Let's face it, talking about taxes usually isn't anyone's idea of a good time. But what if I told you there's a way to make taxes fun? Okay, maybe not *fun* fun, but definitely rewarding! We're talking about the solar tax credit. Specifically, what happens when you get a refund – and how going solar can actually put money back in your pocket. It's like getting paid to save the planet, which is pretty cool, right?

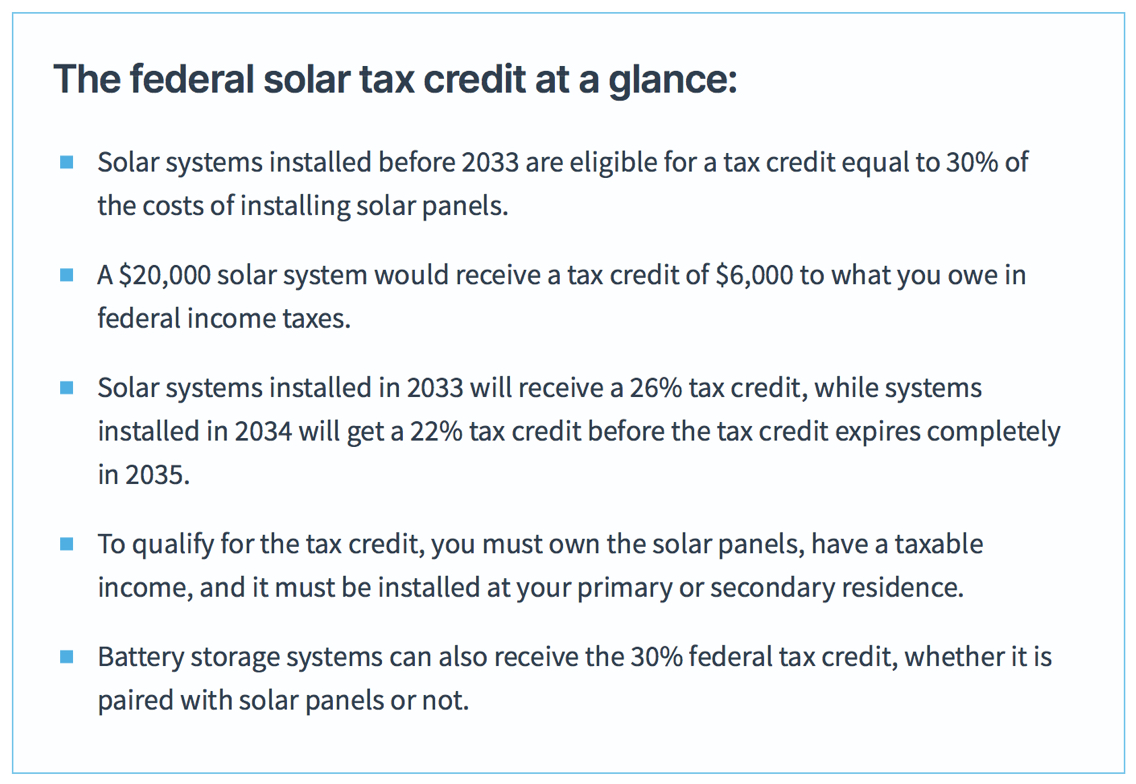

So, what's the deal with this solar tax credit? Simply put, it's a federal incentive designed to encourage homeowners to invest in renewable energy. For 2023-2032, it's a credit for 30% of the cost of your solar panel system. That includes the panels themselves, the installation, permitting fees, and even related equipment like inverters and wiring. Now, here's the important part: this is a *credit*, not a deduction. A credit directly reduces the amount of tax you owe. If the credit is more than you owe, you get a refund!

Why is this beneficial? Well, for the beginner, it dramatically lowers the initial cost of going solar. Imagine you're thinking about solar panels but the price tag seems daunting. The tax credit makes it significantly more accessible. For families, this means potentially lower electricity bills *and* a chunk of money back when you file your taxes. That refund could go towards a family vacation, college savings, or simply improving your home. And for the eco-conscious hobbyist, it's a double win! You get to indulge your passion for sustainable living while also benefiting financially. You can even use the tax credit to expand your system further or invest in other green technologies.

Let's look at an example. Say you install a solar panel system that costs $20,000. With the 30% tax credit, you'd be eligible for a $6,000 credit. If you only owe $4,000 in taxes, you'd get a $2,000 refund from the government! Another variation to consider is battery storage. If you include a battery system to store excess solar energy, that cost is also eligible for the tax credit! This can be particularly useful if your utility company doesn't offer net metering (where you get credit for sending excess energy back to the grid).

Ready to get started? Here are a few simple tips:

- Get quotes from multiple solar installers. Compare prices, warranties, and financing options.

- Understand your energy consumption. Analyze your past electricity bills to determine the right size solar system for your needs.

- Keep detailed records. Save all invoices, receipts, and contracts related to your solar installation. This documentation is crucial for claiming the tax credit.

- Consult with a tax professional. They can help you navigate the specific requirements and ensure you're maximizing your tax benefits.

Going solar is a big decision, but the solar tax credit makes it a financially attractive one. The potential for a refund, combined with long-term savings on your electricity bill and the satisfaction of reducing your carbon footprint, makes it a rewarding investment. So, dive in, do your research, and get ready to enjoy the benefits of sunshine power – and maybe even a little extra cash back in your pocket!