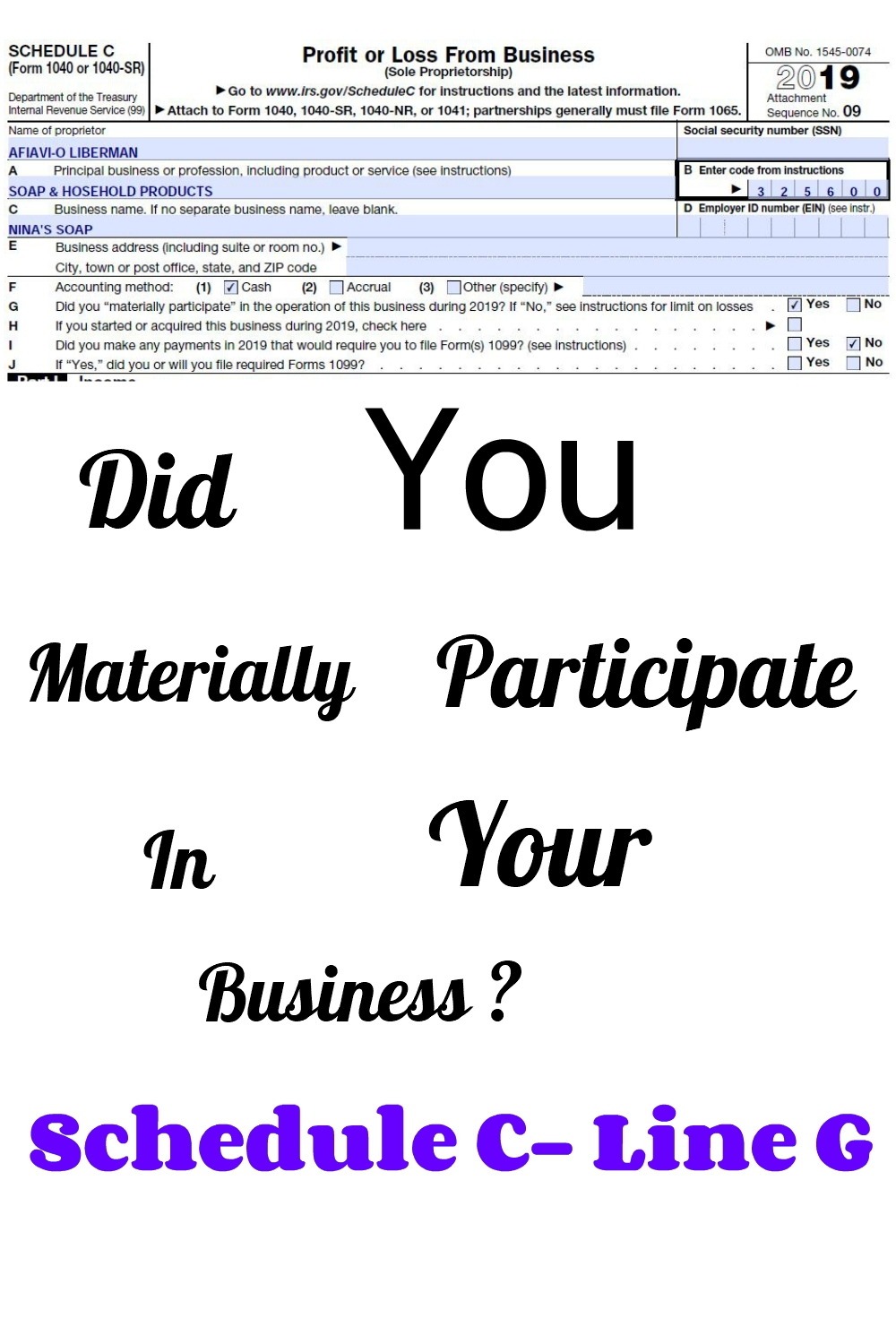

Ever heard someone say, "Did you materially participate?" Sounds like lawyer-speak, right? Actually, it's a question that can unlock some serious tax advantages if you're involved in a business. Think of it as a secret code that, if cracked, could lead to some sweet financial rewards. It's all about proving you weren't just a passive bystander. You were in the thick of it!

The Thrill of the Chase: What Does "Material Participation" Really Mean?

Okay, so what's the big deal? Simply put, it means you were actively involved in the business's operations on a regular, continuous, and substantial basis. Not just popping in for a coffee and a chat. We're talking real work, real effort, and a genuine commitment. It's about showing the tax authorities that you weren't just an investor sitting back and collecting checks. You were down in the trenches, making things happen.

Think of it like this: you're trying to convince a skeptical judge (in this case, the IRS) that you were more than just a spectator at a sporting event. You were a key player on the team, sweating it out on the field. You contributed to the win! You need to provide evidence. This isn't just a game of "he said, she said."

Unlocking the Hidden Treasures: Why It Matters

So, why all the fuss? Well, if you can prove you materially participated, you could potentially deduct losses from the business against your other income. Imagine that! It's like finding a twenty-dollar bill in your old jeans. Who doesn't love that?

Without material participation, those losses might be considered "passive," meaning you can only deduct them against passive income. That can seriously limit your options and leave you feeling like you're missing out on a golden opportunity.

The Detective Work: How Do You Prove It?

Now comes the fun part: gathering evidence. This is where your inner detective gets to shine. Think about all the things you did for the business. Did you manage employees? Make important decisions? Spend countless hours working on projects? Document everything! Emails, meeting notes, calendars, receipts – they're all potential clues in your material participation case.

It's like building a case for a jury. You need to present a compelling narrative that shows you were a driving force behind the business. Don't be afraid to toot your own horn! This is your chance to show off all your hard work and dedication.

The Rules of the Game: Navigating the Tests

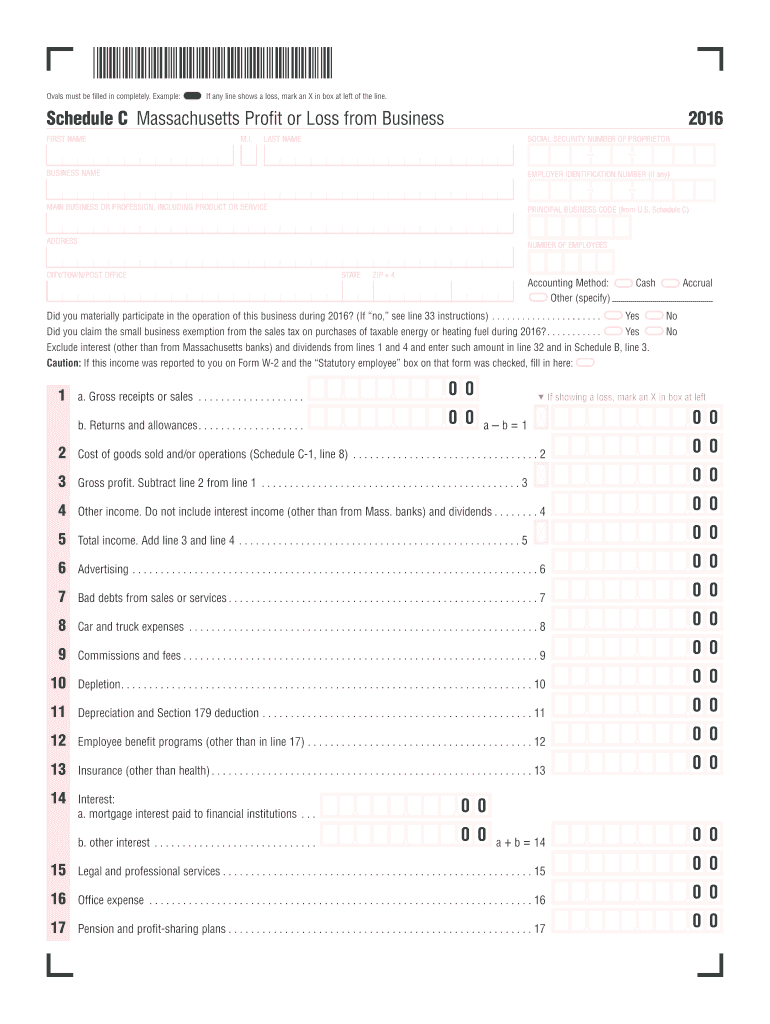

The IRS has a few different tests to determine material participation. These tests focus on things like the number of hours you worked, the level of your involvement compared to others, and whether you were actively managing the business. It's like a series of challenges you need to overcome to prove your worth.

One of the most common tests involves working more than 500 hours in the business during the year. That's a lot of hours! But even if you don't meet that threshold, you might still qualify under other tests. It's all about understanding the rules and finding the test that best fits your situation.

The Expert Advice: When to Call in the Professionals

Navigating the world of material participation can be tricky, especially if you're dealing with complex business structures or unusual circumstances. That's where a qualified tax professional can be your best friend. They can help you understand the rules, gather the necessary evidence, and build a strong case for your material participation.

Think of them as your guide through the tax maze. They can help you avoid potential pitfalls and ensure you're taking advantage of all the tax benefits you're entitled to. Plus, they can save you a ton of time and stress in the long run.

In conclusion, understanding material participation isn't just about taxes; it's about recognizing and rewarding your hard work and dedication to your business. So, embrace the challenge, gather your evidence, and unlock those hidden treasures! You might be surprised at what you discover.

Remember, seeking professional advice is always a good idea when dealing with complex tax matters. Don't be afraid to ask for help!