The Elixir of Life (and Your Portfolio): How Much for a Sip of Coca-Cola?

Ah, Coca-Cola. That fizzy, brown concoction that's been around since your great-grandpappy was knee-high to a grasshopper. It's practically synonymous with "America," right? Even if my unpopular opinion is that Pepsi tastes better, I can't deny its iconic status.

So, you're thinking about grabbing a piece of the action? Maybe dreaming of sipping on Coke dividends while lounging on a tropical beach? Let's talk money. How much does one measly share of Coca-Cola (KO) cost these days?

The Price is Right (Usually)

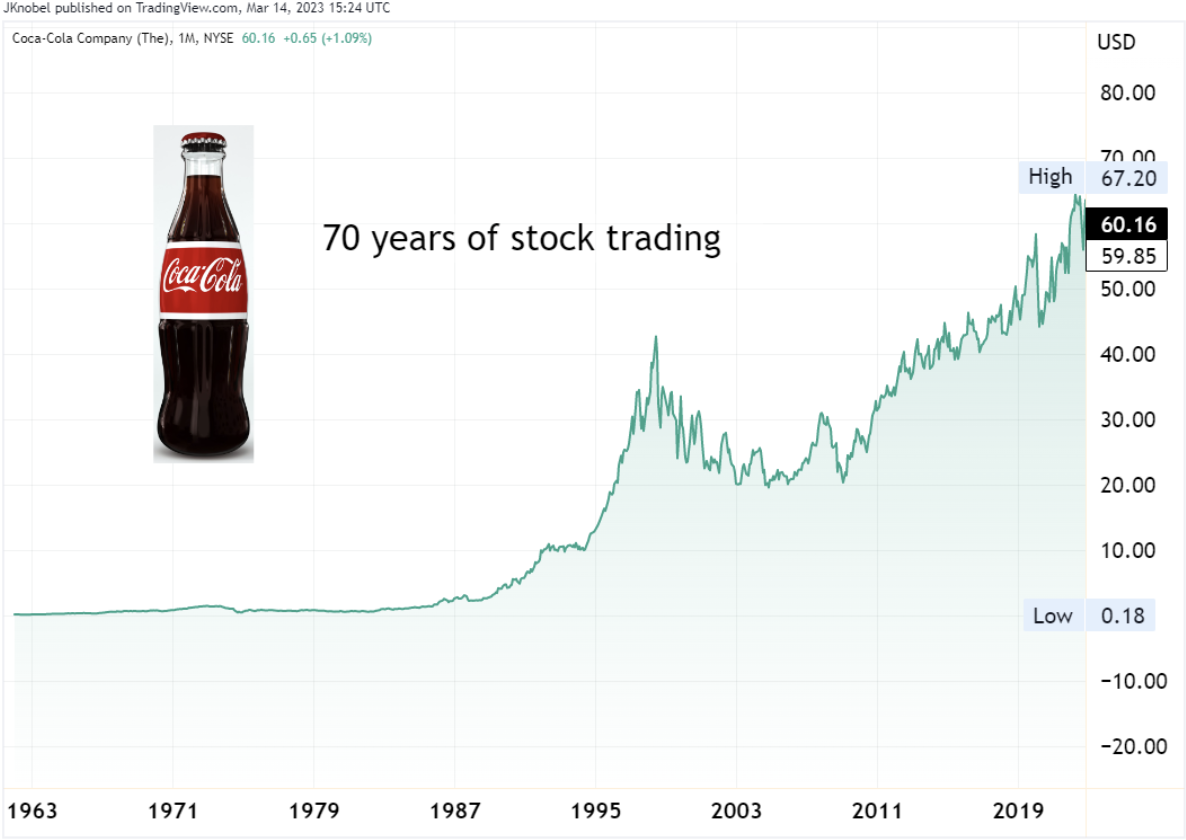

Alright, here's the scoop. Stock prices dance around like a caffeinated toddler. They go up, they go down. Trying to pin down an exact number is like trying to catch smoke. But I'll give you a ballpark.

As of today (because, you know, the stock market is a fickle beast), a single share of Coca-Cola is hovering somewhere in the neighborhood of $60. Give or take a few bucks, naturally. Think of it like a really fancy lunch.

But wait! Before you rush off to empty your piggy bank, let's consider a few things. Because adulting is hard, and investing requires slightly more thought than choosing between Coke and Diet Coke. (Again, Pepsi wins for me).

Factors Affecting the Fizz

Why does the price change at all? Well, that's the million-dollar question, isn't it? It's a cocktail of factors, shaken (not stirred) with a dash of market psychology.

Things like overall economic health, interest rates, and even the weather can influence the price. Seriously! If it's a scorching summer, more people are likely to guzzle down sugary drinks, which *might* give Coca-Cola a little boost.

And of course, company performance matters. If Coca-Cola announces stellar earnings, the stock price usually perks up. But if they release a new flavor that tastes like, well, burnt rubber, investors might get a little skittish. No offense, New Coke.

Beyond the Single Share: The Bigger Picture

Okay, so you know the approximate price of one share. But should you actually buy it? That's where things get interesting. Don't just buy it because you like the taste, unlike me and my Pepsi preference.

Investing in a single share of anything isn't usually going to make you rich overnight. Think of it as planting a tiny seed. It takes time, care, and maybe a little fertilizer (metaphorically speaking, of course).

Most financial advisors (the boring but smart ones) suggest diversifying your investments. Don't put all your eggs – or should I say, all your Coke bottles – in one basket. Spread the love!

Where to Buy Your Slice of the Cola Pie

So, you're still thirsty for some Coca-Cola stock? Great! You have a few options. The easiest way is through an online brokerage account. Think of it as Amazon for stocks.

Companies like Fidelity, Charles Schwab, and Robinhood make it relatively simple to buy and sell shares. Just do your research, read the fine print, and don't invest more than you can afford to lose. No one wants to live on ramen because they went all-in on Coke!

You could also explore fractional shares. Some brokerages let you buy a portion of a share, which is perfect if you don't have enough cash for a whole one. It’s like ordering a small Coke instead of a large one.

The Unpopular Opinion Corner (Again)

Full disclosure: I'm not a financial advisor. I'm just a person with opinions (mostly about Pepsi). This isn't investment advice. It's more like friendly banter over a cold beverage.

Before you invest in anything, talk to a professional. Someone who wears a suit and knows about things like P/E ratios and dividend yields. They'll give you the real deal, without the Pepsi bias.

So, there you have it. A (hopefully) entertaining look at the price of a Coca-Cola share. Now go forth and invest wisely... or just grab a cold one and enjoy the fizz. Your choice! Though, please try a Pepsi sometime.

Disclaimer: I really like Pepsi.