Ready to dive into the exciting world of dividend stocks with Fidelity? It's like going on a treasure hunt, but instead of gold, you're searching for companies that share their profits with you!

Setting Up Your Fidelity Account

First things first: you'll need a Fidelity account. Think of it as your spaceship, ready to launch you into the investing galaxy. Signing up is pretty straightforward. Just follow the prompts on their website.

You'll need to provide some personal info, like your name, address, and social security number. It’s like introducing yourself to a new club! Once you're set up, it's time to fund your account.

Funding Your Account: Fueling Your Spaceship

How do you fuel a spaceship, you ask? With money, of course! Fidelity offers several ways to transfer funds. You can link your bank account, or even deposit a check electronically. It’s super convenient.

Decide how much you want to invest initially. There's no magic number, but start with an amount you're comfortable with. Investing is a marathon, not a sprint, so pace yourself.

Finding Your Dividend Stars

Now for the fun part: finding those dividend-paying stocks! Fidelity has tons of tools to help you. Think of them as your trusty telescope, helping you spot the brightest stars.

You can start by browsing different sectors, like technology, healthcare, or utilities. Or, you can search for specific companies you're interested in. It's like window shopping for investments!

Look for stocks with a history of paying dividends. Dividend yield is a key metric to consider. It tells you how much a company pays out in dividends relative to its stock price.

Don't just chase the highest yield, though! A super high yield might signal that the company is in trouble. It’s like finding a "too good to be true" deal – proceed with caution.

Using Fidelity's Research Tools

Fidelity provides research reports, analyst ratings, and other valuable information. It's like having a team of experts whispering advice in your ear!

Read up on the companies you're interested in. Understand their business model, financial health, and future prospects. Knowledge is power, especially when it comes to investing.

Pay attention to the payout ratio. This tells you what percentage of a company's earnings are paid out as dividends. A high payout ratio might not be sustainable in the long run.

Placing Your Order: Launching Your Investment

Ready to buy? Great! It’s super easy. Click on the stock you want and select "Trade."

You'll then enter the number of shares you want to buy. You can choose to buy at the market price or set a limit order. A limit order allows you to specify the price you're willing to pay. It’s like setting your own price at a flea market!

Review your order carefully before submitting it. Double-check the stock symbol, quantity, and price. Then, hit that "Place Order" button! Your spaceship is now officially in flight!

Understanding Order Types

A market order executes immediately at the best available price. It's fast and simple, but you might not get the exact price you want.

A limit order gives you more control over the price you pay. However, your order might not be filled if the stock doesn't reach your price target. It’s a trade-off between speed and price control.

Reinvesting Dividends: The Magic of Compounding

Here's where the real magic happens: dividend reinvestment! Instead of taking your dividends as cash, you can automatically reinvest them to buy more shares. It’s like planting seeds that grow into more plants!

This is called compounding, and it's a powerful force over time. The more shares you own, the more dividends you receive. The more dividends you receive, the more shares you can buy. It’s a virtuous cycle!

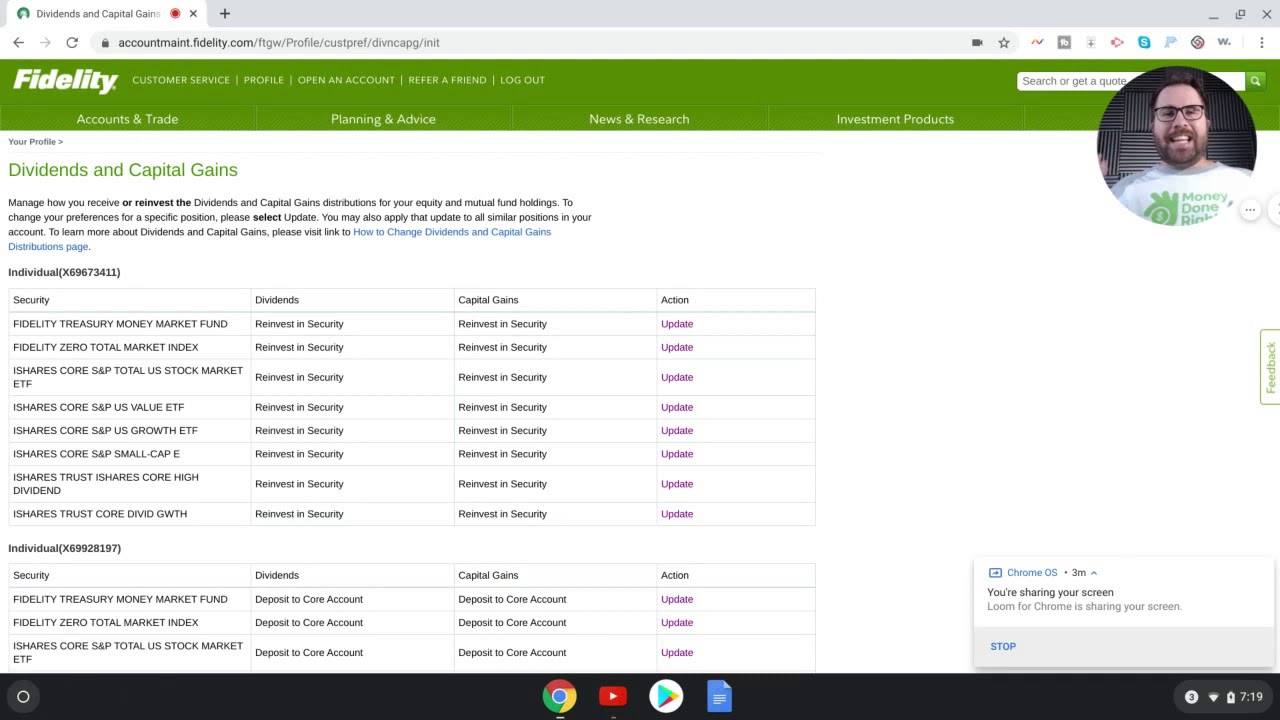

To enroll in dividend reinvestment, simply go to your account settings on Fidelity's website. It's usually just a checkbox or two. Set it and forget it!

Staying the Course: Long-Term Investing

Investing in dividend stocks is a long-term game. Don't get discouraged by short-term market fluctuations. The stock market can be like a rollercoaster sometimes, but dividend stocks are designed to be more stable.

Continue to research and monitor your investments. Rebalance your portfolio periodically to maintain your desired asset allocation. It’s like giving your spaceship a regular tune-up!

Remember, investing involves risk, and there's no guarantee that you'll make money. But with careful research, patience, and a bit of luck, you can build a portfolio of dividend-paying stocks that provide a steady stream of income for years to come. Happy investing!