Let's face it: talking about aging or potential emergencies isn't exactly a barrel of laughs. But equipping ourselves (or our loved ones) with the right tools for safety and peace of mind? Now that's something worth smiling about! And that's where Life Alert comes in. We're diving into the nitty-gritty of Life Alert costs, so you can make an informed decision and avoid any financial surprises. Think of it as a friendly guide to navigating the world of personal emergency response systems (PERS).

So, what exactly is Life Alert? In a nutshell, it's a system designed to get you help fast in case of an emergency, particularly if you're alone. Imagine a scenario: you've taken a tumble in the garden, and your phone is just out of reach. Pressing the button on your Life Alert pendant connects you instantly to a 24/7 emergency response center. A trained operator will assess the situation, contact family members, neighbors, or even dispatch emergency services like paramedics. The primary benefit is simple: rapid access to help when you need it most. It provides peace of mind, not just for the user, but also for their family and friends.

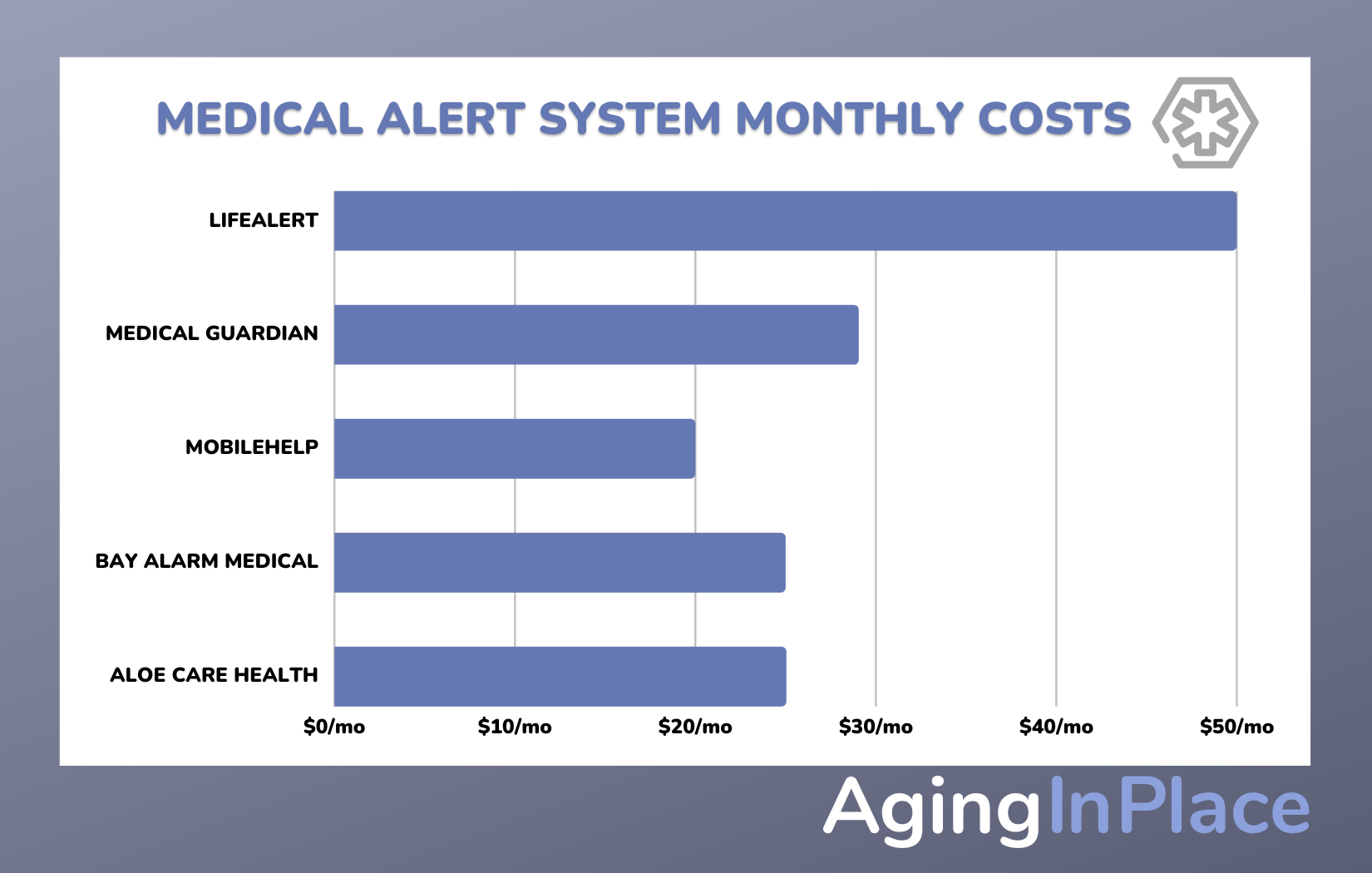

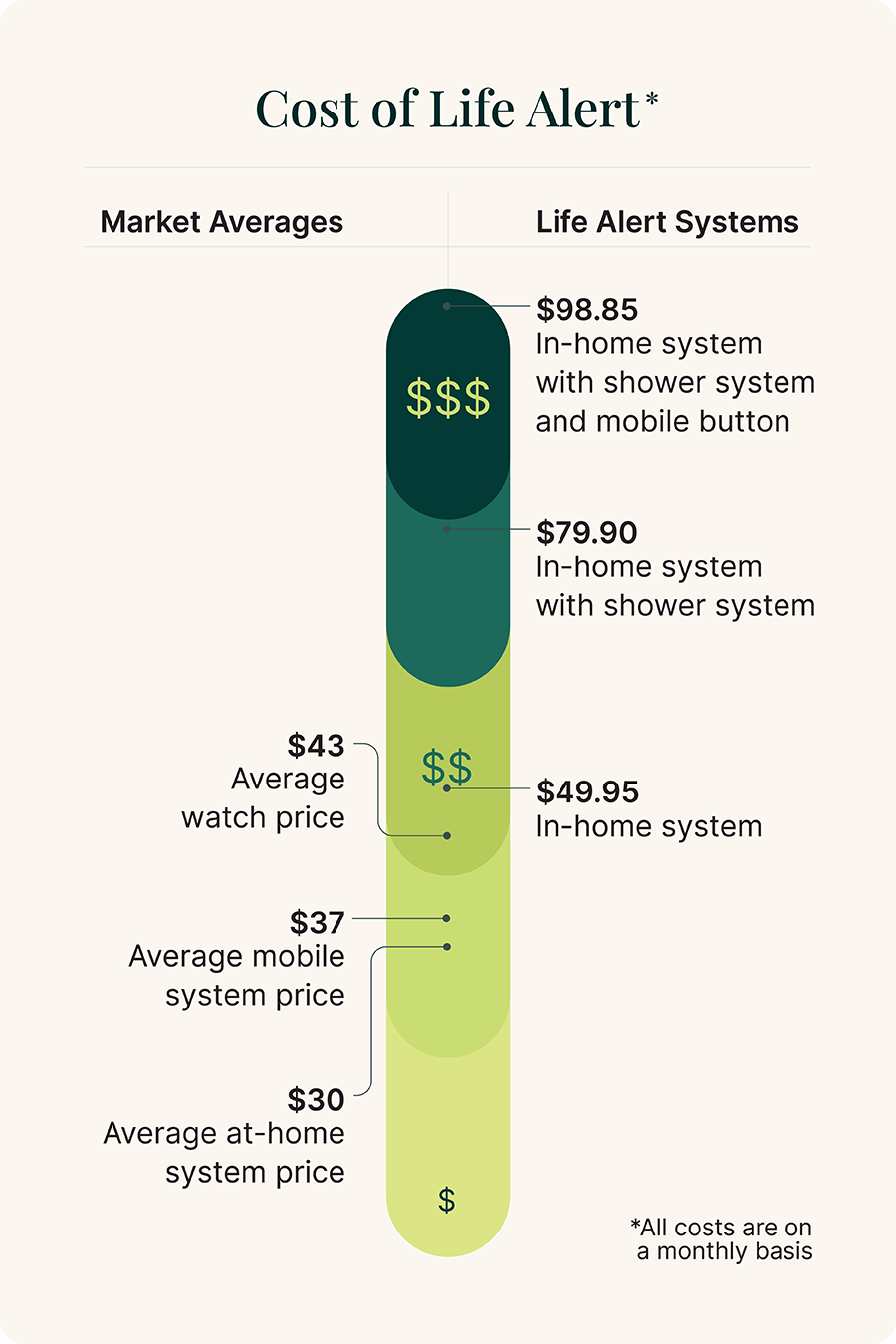

Now for the question everyone's asking: how much does Life Alert actually cost each month? Unlike a one-size-fits-all pair of socks, Life Alert pricing depends on the specific plan you choose. Generally, you'll be looking at a monthly fee. The exact cost can vary based on factors such as the equipment you need, whether you opt for in-home or mobile protection, and any additional features. Think of it like choosing a cell phone plan – more features, more data, higher price.

Here's a general idea of what to expect. The basic in-home system, which connects to a landline, is typically the most affordable option. Mobile systems, which use cellular technology and GPS to locate you even outside the home, usually come with a slightly higher monthly fee. Some plans may also offer fall detection technology, which automatically alerts the response center if it senses a fall, even if you're unable to press the button yourself. This feature naturally adds to the cost.

Important Note: It's crucial to contact Life Alert directly or visit their website for the most up-to-date and accurate pricing information. Don't rely solely on information you find on other websites, as prices and plans can change. Be sure to ask about any activation fees, equipment costs, and cancellation policies. Understanding these details upfront will help you avoid any unwelcome surprises down the road.

While cost is a major consideration, it's also important to weigh the benefits of Life Alert against the potential risks of not having a safety net in place. Consider the peace of mind it provides, the rapid access to help in an emergency, and the increased independence it can offer. For many, the investment is well worth it. It's about investing in security, independence, and ultimately, a better quality of life for yourself or your loved ones. So, do your research, compare your options, and choose the Life Alert plan that best fits your needs and budget. It's a decision you (and your loved ones) will be grateful for.