Thinking about a new car? Awesome! That fresh car smell, the shiny paint, the upgraded tech. It’s tempting, right?

But hold on a sec. That dream ride can also bring a bit of a financial buzzkill. Let's explore why hitting the car lot can be a bit of a challenge for your wallet.

The Sticker Shock is Real

New cars ain't cheap. Plain and simple. Even the most basic models come with a hefty price tag these days.

It’s not just the base price, either. Prepare yourself for a bunch of extra fees and charges.

Sales tax, registration fees, destination charges... the list goes on! Before you know it, you're paying way more than you initially thought. That’s a financial punch in the gut before you even drive off the lot!

Depreciation: The Value Plunge

Here's a fun fact: your brand-new car starts losing value the second you drive it away. Seriously!

This is called depreciation. And it's a big deal. Your shiny new investment is suddenly worth less.

Imagine buying a car for $30,000 and a year later it's only worth $25,000. Ouch! That's a $5,000 hit to your net worth.

The Loan Ranger: Interest Rates

Unless you're paying cash (lucky you!), you'll probably need a car loan. And loans come with interest rates.

Interest is basically the cost of borrowing money. The higher the interest rate, the more you'll pay over the life of the loan.

Even a seemingly small difference in interest rates can add up to thousands of dollars over several years. Shop around for the best rates! It’s worth it!

Insurance: Gotta Have It, Gotta Pay For It

Car insurance is a must. But it's another expense to factor in.

New cars often cost more to insure than older ones. This is because they're more expensive to repair or replace.

Call your insurance company for a quote before you buy a car. You might be surprised at how much it can impact your monthly budget.

Fueling the Fire: Gas Prices

Don't forget about the ongoing cost of gas!

Depending on the car you choose, you could be spending a significant amount of money on fuel each month. Especially with those fluctuating gas prices.

Consider a more fuel-efficient vehicle. Or maybe even an electric car. Your wallet (and the planet) will thank you.

Maintenance and Repairs: Stuff Happens

Cars need maintenance. It's just a fact of life.

Oil changes, tire rotations, new brakes... these things add up. And new cars, while often under warranty, aren't immune to needing repairs.

Set aside some money each month for potential maintenance costs. You'll be glad you did when that unexpected repair bill arrives.

The Trade-In Trap

Trading in your old car? Be careful! Dealers are experts at negotiating.

They might offer you a low price for your trade-in. Then make up for it by increasing the price of the new car.

Do your research! Know the value of your trade-in before you even step foot in the dealership. Websites like Kelley Blue Book can help.

Lifestyle Creep: The Upgrade Bug

Sometimes, buying a new car can lead to "lifestyle creep." This is when you start spending more money on other things to match your fancy new ride.

Maybe you feel the need to get a better car wash or upgrade your parking spot. These seemingly small expenses can snowball.

Be mindful of your spending habits after you buy a new car. Don't let it lead to unnecessary expenses.

The Emotional Factor: Impulse Buys

Car dealerships can be emotionally charged environments. Salespeople are trained to appeal to your emotions.

It's easy to get caught up in the excitement and make an impulse purchase you later regret. Resist the urge!

Take your time. Do your research. And don't let emotions cloud your judgment. Bringing a friend can help keep you grounded.

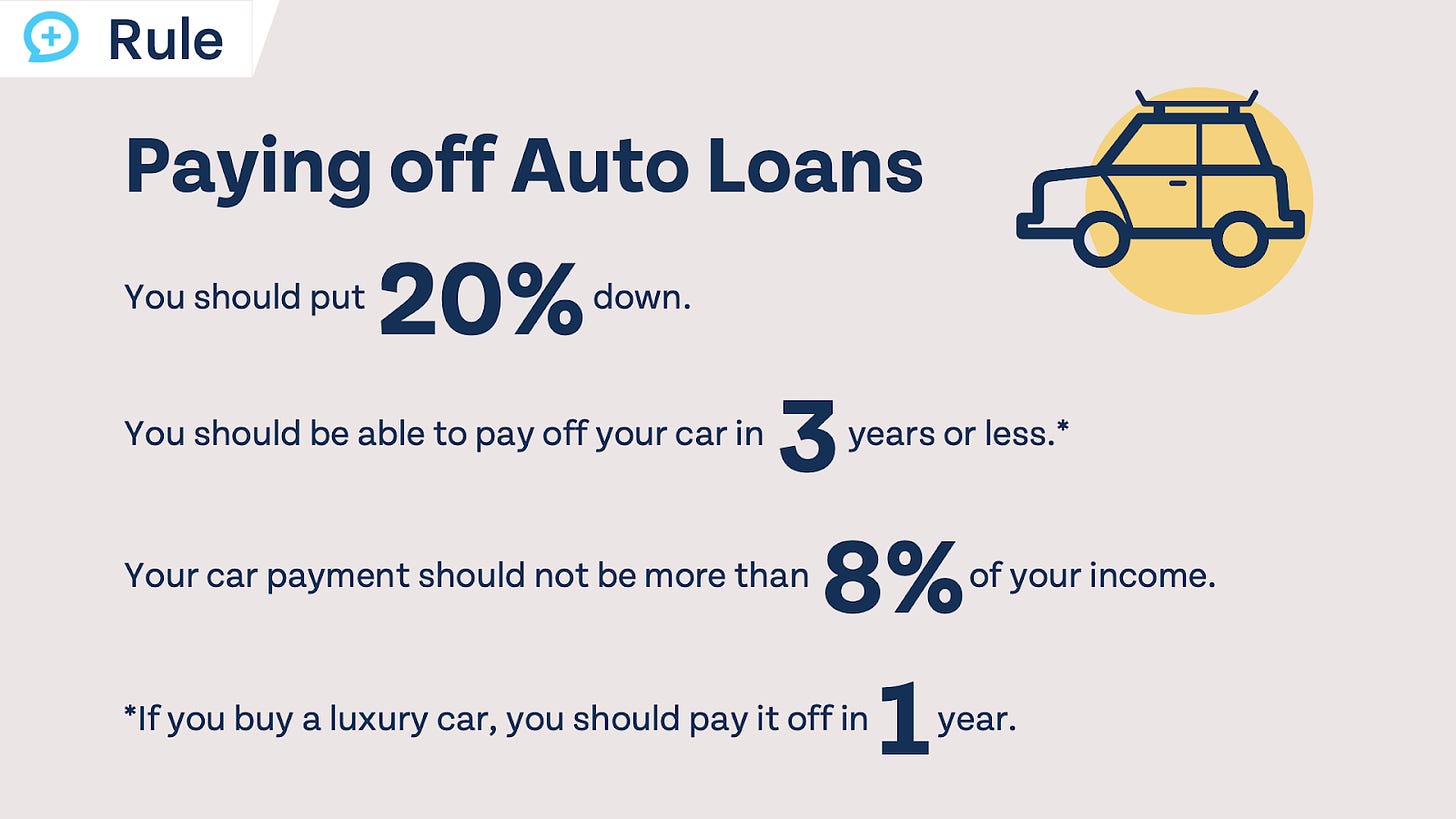

Long-Term Commitment: The Lengthy Loan

Car loans can last for several years. Committing to a long-term loan can be a big decision.

Make sure you can comfortably afford the monthly payments. And consider what other financial goals you might have during that time.

A shorter loan term might mean higher monthly payments. But you'll pay less interest overall and be debt-free sooner.

Opportunity Cost: What Else Could You Do?

Money spent on a new car could be used for other things. This is called opportunity cost.

Think about what else you could do with that money. Invest it, pay off debt, travel the world?

Consider the opportunity cost before you buy a new car. Make sure it aligns with your overall financial goals.

The Hidden Costs: It Adds Up Fast

Beyond the obvious expenses, there are often hidden costs associated with owning a new car.

These might include things like extended warranties, paint protection, or upgraded floor mats.

Resist the urge to add on unnecessary extras. They can significantly increase the overall cost of the car.

The Alternative: Consider Used

A new car isn't the only option. A well-maintained used car can be a great alternative.

Used cars are typically much cheaper than new cars. You'll avoid the initial depreciation hit. Plus, you might be able to pay cash and avoid a loan altogether.

Get a pre-purchase inspection from a trusted mechanic before buying a used car. This can help you avoid potential problems down the road.

Budgeting is Key

Before you even start looking at cars, create a budget.

Determine how much you can realistically afford to spend each month. And stick to that budget!

Factor in all the costs associated with owning a car: loan payments, insurance, gas, maintenance, etc. Being prepared is the best defense.

Negotiate Like a Pro

Don't be afraid to negotiate! The sticker price is rarely the final price.

Do your research and know what other dealers are charging for the same car. Be prepared to walk away if you're not getting a good deal.

Remember, the dealer wants to sell you a car. Use that to your advantage!

Shop Around: Don't Settle

Don't settle for the first car you see. Shop around and compare prices.

Visit multiple dealerships and test drive different models. Get quotes from different insurance companies.

The more research you do, the better equipped you'll be to make an informed decision.

Read the Fine Print: Know What You're Signing

Before you sign any paperwork, read it carefully. Understand all the terms and conditions of the loan agreement.

Don't be afraid to ask questions if anything is unclear. Get everything in writing.

Protect yourself from potential scams or hidden fees. Knowledge is power!

Think Long-Term: Beyond the Initial Excitement

Buying a car is a long-term commitment. Think beyond the initial excitement.

Consider how the car will fit into your lifestyle in the years to come. Will it still meet your needs?

Choose a car that is practical, reliable, and affordable. Don't just focus on the flash and glamour.

The Bottom Line: Be Smart, Be Prepared

Buying a new car can be exciting. But it's important to be aware of the potential financial challenges.

By doing your research, creating a budget, and negotiating effectively, you can minimize the financial impact. You can still enjoy your new ride without breaking the bank.

So, go ahead and start dreaming about that new car. Just remember to be smart, be prepared, and enjoy the ride! Happy car hunting!