Okay, let's talk Office Depot credit cards! I know, I know, credit cards aren't *always* the most thrilling subject. But trust me, knowing your chances of approval for an Office Depot card can actually be pretty empowering. Think of it as unlocking a secret level in the game of life... a level filled with savings on pens, paper, and maybe even that fancy new office chair you've been eyeing!

So, What Are the Odds?

Alright, down to brass tacks. Figuring out your Office Depot credit card approval odds is like understanding the weather forecast. You can't *guarantee* sunshine, but you can get a pretty good idea if you should pack your umbrella (or, in this case, maybe brush up on your credit score!).

Generally, the Office Depot credit card is geared towards people with fair to good credit. But what does *that* even mean? Let's break it down:

- Fair Credit (620-699): You have a decent shot! Work on showing you can manage credit responsibly (more on that later).

- Good Credit (700-749): Your chances are looking pretty good! You're playing the game well.

- Excellent Credit (750+): You're practically a shoo-in! Go get that card (and maybe treat yourself to a celebratory coffee with your savings!).

See? Not so scary, right? But remember, your credit score is just *one* piece of the puzzle. There are other factors at play.

Beyond the Score: Decoding the Mystery

So, you know your credit score. Great! But lenders also look at things like:

- Your income: Can you actually afford to pay your bills? (Makes sense, right?)

- Your employment history: Stability is key!

- Your debt-to-income ratio: How much of your income is already going towards debt? (Lenders want to see you have some breathing room.)

- Your credit history: Have you been a responsible borrower in the past? (Past behavior is often the best predictor of future behavior, as they say.)

These things all paint a picture of your overall financial health. Think of it as a financial resume. You want to make a good impression!

Boosting Your Approval Odds: Game On!

Okay, so maybe your credit score isn't quite where you want it to be. No worries! There are definitely things you can do to improve your chances. Think of it as leveling up your financial character!

Here are a few tips:

- Pay your bills on time: Seriously, this is *huge*. Late payments are a major credit score killer. Set reminders, automate payments – do whatever it takes!

- Keep your credit utilization low: This means using a small percentage of your available credit. Aim for under 30%. (If you have a $1000 credit limit, try not to charge more than $300.)

- Check your credit report for errors: Mistakes happen! Dispute any inaccuracies you find. You can get free credit reports from AnnualCreditReport.com.

- Don't apply for too many credit cards at once: Each application can ding your credit score a little. Be strategic!

- Consider becoming an authorized user on someone else's credit card: If you have a trusted friend or family member with good credit, this can help you build your own credit history.

These things take time, but the results are worth it! A better credit score opens doors to so many opportunities – not just credit cards, but also loans, mortgages, and even lower insurance rates.

Why Bother with the Office Depot Card Anyway?

Good question! So why all this effort for a store credit card? Well, Office Depot cards often come with some pretty sweet perks, like:

- Exclusive discounts and promotions: Saving money is *always* a good thing.

- Rewards points on purchases: Rack up those points and redeem them for even *more* office supplies!

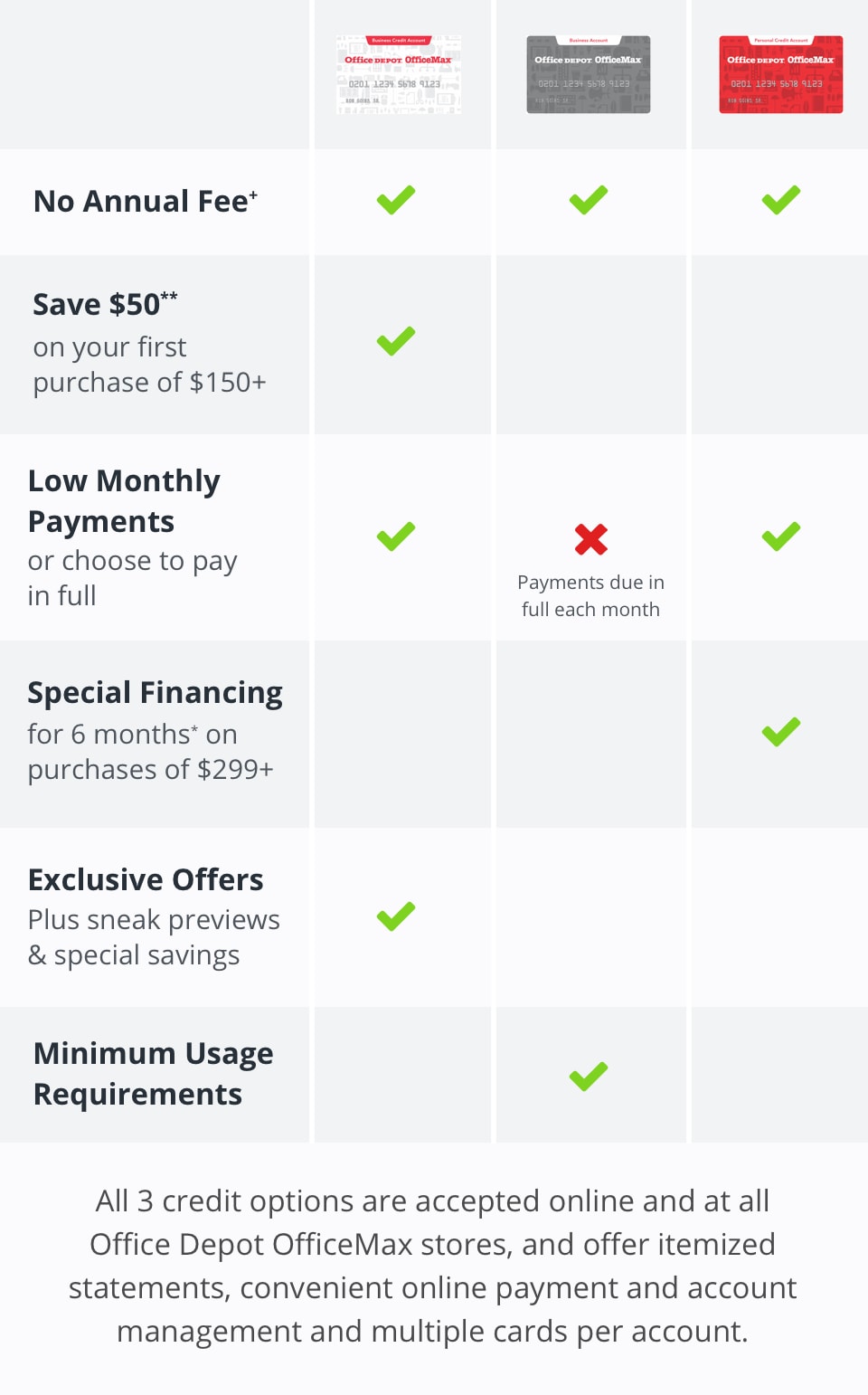

- Special financing options: This can be helpful if you need to make a large purchase.

Plus, using the card responsibly can help you build your credit score even further! It's a win-win!

The Takeaway: Knowledge is Power (and Savings!)

Understanding your Office Depot credit card approval odds isn't just about getting a credit card. It's about understanding your financial health, taking control of your credit, and making smart decisions that will benefit you in the long run.

So, go forth and conquer! Research your options, check your credit score, and take the steps necessary to improve your chances of approval. You've got this! And hey, even if you don't get approved right away, don't give up! Use it as motivation to build your credit and try again later. The rewards are worth the effort!

Ready to learn more? There are tons of resources online (including the official Office Depot website, of course!). Take the time to educate yourself, and you'll be well on your way to financial success. Good luck, and happy shopping!