Okay, so you've been in an accident. Not fun, right? Dealing with the insurance company, getting your car fixed... it's a total headache. But what if I told you there might be more to it than just getting your car back to its pre-accident condition? What if there's a way to recoup some of the value your car lost because of the accident? Enter: The Diminished Value Claim!

Think of it like this: imagine you spill coffee on a brand new designer handbag. You clean it up, it *looks* fine, but deep down, you know it's not quite the same. The value has taken a hit, right? That's exactly what happens with a car after an accident, even if it's perfectly repaired. It's got a history now.

What Exactly IS Diminished Value?

Great question! Diminished value, in a nutshell, is the difference between what your car was worth *before* the accident and what it's worth *after* it's been repaired. Even with top-notch repairs, a car with an accident on its record is often worth less than a comparable car with a clean history. Buyers are wary, plain and simple.

It's like buying a house. Would you pay the same price for a house that had a major fire, even if it was rebuilt perfectly? Probably not. There's a perceived risk, a stigma, and that translates to lost value.

Is This Something *I* Can Actually Do?

Another excellent question! The good news is, in many states, you absolutely can file a diminished value claim. The catch? Usually, you can only file against the *other driver's* insurance company if they were at fault for the accident. If you were at fault, you're typically out of luck. Sorry!

Think of it like this: you wouldn't ask your neighbor to pay for damage you accidentally caused to your own property, would you? Same principle applies here.

Okay, I'm In. How Do I Actually *Make* a Diminished Value Claim?

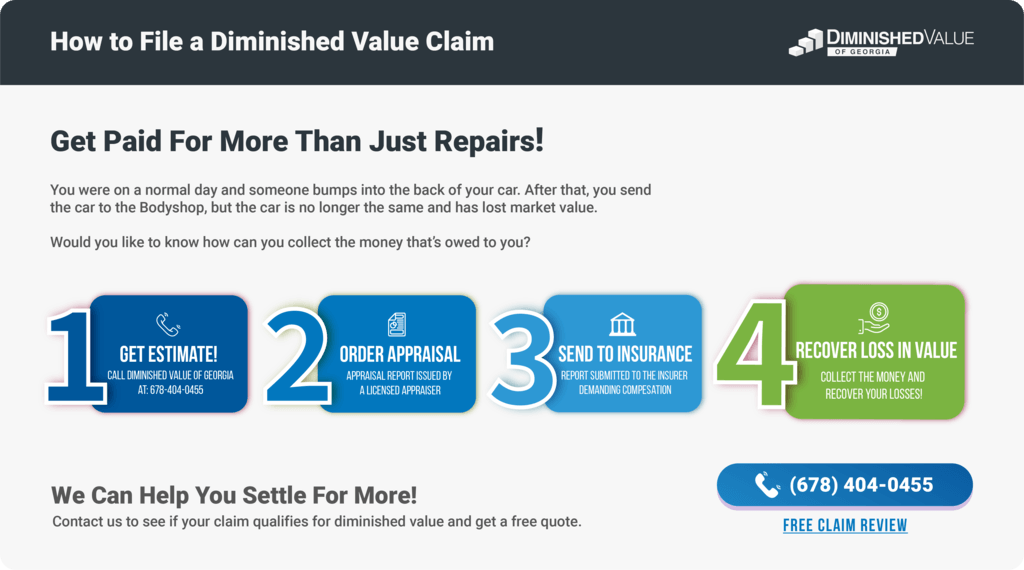

Alright, let's get down to brass tacks. Here’s a simplified breakdown of the process:

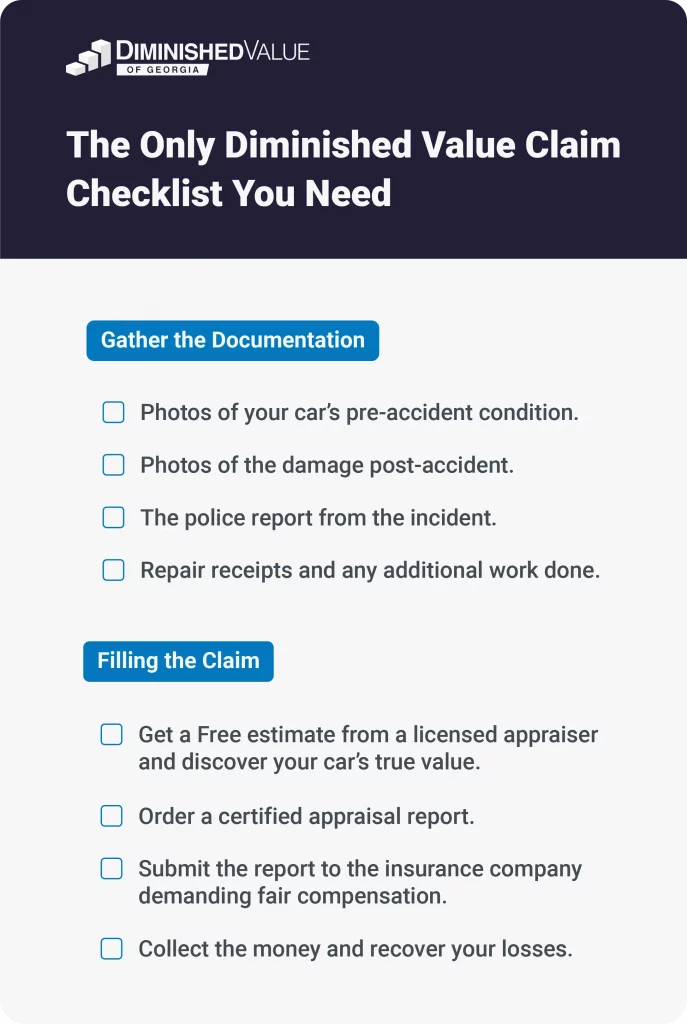

1. Document, Document, Document! Gather everything related to the accident and the repairs. Police report, photos of the damage *before* and *after* repairs, repair bills, estimates… everything. Think of yourself as a detective building a case. The more evidence you have, the stronger your claim will be.

2. Determine Your Eligibility. Make sure the accident wasn't your fault and that you're in a state that allows diminished value claims. A quick Google search of "[Your State] Diminished Value Laws" should point you in the right direction.

3. Get a Diminished Value Appraisal. This is where the professionals come in. A qualified appraiser will assess your car's value *before* the accident and estimate its value *after* the repairs, taking into account the accident history. This appraisal is critical for backing up your claim. Think of it as your expert witness.

4. File Your Claim. Send a demand letter to the at-fault driver's insurance company, outlining the accident, the repairs, the diminished value appraisal, and the amount you're claiming. Be clear, concise, and professional. This is where your meticulous documentation pays off.

5. Negotiate! Don't expect the insurance company to immediately agree to your full claim amount. They'll likely try to lowball you. Be prepared to negotiate and stand your ground, armed with your appraisal and documentation. Remember, they want to settle for as little as possible. You want what's fair.

Is It Worth It?

That's the million-dollar question (or, you know, the maybe-a-few-hundred-or-thousand-dollar question). The answer depends on a few factors: the severity of the damage, the age and value of your car, and the insurance company's willingness to negotiate.

If your car sustained significant damage, is relatively new, and was worth a good chunk of change before the accident, then a diminished value claim is definitely worth considering. On the other hand, if your car was already on its last legs, the damage was minor, or the other driver's insurance company is being incredibly difficult, it might not be worth the hassle.

The bottom line: Do your research, gather your documents, get an appraisal, and see what happens. You might be surprised at how much money you can recover. After all, it's your car, your loss in value, and you deserve to be compensated fairly. Good luck!