhere in the abyss of your purse/backpack). You're practically swimming in possibilities!

Let's face it, nobody *loves* going to the bank. The lines! The fluorescent lighting! The existential dread of accidentally making eye contact with someone you went to high school with but haven't seen in 15 years!

Say "Cheese!" (to Your Check)

Fear not, friend! Because depositing that paper rectangle of joy into your Chime account is easier than making toast. Seriously, if you can operate a toaster, you can do this. I have unwavering faith in you.

First things first, fire up your Chime app. It's the little icon on your phone that probably gets more love than your actual family (don't worry, we won't tell them). Log in with all the grace and dexterity you can muster.

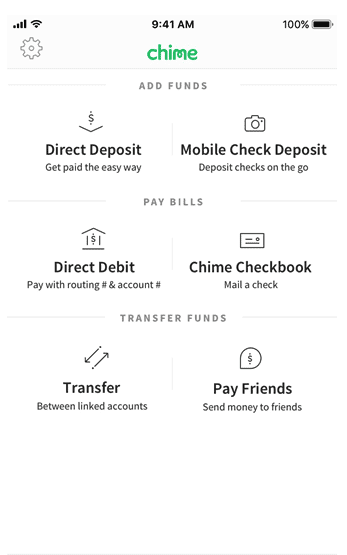

Now, hunt down the magical "Move Money" button. It might be hiding, but trust me, it's there. Think of it like a scavenger hunt, but the prize is financial freedom! Okay, maybe *slight* financial freedom, but still!

Once you've located the "Move Money" oasis, tap on "Mobile Check Deposit." Prepare to be amazed! You're about to wield the power of mobile banking like a seasoned pro. Feel the power coursing through your veins!

Strike a Pose (with Your Check)

Now comes the fun part: the photo shoot! Grab your check and find a well-lit area. Natural light is your friend. Avoid that creepy basement lighting that makes everything look like a horror movie scene.

Place your check on a flat, dark surface. Think of it like setting the stage for a superstar. A dark countertop, a piece of dark paper, even your sleek black yoga mat will do the trick. Just make sure it's not distracting!

Make sure the entire check is visible in the frame. No sneaky corners hiding! We need the whole enchilada, the complete picture, the entire financial shebang. Don't cut off any of the vital information.

Here's the pro tip: tap the screen on your phone to focus the camera. This is like giving your check the star treatment. A crisp, clear image is what we're after. Imagine you're taking a portrait for the check's LinkedIn profile.

Take a picture of the front of the check. Then, flip it over and endorse it with your signature. This is like giving your check your autograph, your official seal of approval. "Yep, this is my check, and I approve this message!"

Under your signature, write "For Mobile Deposit Only to Chime". This is super important! It tells the bank that you're depositing this check electronically. It's like giving the check specific instructions for its journey.

Now, take a picture of the back of the endorsed check. Again, make sure everything is clear and visible. Double-check that you endorsed it correctly. Triple-check if you're feeling paranoid (we've all been there!).

Number Crunching Time

The app will now prompt you to enter the check amount. Type it in carefully, double-checking that you haven't accidentally added an extra zero (or subtracted one!). Accuracy is key, my friend.

Think of it like entering the winning lottery numbers. Except, instead of millions, you're entering the amount of your check. Still exciting, right? Okay, maybe not *that* exciting, but important nonetheless!

Review everything one last time. Make sure the images are clear, the amount is correct, and your endorsement is legible. This is your chance to catch any mistakes before they become a problem.

Now, hit that "Submit" button! You've done it! You've successfully deposited your check using the power of your phone and the magic of Chime. Give yourself a pat on the back. You deserve it!

You might see a confirmation screen that displays when you will see the money in your account. Mark your calendar and get ready to spend. (Responsibly, of course!).

Usually, it takes a business day or two for the deposit to fully process. This is the hardest part: the waiting game. Try to distract yourself with something fun. Binge-watch a TV show, read a book, or finally organize that junk drawer.

Check Mate! (Almost)

Once the deposit is complete, you're golden! The money is officially in your Chime account, ready to be used for whatever your heart desires. Pay bills, buy groceries, treat yourself to something nice. You've earned it!

Pro Tip: Keep the paper check in a safe place for a week or two after the deposit clears. Just in case anything goes wrong. It's always good to have a backup. Think of it like a financial insurance policy.

After a couple of weeks, you can shred the check. Or, if you're feeling particularly creative, you can use it to make some art! Check origami, anyone? The possibilities are endless!

Congratulations! You've conquered the world of mobile check deposits. You are now a certified Chime check-depositing master. Go forth and conquer your financial goals!

Important Disclaimer (Because Lawyers)

Okay, so this is where I have to be all responsible and tell you that deposit times aren't always guaranteed. Sometimes, things can take a little longer. It's rare, but it can happen.

So just be patient and check your Chime account periodically. If you have any questions or concerns, contact Chime customer support. They're there to help you!

Also, Chime may have deposit limits. So if you are depositing a really large check, you may want to confirm their deposit limits. Just go to Chime's website.

And, to reiterate, make sure your check endorsement is *exactly* as they instruct it! Chime, or any mobile deposit service, is very particular about this. If you don't endorse it correctly, your deposit may be rejected.

So now you know how to take a picture of a check to deposit it with Chime. Go forth and conquer!